Invest in Mexico Real Estate: Is It Worth It?

Mexico’s real estate market has been drawing the attention of investors, retirees, and digital nomads looking for affordability, warm weather, and strong rental opportunities. But is it really a smart move to invest in Mexico real estate?

The short answer: Yes, but you need to do it wisely.

Mexico offers stunning beachfront properties, colonial homes in historic cities, and modern condos in fast-growing urban areas—all for a fraction of what you’d pay in the U.S. or Canada. However, buying property in Mexico isn’t as simple as making an offer and signing papers. There are laws, taxes, and risks you need to understand before diving in.

In this guide, we’ll break down everything you need to know about buying property in Mexico, including the best locations, legal requirements, and expert tips to make the most out of your investment.

Is Investing in Real Estate in Mexico a Good Idea?

Investing in Mexico real estate has become a hot topic among investors, retirees, and expats. But is it really a good idea? The answer depends on your goals, location, and understanding of the market.

Why Mexico’s Real Estate Market Is Booming

1. Strong Rental Demand

Millions of tourists visit Mexico each year, creating a booming short-term rental market, especially in coastal cities like Cancun, Playa del Carmen, and Tulum. Additionally, the rise of digital nomads and retirees has fueled demand for long-term rentals in cities like Merida and Puerto Vallarta.

2. Affordable Property Prices

Compared to the U.S., property in Mexico is significantly cheaper. You can find modern condos, luxury villas, and even beachfront homes for a fraction of the cost. A home that would cost $500,000 in Florida might only cost $200,000 or less in Mexico.

3. Potential for Property Value Appreciation

Certain areas of Mexico are experiencing rapid growth, leading to rising property values. Places like Tulum, Puerto Escondido, and parts of the Yucatán Peninsula have seen double-digit appreciation rates in recent years.

4. Lower Cost of Living

Mexico’s lower cost of living attracts expats and retirees, driving steady demand for rentals. This makes it a great place to own an income-generating property with lower expenses than in the U.S.

Can a U.S. Citizen Buy Real Estate in Mexico?

Yes! U.S. citizens and other foreigners can legally buy property in Mexico, but the process differs depending on the property’s location. While buying inland is straightforward, purchasing within certain zones requires special arrangements.

Buying Inside the Restricted Zone

Mexico’s Restricted Zone includes:

- 50 km (31 miles) from the coastline

- 100 km (62 miles) from international borders

Foreigners cannot directly own property in these areas. Instead, you must use one of the following legal methods:

1. Fideicomiso (Bank Trust)

A Fideicomiso is a trust agreement with a Mexican bank that allows foreigners to hold property in the Restricted Zone. The bank acts as a trustee, but you retain full ownership rights, including selling, renting, or passing the property to heirs.

- The trust is renewable every 50 years.

- The bank cannot use or control your property—it only holds the title for legal purposes.

- Annual trust fees range from $500 to $1,000 USD.

2. Mexican Corporation (For Business Investments)

If you plan to buy multiple properties for rental or commercial purposes, forming a Mexican corporation may be a better option. This allows you to:

- Own real estate anywhere in Mexico (including the Restricted Zone).

- Avoid using a Fideicomiso.

- Qualify for business-related tax deductions.

Note: This option comes with additional legal and tax requirements, so it’s best for investors purchasing multiple properties.

Buying Outside the Restricted Zone

If the property is outside the Restricted Zone, foreigners can buy it just like a Mexican citizen—with a direct property title in your name. No bank trust or special legal structure is needed.

Looking to invest in real estate from anywhere? Here’s how Fundrise makes it easy.

What Are the Risks of Buying Property in Mexico?

While investing in Mexico real estate can be highly profitable, it’s not without risks. Understanding these potential pitfalls will help you protect your investment and avoid costly mistakes.

1. Title Fraud & Scams

One of the biggest risks is buying property without a clear title. Some properties in Mexico—especially in rural areas—lack proper documentation, meaning you could unknowingly purchase land that isn’t legally for sale.

