Is It Smarter to Buy a New or Used Car? Here’s the Truth

If you’re wondering is it smarter to buy a new or used car, you’re not alone — I used to think newer meant better… until I looked at my bank account. 🚨 The truth is, the decision can make or break your finances, especially if you’re trying to escape the cycle of debt or build real wealth.

I’ve been on both sides. I’ve driven off the lot in a shiny new car… and I’ve also paid cash for a well-loved used one. The difference? One left me broke, the other left me with peace of mind (and way more money in the bank).

Why Buying a New Car Feels Smart — But Might Not Be

Car dealerships make it so easy to fall in love with that new-car smell. They’ll tell you the warranty, reliability, and latest tech make it a “smart investment.” But here’s the truth: cars are not investments — they’re depreciating assets.

The second you drive a new car off the lot, it loses around 10-20% of its value instantly. That’s thousands of dollars gone in minutes. Over the next 5 years? Most new cars lose over 50% of their value. So while it feels like you’re “buying security,” what you’re really buying is a fancy loan with interest that works against you.

💡 If you’re someone trying to live smarter with your money, check out this post I wrote on how to stop impulse shopping — it’s all connected.

What Happened When I Bought New (and Regretted It)

Years ago, I bought a brand-new car with zero down and a five-year loan. It felt like a win at first — smooth ride, Bluetooth everything, and compliments everywhere I went. But within a year, I was underwater on the loan. The car’s value had plummeted, but my payments didn’t.

Maintenance was low, sure, but that monthly $500+ payment was eating me alive, especially when life threw curveballs. And insurance? Sky-high. It took me years to pay off — and by then, it wasn’t even worth half of what I paid.

If you’re feeling that squeeze too, you’ll relate to this story I shared about being constantly broke. Buying new made me feel good short-term, but it wrecked my long-term money game.

Used Cars: Where the Real Value Often Hides

Buying used doesn’t mean buying junk. You just need to know where to look — and be a little patient. The sweet spot for value? Cars that are 2–4 years old. They’ve already taken the biggest depreciation hit but often still have modern features and decent mileage.

My current ride? A reliable used SUV I paid cash for. No payments, low insurance, and it runs like a champ. Plus, when something needs fixing, I’ve got savings ready — because I’m not bleeding money on a loan.

And guess what? That monthly amount I used to dump into a car payment? I now invest instead. If you’re curious how that works, check out how to start investing with as little as $10 — it’s easier than you think.

Depreciation: The Silent Wallet Killer

One of the biggest reasons I stopped buying new cars? Depreciation is brutal. The second you drive a new car off the lot, it loses 10–20% of its value. Within the first year, it’s down another 15–25%. That’s not just numbers — that’s thousands of dollars disappearing for the luxury of “new car smell.”

I didn’t understand that at first. But once I realized I was paying interest on money I’d never get back, it hit hard. That’s when I started running the numbers — and it changed everything. I’m not saying don’t ever buy new, but if you’re trying to build wealth, that kind of automatic loss is a major setback.

If you’re working hard to avoid money traps like this, you might relate to these powerful tips for broke beginners trying to start investing.

New Cars Come With Hidden Costs

Sure, new cars offer peace of mind — no strange smells, no previous owners, fewer breakdowns. But what no one talks about are the hidden expenses: full coverage insurance, higher registration fees, expensive dealership maintenance, and sometimes mandatory service packages.

My insurance dropped almost 40% when I switched to a used vehicle. That alone saved me hundreds per year. Plus, used cars give you options: independent mechanics, cheaper tires, and no pressure to buy $100 oil changes from the dealership.

If you’re still adjusting your finances, this quick tool helped me track my monthly budget like a pro — and it works for both car buyers and everyday spending.

Reliability Has Changed Over the Years

One argument I used to hear constantly was, “But used cars break down all the time.” That might have been true 20 years ago — but cars today are built better and last longer than ever. I’ve driven multiple used cars over 100,000 miles with barely more than routine maintenance.

In fact, some of the best purchases I’ve ever made were cars with 50k–70k miles that still ran like new. And guess what? Someone else took the depreciation hit. I just got a reliable ride for a fraction of the original cost.

If you’re trying to avoid financial landmines like overpaying for a car, you might like this breakdown of why your budget might not be working. It opened my eyes to more than just car payments.

What Car Dealers Won’t Tell You

When I bought new, dealers were all smiles — until the paperwork came out. Suddenly I was signing for add-ons I didn’t really want: extended warranties, service plans, even paint protection that sounded more like a scam. These upsells can add thousands to the price of a new vehicle.

Used car purchases, on the other hand? More straightforward. You can negotiate, walk away, or buy from private sellers. No pressure. No fluff.

I learned the hard way that dealers have one goal: maximize their profit, not protect your financial future. And if you’re serious about breaking free from spending traps, check out how to stop impulse shopping and regain control. It’s not just about cars — it’s about your mindset.

