Why You Need Multiple Streams of Income

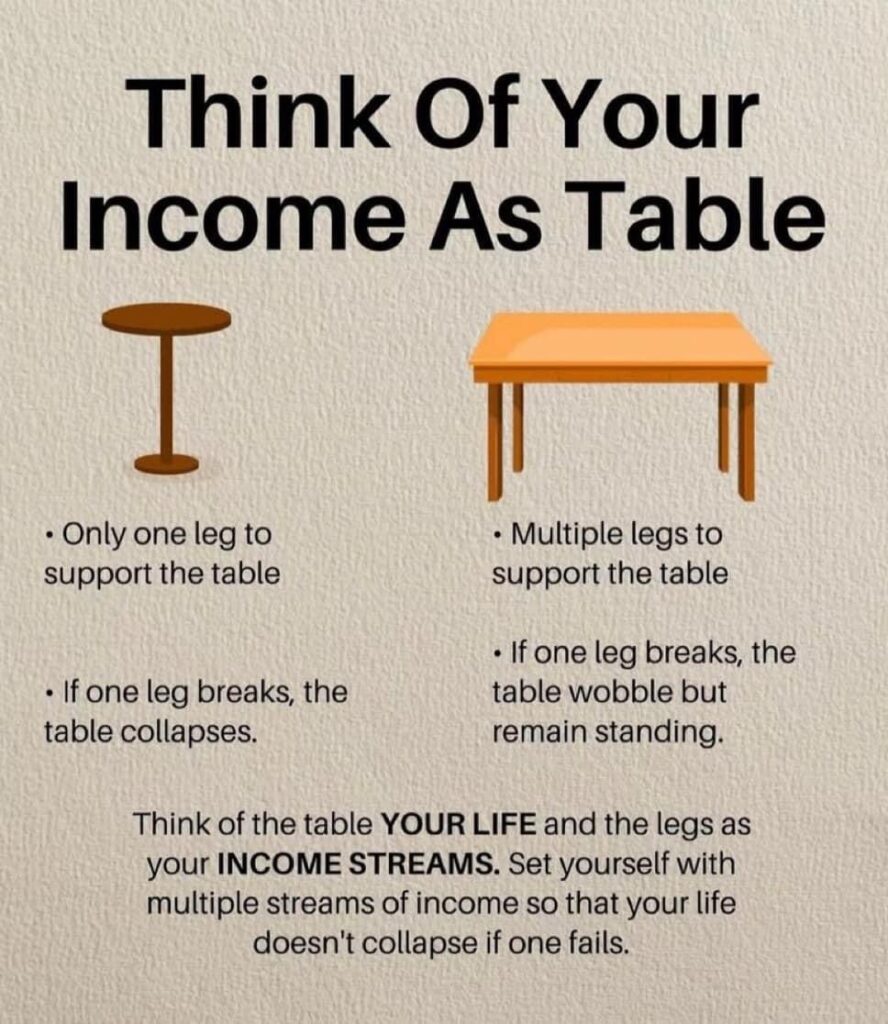

When I first heard about the idea of creating multiple streams of income, I didn’t take it seriously. I figured my regular job was enough and that diversifying my income wasn’t something I needed to worry about. But then life happened—a job layoff, unexpected expenses, and suddenly I realized how risky it was to rely on just one source of income. That’s when it clicked: if your entire life is supported by just one income stream, it’s like balancing a table on a single leg—once that leg breaks, everything comes crashing down.

By having multiple income streams, you’re setting yourself up for financial security. Think of your income as a table with several legs. If one leg breaks, your table (or your financial life) might wobble, but it won’t collapse. This approach has given me peace of mind, knowing that if one income source takes a hit, I’ve got others to keep me stable.

Creating multiple streams of income is more than just a smart financial move—it’s essential for long-term security. If you’re looking to build a future that’s financially solid, you’ve got to start thinking beyond just your 9-to-5.

And if you need a little motivation to get started, I’d recommend reading Act Like You Can’t Afford the Bread Until You Own the Bakery. It’s a great reminder that hustling hard and playing the long game is what gets you ahead.

Understanding the Types of Income Streams

When I first started thinking about multiple streams of income, it felt a little overwhelming. I mean, where do you even start? But once I broke it down into active and passive income, it started making a lot more sense.

