When it comes to building wealth, one of the most common dilemmas people face is whether to save money or invest money. Both options have their benefits and drawbacks, and choosing the right approach can be a daunting task.

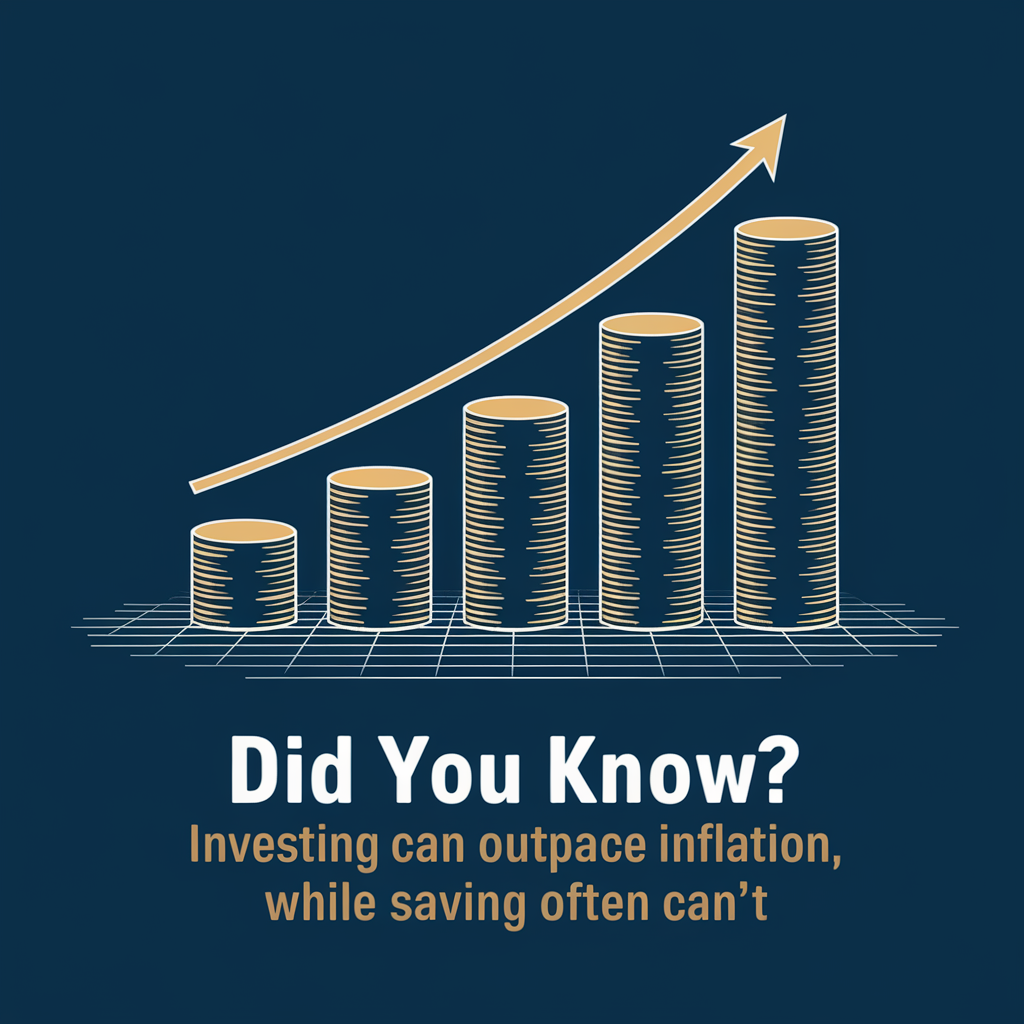

On one hand, saving money seems like the safer option. You’re keeping your money in a secure place, and you don’t have to worry about losing it due to market fluctuations or other risks. However, the downside of saving is that inflation can erode the value of your savings over time. This means that the purchasing power of your money will decrease as prices go up, and you may end up with less money than you started with.

On the other hand, investing money can offer greater returns than saving, but it also comes with greater risks. Depending on the type of investment you choose, you could experience significant losses if the market doesn’t perform as expected. However, historically, investing has been shown to offer higher returns than savings in the long run, helping your money grow and potentially even outpace inflation.

So, should you save or invest? The answer ultimately depends on your individual financial goals and risk tolerance. If you’re looking for short-term security or have a low tolerance for risk, saving may be the better option for you. However, if you’re willing to take on more risk for potentially higher returns in the long run, investing may be the way to go.

It’s worth noting that there are also a variety of options that offer a blend of savings and investment features, such as high-yield savings accounts or retirement accounts like 401(k)s or IRAs. These options can provide a balance of security and potential growth.

Ultimately, the key to building wealth is to find a strategy that works for your individual needs and financial goals. Whether you choose to save, invest, or a combination of both, staying consistent and disciplined in your approach can help you achieve financial success over time.

Sign up and use the Acorns app here! Easily invest and grow your money!