✔ Solution: Always work with a Notario Público (a government-authorized attorney) to verify the title and ensure there are no legal issues.

✔ Pro Tip: Avoid “Ejido” land unless you fully understand the legal process. Ejido land is community-owned and often cannot be legally sold to foreigners.

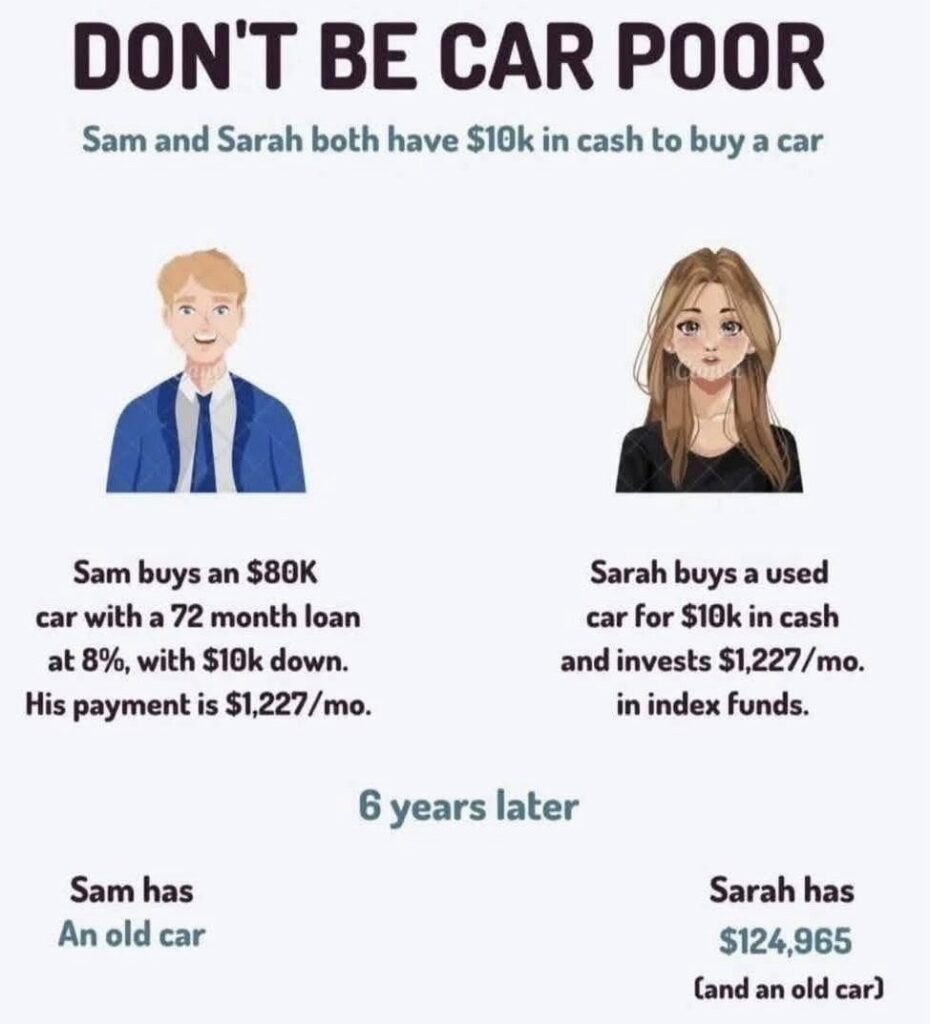

Looking for expert strategies? Check out these 100 ways to profit from real estate.

2. Unclear Zoning & Land-Use Restrictions

Some areas have strict zoning laws that could impact how you use the property. Just because you see a neighbor running an Airbnb doesn’t mean it’s legally allowed.

✔ Solution: Before buying, confirm zoning laws with a local real estate attorney and check if short-term rentals are permitted.