Active Income

Active income is what most of us are familiar with—your regular 9-to-5 job, freelance gigs, or side hustles. Basically, any time you’re trading time for money, that’s active income. It’s reliable, but the downside is that you’re only making money when you’re working. I’ve always thought of this as the main “leg” of my income table. It keeps things stable, but if something happens, like a job loss, that leg can break.

Passive Income

Then there’s passive income, which has been a game-changer for me. This is the money you earn without having to work for it day in and day out. Things like investments, rental income, or selling digital products fall into this category. Once you set it up, it keeps earning you money even when you’re not actively involved. At first, passive income seemed like a myth to me—how could you make money without constantly working? But after trying a few different strategies, I realized it’s not only possible but essential for building wealth.

The key is to balance both. Relying only on active income can be risky, but when you pair it with passive income, you start creating a safety net for yourself. For example, selling products online has become one of my favorite side hustles. You can read more about how to maximize profits on platforms like Shopify and Amazon here: Maximizing Profits: Insider Guide to Selling on Shopify vs. Amazon.

Once I realized how important both types of income are, I knew I needed to start building up my passive streams. Up next, we’ll get into how you can start creating passive income streams that continue to make money while you sleep.

How to Build Passive Income Streams

I remember the first time I heard about passive income, I thought it was too good to be true. I figured, if you’re not working for it, how can you really make money? But as I started learning more, I realized that passive income isn’t about “getting rich quick”—it’s about setting up systems that work for you over time, allowing you to earn without constantly hustling. Once I started building passive income streams, it felt like a weight lifted off my shoulders because I wasn’t relying solely on my day job anymore.

1. Investing in the Stock Market

One of the most straightforward ways to build passive income is by investing. I started small, putting a bit of money into index funds like the S&P 500. The beauty of these funds is that they track the overall market, meaning your money grows over time with minimal effort. You can literally set it and forget it while your investment compounds. The key is consistency—keep investing regularly, and over the years, you’ll be surprised at how much passive income you’ve built. For more on the power of the S&P 500, check out The Might of S&P 500 Returns.

2. Real Estate & Renting

Another passive income stream I’ve explored is real estate. If you have extra space or are able to invest in a rental property, renting out rooms or homes can generate a steady stream of income. I started by renting out an extra room, and it turned into a simple way to bring in extra cash without much ongoing effort. Managing tenants can take some time, but once things are up and running, it’s mostly hands-off. If you’re thinking about getting into real estate, here’s a guide on how to turn your extra space into extra cash.

3. Selling Digital Products

One of the easiest ways to create passive income that I’ve personally enjoyed is selling digital products. Whether it’s eBooks, courses, or even stock photos, once you create it, the product can sell over and over again. I’ve dabbled in selling photos online, and while it took a bit of effort upfront, it’s been a fantastic source of passive income ever since. For inspiration, you can read about how others have earned money by selling photos online.

The key to passive income is starting small and being patient. None of these streams are get-rich-quick solutions, but they are reliable ways to build wealth over time, giving you the freedom to focus on other things.

How to Build Active Income Streams

While passive income is great for earning money over time, building active income streams is something I focused on when I wanted to see more immediate results. This is the income you generate by putting in the work—whether through a side hustle or even starting a small business. For me, the key was finding active income streams that I could manage alongside my main job without burning out.

1. Side Hustles

When I first started looking for ways to boost my income, side hustles seemed like the most logical step. It was work I could do outside of my 9-to-5 and still have time for. I’ve done everything from freelance writing to consulting, but there are endless possibilities depending on your skills and interests. The great thing about side hustles is that you control how much time and energy you put into them. Plus, they can sometimes turn into something bigger if you want them to.

One thing I’ve learned: don’t be afraid to go after your dreams and hustle hard. If you’re serious about growing your income, it’s all about putting yourself in “beast mode” and going after what you want. For a little motivation on attacking your goals, check out this article on Beast Mode vs. Scared Mode: Attack Your Dreams.

2. Freelancing or Consulting

If you’ve got a skill set you can market, freelancing is an excellent way to generate extra income. I started freelancing in my spare time, doing work that aligned with my expertise. Whether you’re a designer, writer, coder, or marketing expert, there are always people willing to pay for your services. The best part? You can set your own rates and work on your own schedule.

Consulting is another great option if you have specialized knowledge in a particular field. It allows you to share your expertise with clients, usually for higher rates, while still working on a flexible schedule. You can do it alongside your main job, and eventually, it can even become a full-time gig if you want to go that route.

