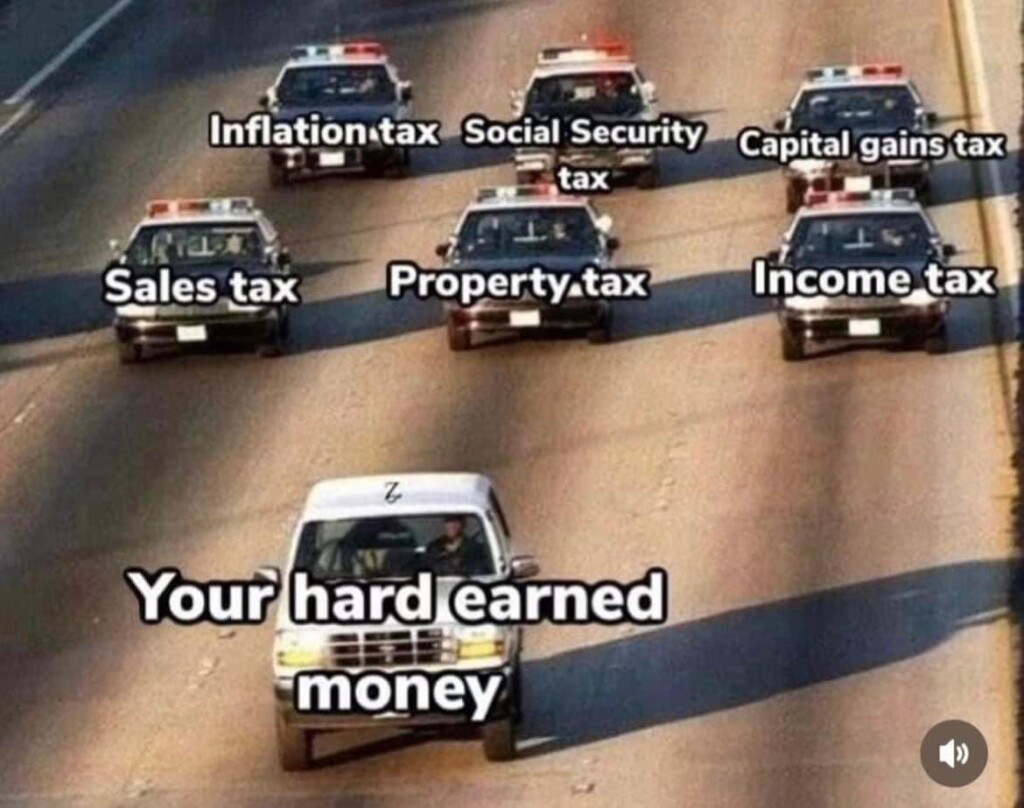

Greetings, financial enthusiasts! If you’ve ever felt like your hard-earned money is in a perpetual chase, pursued by a plethora of taxes and fees, you’re not alone. From property taxes to income taxes, sales tax to license fees, and an array of deductions, it can often feel like maneuvering through a financial labyrinth. Join us as we delve into this intricate world and discover how to navigate it with finesse on the path to financial success.

Property Taxes: Annual Calculations Unveiled

Imagine your mailbox as a regular stop for an annual visitor – the property tax bill. While these taxes support local services, their persistence can feel burdensome. Delving into the mechanics of property tax calculations and how they contribute to community development can shed light on this unavoidable aspect of ownership.

Income Taxes: The Annual Financial Choreography

Enter income taxes – the annual choreography you can’t escape. It’s that time of year when meticulous document assembly and tax deduction maneuvers take the spotlight. Grasping the nuances of tax credits, deductions, and staying updated on tax code alterations can enhance your tax returns and prevent excessive financial leakage.

Sales Tax: The Subtle Contributor

With each purchase, an inconspicuous participant steps forward – sales tax. Often overlooked, these nominal percentages accumulate over time. Delving into state-specific sales tax regulations, and even local variations, enables you to plan your expenditures more strategically.

License Fees: Unmasking Hidden Costs

While your vehicle offers freedom, it also comes with license fees. From vehicle registration to emissions tests, these costs can catch you off guard. Familiarizing yourself with the diverse fees associated with vehicle ownership and maintenance can save you from feeling like you’re forking out for a backstage pass to the road.

Social Security Tax: Investing in Your Future

A familiar sight on pay stubs – the Social Security deduction. It’s an investment in your future, despite the immediate deduction. Unveiling the mechanics of Social Security and understanding its long-term benefits can provide solace when witnessing those deductions.

Navigating the Financial Matrix

Friends, in the world of finance, it often feels like our hard-earned money is weaving through a matrix of taxes and fees. Yet, equipped with insight and strategic know-how, we can navigate this intricate web more proficiently. Thorough research, meticulous financial planning, and staying attuned to tax laws and updates can empower us to preserve more of our earnings and make astute financial decisions. Remember, while taxes and fees persist, your financial prudence can help you maximize your financial journey.