The quest for wealth and financial freedom is a journey shared by many, yet achieved by few. It’s a path laden with challenges, requiring not just hard work and smart strategies but also the wisdom to know what habits to avoid. While much has been said about the steps to take towards amassing wealth, equally important is recognizing and stopping the actions that hinder financial success. In this exploration of financial growth, we delve into eight wealth-destroying habits that must be ditched for anyone aspiring to financial freedom.

Ignoring Your Retirement Plan

One of the most common pitfalls on the road to wealth is neglecting long-term financial planning, particularly when it comes to retirement. The allure of immediate gratification often overshadows the importance of saving for the future. However, understanding and leveraging retirement planning tools, such as Social Security, can significantly impact your financial health in later years. By exploring strategies like “Unlocking Your Social Security at 62: A Strategy for Million-Dollar Return,” individuals can gain insights into maximizing their retirement benefits and securing a financially stable future.

Neglecting Multiple Income Streams

Relying solely on a single source of income is akin to putting all your eggs in one basket—a risky strategy that can lead to financial instability. Diversifying your income streams can not only provide financial security but also open up new avenues for wealth accumulation. For inspiration, consider the journey detailed in “My Journey to 10K a Year Selling Photos Online,” which showcases how passive income can be a valuable addition to your financial portfolio.

Overlooking the Impact of Mortgage Rates

The decision to buy a home is a significant financial milestone, but without a keen understanding of how mortgage rates affect your finances, it can become a burden. Mortgage rates have a direct impact on your monthly payments and overall financial well-being. Gaining a deeper understanding through resources like “The Surprising Impact of Mortgage Rate Changes on Your Wallet” can help you make informed decisions that align with your wealth-building goals.

Procrastinating Entrepreneurial Ventures

Many dream of entrepreneurship but delay taking the plunge due to fear of failure or uncertainty. However, the journey to wealth often requires stepping out of your comfort zone and seizing opportunities. “A Look at Entrepreneurship and the Rewards of Early Action” (richmoneymind.com) highlights the benefits of diving into entrepreneurship and how taking early action can lead to significant rewards.

Living Beyond Your Means

A common barrier to wealth accumulation is the habit of spending more than you earn. Living beyond your means and accruing debt can severely hinder your ability to build wealth. Embracing a lifestyle that prioritizes saving over spending is crucial for long-term financial success.

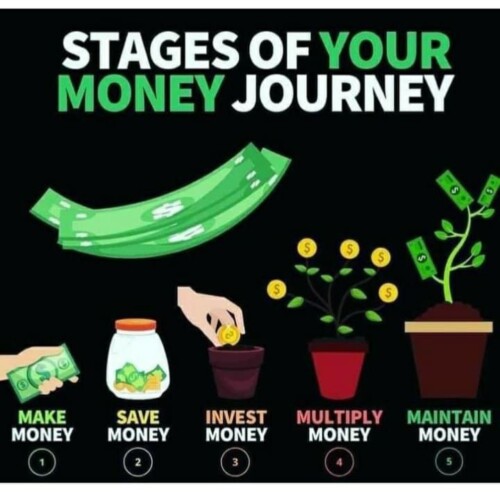

Underestimating the Power of Investing

Investing is a powerful tool for wealth creation, yet many underestimate its potential due to fear of risk or lack of knowledge. Educating yourself on investment strategies and understanding the power of compound interest can transform your financial future. Resources like “How to Build Wealth and Retire Early” offer valuable insights into making your money work for you.

Ignoring Financial Education

In the age of information, ignorance is a choice—especially when it comes to financial education. Continuously learning and staying informed about financial matters is essential for making wise decisions that propel you toward wealth. Whether it’s reading books, attending workshops, or exploring resources online, investing in your financial education pays dividends.

Avoiding Risk Completely

While reckless financial decisions can lead to ruin, avoiding risk entirely can also be detrimental to wealth accumulation. Calculated risks, especially in investments, are necessary for growth. Understanding the balance between risk and reward is key to building a robust financial portfolio.

Achieving financial freedom is a multifaceted endeavor that requires both the adoption of positive habits and the cessation of negative ones. By steering clear of these eight wealth-destroying actions and embracing strategies that promote financial health, you pave the way for a future filled with financial abundance. Remember, the path to wealth is a journey of continuous learning, disciplined saving, and strategic investing. Start today by examining your habits, making informed decisions, and taking deliberate actions towards building the wealth you desire.

Can You Really Unlock a Million-Dollar Return by Claiming Social Security at 62?

Absolutely! Making informed decisions about when to start claiming Social Security benefits can significantly impact your retirement savings. Dive into the strategies with “Unlocking Your Social Security at 62: A Strategy for Million-Dollar Return” to understand how early planning can lead to substantial returns.

How Did Someone Earn $10K a Year from Selling Photos Online?

The digital age has opened up myriad avenues for generating passive income. “My Journey to 10K a Year Selling Photos Online” is a testament to how leveraging your hobbies and the internet can result in a significant income stream.

Are Mortgage Rates Secretly Draining Your Wallet?

You might be surprised to learn how fluctuations in mortgage rates can impact your financial health over time. Uncover the secrets with “The Surprising Impact of Mortgage Rate Changes on Your Wallet” and learn how to make mortgage rates work in your favor.

What’s the Real Reward of Entrepreneurship and Early Action?

Embarking on an entrepreneurial journey can be daunting, but the rewards of early action are substantial. Discover the entrepreneurial rewards at “A Look at Entrepreneurship and the Rewards of Early Action” and get inspired to take your first step.

Can Investing Early Truly Accelerate Your Path to Retirement?

Yes! Starting your investment journey early can drastically change your financial landscape by retirement. Explore effective strategies in “How to Build Wealth and Retire Early” to kickstart your journey toward financial freedom.

Is Living Beyond Your Means Really That Dangerous for Your Wealth?

Living beyond your means is like sailing into a financial storm. Understanding the long-term impact of your spending habits is crucial for securing your financial future.

What Are the Golden Rules of Smart Investing?

Smart investing isn’t just about where you put your money; it’s also about timing, diversification, and risk management. Learn the golden rules to grow your wealth effectively.

Why Should You Never Ignore Financial Education?

Staying informed and continuously learning about financial management can transform your financial decisions. Ignorance is not bliss when it comes to building wealth.

How Can Multiple Income Streams Protect You from Financial Disaster?

Diversifying your income can provide a safety net that protects you against economic downturns and unexpected financial challenges.

What’s the Biggest Mistake People Make with Their Retirement Planning?

Procrastination and lack of strategy can derail your retirement plans. Start early and plan wisely to ensure a comfortable retirement.

Why Is Risk Necessary for Financial Growth?

Avoiding all risks can lead to missed opportunities. Learn to assess and take calculated risks to maximize your financial potential.

Can Entrepreneurship Be Your Fast Track to Wealth?

Absolutely! While entrepreneurship comes with its challenges, it also offers the potential for significant financial rewards and personal growth.