3. Starting a Small Business

If you’re looking for something more ambitious, starting a small business might be the way to go. Whether it’s an e-commerce store, selling crafts, or even launching a service-based business, owning something that’s yours can be a great way to build wealth. I started small with online sales, and while it took time to grow, it became one of my most reliable income streams.

When considering platforms, I’ve found success comparing options like Shopify and Amazon. Each has its pros and cons, but both can be lucrative if you know how to work them. You can read about how others have maximized their profits with these platforms in this guide on Maximizing Profits: Shopify vs. Amazon.

Active income streams require effort, but they can be incredibly rewarding if you’re willing to put in the work. Whether it’s a side hustle or a full-blown business, having multiple active streams can give you more control over your financial future.

Diversifying Your Investment Portfolio

One of the biggest lessons I’ve learned on my financial journey is the importance of diversifying your investments. Relying on one type of investment is like relying on a single stream of income—it’s risky. By spreading your money across different assets, you’re protecting yourself against market fluctuations and creating a more secure foundation for long-term wealth.

1. Stocks and Bonds

The most common form of investment is the stock market, and it’s where I started building my portfolio. I invested in index funds like the S&P 500, which spreads your money across hundreds of companies, minimizing risk. This way, even if a few companies aren’t performing well, others in the fund will keep your investments growing. You can invest in individual stocks too, but the key is diversification. Don’t put all your money in one company or sector.

I also included bonds in my portfolio. They don’t offer the same high returns as stocks, but they’re much more stable, making them a great way to balance out riskier investments. It’s a way to ensure that, even in tough market conditions, I still have some steady returns. If you’re curious about how the wealthy use diversification to keep growing their money, I recommend reading Why the Rich Stay Rich: The $25,000 Financial Experiment. It’s eye-opening!

2. Real Estate

Real estate is another powerful tool for diversification. I started small, investing in rental properties, and it quickly became a reliable source of passive income. The great thing about real estate is that it tends to appreciate over time, and in the meantime, you can earn rental income. This combination of short-term and long-term returns makes real estate one of my favorite ways to diversify. If buying property isn’t in your immediate future, even renting out a room or part of your home can create a new income stream.

If you’re considering this option, you can learn more about turning your extra space into cash with this guide on renting out your room.

3. Other Investments

There are plenty of other ways to diversify beyond just stocks and real estate. Cryptocurrency has become popular, though I approach it with caution since it’s a highly volatile market. I’ve also looked into peer-to-peer lending, where you can lend money to others and earn interest on your loans. The key to any of these is not putting all your eggs in one basket. Spread your investments across different types of assets to protect yourself from market shifts and downturns.

By diversifying, you’re creating a financial safety net. Even if one investment doesn’t perform as expected, others will help you stay stable. For me, this strategy has been crucial in growing wealth while minimizing risk.

Avoiding Common Financial Mistakes

As I started building multiple streams of income, I quickly realized that it wasn’t just about creating as many income sources as possible—it was also about managing them wisely. There are plenty of pitfalls that can easily derail your financial plans if you’re not careful. Here are a few common mistakes I’ve learned to avoid along the way.

1. Overextending Yourself

One of the biggest mistakes I made early on was trying to do too much at once. It’s easy to get excited about all the possibilities when you’re starting new income streams—whether it’s a side hustle, investments, or real estate. But the truth is, if you spread yourself too thin, you can end up burning out or losing track of where your money is going. It’s important to focus on a few key streams that you can manage effectively, rather than trying to juggle too many things.

2. Ignoring Cash Flow

When I started making money from multiple sources, I learned the hard way that cash flow management is crucial. Even though you’re bringing in more income, if you’re not tracking your expenses and understanding where your money is going, you can end up in a financial mess. I had a few months where I wasn’t paying attention to my cash flow, and it caused unnecessary stress. Make sure to regularly review your budget and track both income and expenses across all your streams.

3. Falling Into Bad Financial Habits

Creating multiple streams of income is great, but if you don’t fix bad financial habits, all that extra money can slip through your fingers. For example, if you’re someone who tends to overspend or rack up credit card debt, your new income streams might just go towards paying off those debts instead of building wealth. I had to address my own spending habits before I could really make the most of my extra income. If you’re looking to ditch bad habits, check out 8 Wealth-Destroying Habits to Ditch for Financial Freedom.