3. Currency Fluctuations

If you’re buying property in pesos but earning in U.S. dollars, exchange rate fluctuations could affect your investment’s value over time.

✔ Solution: Consider holding funds in a Mexican bank to avoid sudden currency shifts when making payments.

4. HOA Fees & Hidden Costs

Many properties in resort areas have Homeowners Association (HOA) fees, which can be surprisingly high. Also, maintenance costs for beachfront properties tend to be more expensive due to saltwater damage.

✔ Solution: Get a full breakdown of all fees and maintenance costs before purchasing.

Want to buy property for less money? These insider tips can help you save big.

Where Is the Best Place in Mexico to Invest in Real Estate?

Not all locations in Mexico offer the same investment potential. Some areas are booming with tourism and rising property values, while others remain undervalued. Here are some of the best places to invest in Mexico real estate right now.

1. Merida – A Hidden Gem for Investors

Merida, the capital of Yucatán, is one of Mexico’s fastest-growing cities and a top choice for real estate investors.

✔ Affordable property prices – Homes in Merida are cheaper than in coastal cities but still offer great rental demand.

✔ Low crime rates – Merida is known as one of the safest cities in Mexico, making it ideal for families and retirees.

✔ Booming economy – Infrastructure improvements and business growth are driving up property values.

Expert Tip: The Centro Histórico district offers charming colonial homes that can be renovated and flipped for a profit.

Want to build wealth with real estate? Here’s how Fundrise is changing the game.

2. Tulum & Playa del Carmen – The Airbnb Goldmine

These Riviera Maya hotspots attract millions of tourists every year, making them top locations for vacation rentals.

✔ High Airbnb demand – Tourists flock here year-round, keeping rental occupancy rates high.

✔ Eco-friendly developments – Tulum is seeing a rise in sustainable, off-grid properties that appeal to international buyers.

✔ Fast appreciation – Property values in Playa del Carmen and Tulum have seen double-digit growth over the past decade.

Expert Tip: Investing in a pre-construction condo can offer huge discounts and high appreciation.

Looking for passive income? This real estate platform lets you invest from anywhere.

3. Puerto Vallarta – Luxury & Long-Term Growth

Puerto Vallarta has a thriving expat community, stunning beaches, and some of the best real estate deals in Mexico.

✔ Strong rental market – Both short-term vacation rentals and long-term leases are in demand.

✔ Luxury opportunities – High-end condos and beachfront villas are available for far less than in the U.S.

✔ Established infrastructure – Unlike newer hotspots, Puerto Vallarta has reliable utilities, roads, and services.

Expert Tip: Properties in Zona Romántica and Conchas Chinas tend to appreciate faster and attract high-paying renters.

Want more ways to make money in real estate? Check out these 100 real estate strategies.

Where Do Most Americans Buy Homes in Mexico?

Americans have been buying homes in Mexico for decades, drawn by affordable prices, great weather, and a lower cost of living. Certain cities have become hotspots for U.S. buyers, offering everything from luxury beachfront villas to charming colonial homes.

1. Puerto Vallarta – A Beach Paradise for Expats

Puerto Vallarta is one of the most popular cities for American homebuyers, thanks to its:

✔ Affordable beachfront properties compared to the U.S.

✔ Large expat community that makes settling in easier.

✔ Established medical facilities that cater to retirees.

Best Areas to Buy:

- Zona Romántica – Trendy area with walkable streets, cafes, and nightlife.

- Marina Vallarta – High-end condos with ocean views.

Pro Tip: Many Americans buy pre-construction condos here at a lower price and sell them later for a profit.

Thinking about investing? Here’s a modern way to grow your real estate portfolio.

2. San Miguel de Allende – A Colonial Retreat

This UNESCO World Heritage city is a favorite among retirees and artists, offering:

✔ Stunning colonial architecture and historic charm.