4. Not Having an Emergency Fund

One of the first things I did when I started generating multiple streams of income was set aside money for an emergency fund. It’s tempting to invest everything or reinvest into your businesses, but having an emergency fund is essential to protect you if one of your income streams dries up or unexpected expenses come up. Ideally, you should have 3 to 6 months of living expenses saved up.

5. Focusing Only on Short-Term Gains

It’s easy to get caught up in trying to make quick money, but I’ve learned that long-term planning is where the real wealth-building happens. If you’re only chasing short-term gains, you risk missing out on more sustainable, long-term investments that will grow steadily over time. Whether it’s through investing in the stock market, growing a business, or building passive income streams, having a long-term vision is crucial.

Avoiding these financial mistakes has helped me stay on track and build a more stable financial foundation. If you’re serious about growing your income and creating wealth, staying disciplined and focused will be your greatest asset.

How to Get Started with Multiple Income Streams

When I decided to start building multiple streams of income, the hardest part was knowing where to begin. It can feel overwhelming when you’re trying to figure out which direction to take, especially if you’re balancing a full-time job. But once I broke it down into manageable steps, it became a lot easier to get started. Here’s what worked for me.

1. Assess Your Skills and Resources

The first step is to take a look at what you already have. I started by assessing my skills, experiences, and resources. Do you have a talent for writing? Are you good with numbers? Maybe you’re a DIY expert or have extra space in your home you could rent out. Your existing skills and resources can be the foundation for creating new income streams. For example, if you have a creative hobby, you can turn that into a profitable side hustle, like selling photos or crafts online.

If you’re looking for ideas, check out this guide on turning your extra space into extra cash by renting out a room or property. It’s one of the easiest ways to start generating income.

2. Start Small with Side Hustles

Don’t feel like you have to dive into something huge right away. I started small, picking one side hustle that I could fit into my free time. This could be something like freelance work, consulting, or selling products online. Over time, I expanded into other areas, but starting with one manageable project was key to not getting overwhelmed.

You can also read stories about others who started from scratch, like Act Like You Can’t Afford the Bread Until You Own the Bakery, which is a great example of how to build something from small beginnings.

3. Invest in Income-Generating Assets

Once I had my first few side hustles going, I started putting any extra money into investments. This is where I began building passive income. Even small investments in things like the stock market or real estate can start generating returns over time. You don’t need to be an expert; there are plenty of simple investing strategies that are beginner-friendly. The important thing is to start early and let your investments grow.

If you’re interested in how others have maximized their returns, check out The Might of S&P 500 Returns for inspiration on long-term investment strategies.

4. Reinvest Your Earnings

As my income streams started producing results, I made sure to reinvest a portion of those earnings. This could mean putting more money into investments, scaling up a business, or launching another side hustle. Reinvesting allowed me to keep growing my income without relying on just one source. It also gave me more security knowing that my money was working for me, not just sitting in a savings account.

5. Stay Consistent

The key to building multiple income streams is consistency. It takes time to get everything set up, but once your systems are running, the effort starts to pay off. Whether it’s maintaining a side hustle, tracking your investments, or managing rental properties, staying committed is what will ultimately lead to success.

If you’re serious about creating financial stability, taking these small, manageable steps is the best way to get started. It’s not about overnight success; it’s about building a foundation that keeps you secure for the long term.

Securing Your Financial Future with Multiple Income Streams

Building multiple streams of income has completely transformed the way I think about money and financial security. When I was relying on just one income source, I felt vulnerable—like if anything went wrong, my entire life could be turned upside down. Now, with income coming in from different streams, I know that I have a safety net, and that gives me a huge sense of relief.

The beauty of creating multiple income streams is that it doesn’t all have to happen overnight. It’s a gradual process, and you can start small with something as simple as a side hustle or investing a little money in the stock market. The key is taking that first step, then consistently building on it. Whether it’s active income from a freelance gig or passive incomefrom an investment, every stream you create adds another layer of security to your financial future.

Looking back, the effort I put into this has been one of the best investments I’ve ever made. Even when one income stream slows down, the others keep me afloat. And that’s what it’s all about—financial freedom and stability. If you haven’t already started creating multiple income streams, now’s the time. Trust me, your future self will thank you.

And if you’re looking for more inspiration on how others have built their wealth from scratch, take a look at stories like The Might of S&P 500 Returns and Act Like You Can’t Afford the Bread Until You Own the Bakery. These are great examples of how small steps can lead to big financial results.

So, what are you waiting for? Start building your multiple streams of income today and take control of your financial future!