✔ A vibrant cultural scene with festivals and art galleries.

✔ Walkable streets and a welcoming expat community.

Best Areas to Buy:

- Centro Histórico – Historic homes with courtyards.

- Atascadero – A quieter residential area with great views.

Pro Tip: Unlike beachfront cities, San Miguel de Allende has no hurricane risks, making it a safer long-term investment.

Want expert advice on buying property? Check out these insider home-buying tips.

3. Lake Chapala – The Retirement Haven

Just outside Guadalajara, Lake Chapala is one of the most popular retirement destinations for Americans, thanks to:

✔ Perfect weather year-round – Spring-like temperatures with no extreme heat.

✔ Affordable cost of living – Property, food, and healthcare are much cheaper than in the U.S.

✔ Large English-speaking community – Many retirees make the transition easy.

Best Areas to Buy:

- Ajijic – The most popular town with a strong expat presence.

- Chapala – A quieter, more affordable option.

Pro Tip: Property taxes here are incredibly low, making it an ideal place to retire on a budget.

Looking for a smarter way to invest? This real estate platform lets you invest from your phone.

Do You Pay Real Estate Taxes in Mexico?

Yes, but Mexico’s real estate taxes are much lower compared to the U.S. While taxes vary by location, they are generally affordable and straightforward. Here’s what you need to know before investing in Mexico real estate.

1. Acquisition Tax (Impuesto Sobre Adquisición de Inmuebles)

When purchasing property in Mexico, buyers pay a one-time acquisition tax, which typically ranges from:

✔ 2% to 4% of the purchase price, depending on the state.

Pro Tip: This tax is paid at the time of closing and is non-refundable, so factor it into your buying budget.

2. Annual Property Tax (Predial)

Mexico’s annual property tax is incredibly low compared to U.S. property taxes.

✔ Usually 0.1% of the home’s assessed value—a fraction of what Americans pay.

✔ Assessed values are often lower than market value, further reducing costs.

✔ Discounts available if you pay early in the year.

Example: If your home in Mexico is valued at $200,000, your annual property tax might only be $200.

Want more real estate investment ideas? Here are 100 creative ways to profit in real estate.

3. Capital Gains Tax (Impuesto Sobre la Renta – ISR)

When selling property in Mexico, you may owe capital gains tax, but there are ways to reduce or avoid it.

✔ Standard Rate: 25% of the total sale price or 35% of the net gain.

✔ Primary Residence Exemption: If you’ve lived in the property as your primary residence for at least three years, you may be exempt from capital gains tax (with proof of residency).

✔ Deductible Expenses: Legal fees, renovations, and improvements can help reduce taxable gains.

Pro Tip: If you plan to sell in the future, keep detailed records of renovations and expenses to lower your taxable gains.

Looking for passive real estate income? This platform lets you invest from anywhere.

Final Thoughts on Investing in Mexico Real Estate

Investing in Mexico real estate can be an incredible opportunity—whether you’re looking for a vacation home, rental property, or long-term investment. With affordable property prices, strong rental demand, and low property taxes, Mexico has become a top destination for savvy investors.

However, success in the Mexican real estate market comes down to making smart choices:

✔ Choose the right location – Whether it’s the booming Airbnb market in Tulum, the expat-friendly Puerto Vallarta, or the colonial charm of Merida, location determines your success.

✔ Understand the legal process – If you’re buying in the Restricted Zone, be prepared to use a Fideicomiso (bank trust) or set up a Mexican corporation for investment purposes.

✔ Work with trusted professionals – A Notario Público, real estate attorney, and reputable local agent are essential to avoid scams and legal issues.

✔ Know the financial side – While property taxes are low, factor in acquisition costs, HOA fees, and potential capital gains taxes when selling.

Mexico’s real estate market offers incredible potential, but knowledge is key to making a profitable investment.

Looking for a modern way to invest? Here’s how Fundrise is revolutionizing real estate investing.