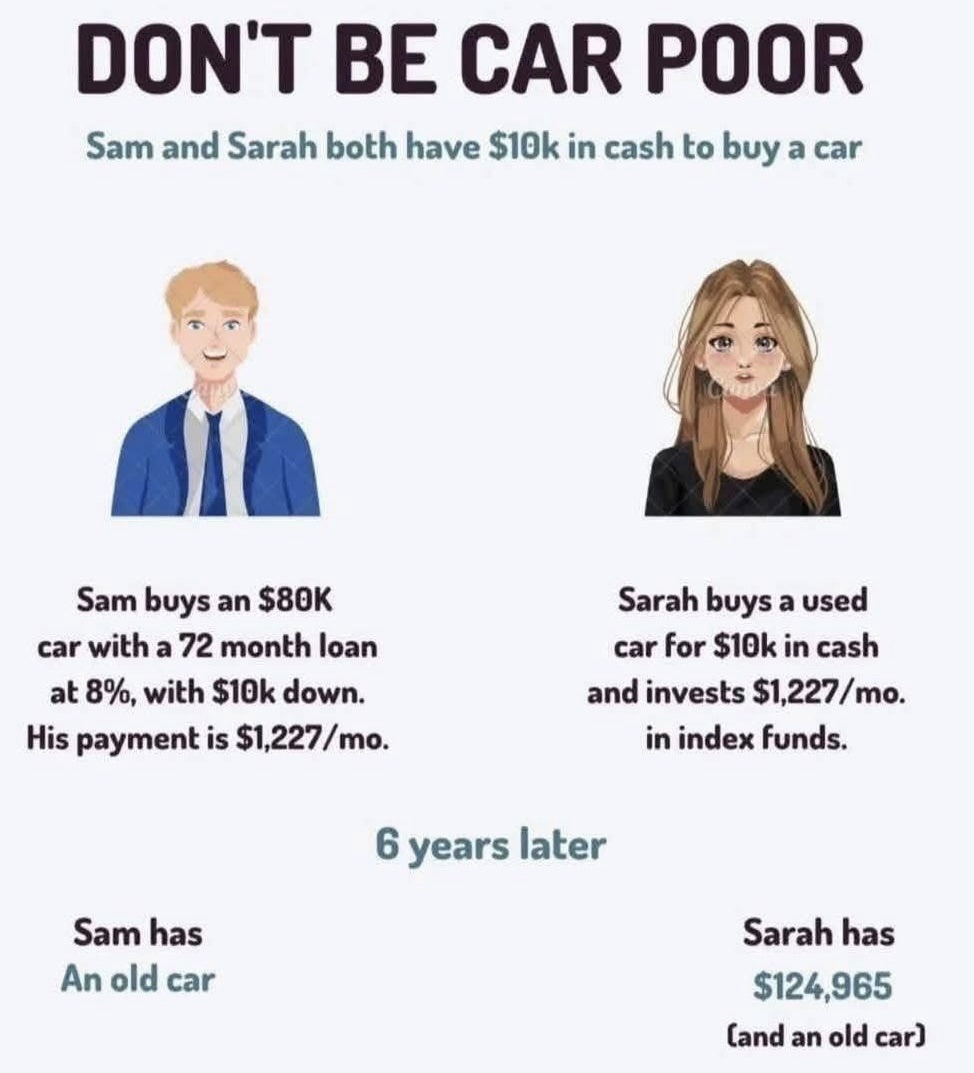

I Compared the Total Cost — And It Wasn’t Even Close

I sat down one day and ran the numbers. A new car I was considering would’ve cost me $42,000 after taxes, fees, and financing over six years. Meanwhile, the used car I ended up buying cost me $11,500 total — and I paid it off in 14 months.

That difference? It didn’t just help me breathe easier. It gave me space to pay off debt faster than I thought possible and start investing.

When folks say, “But a new car comes with a warranty,” I get it. But I’d rather have an emergency fund and a car that’s 3 years old than a brand-new one that keeps me living paycheck to paycheck.

The Depreciation Trap Most People Miss

Here’s something no car dealership reminds you of: a new car loses 10–20% of its value the moment you drive it off the lot. By year five, it’s typically worth 40–60% less than what you paid. That’s thousands of dollars evaporating just because you wanted that new car smell.

The used car I drive now? It’s already done most of its depreciating. What I paid for it is a lot closer to what I could still sell it for today.

If you want to get ahead financially, avoiding traps like this is critical. I’d also suggest reading how to live within your means without feeling miserable — it completely changed the way I think about lifestyle and money.

I’ll Never Finance a Car Again — Here’s Why

After financing a brand-new SUV years ago, I learned a brutal lesson: monthly payments rob your future self. Every $600–$800 going toward a car note could’ve been building my emergency fund or going into my Roth IRA.

With a used car, I’ve been able to say goodbye to interest payments and hello to real peace of mind. I don’t miss the stress of knowing I owed thousands on something losing value daily.

If you’re stuck in this cycle, you might want to explore how to stop impulse shopping and regain control of your wallet— because sometimes, buying new is just a dressed-up impulse buy.

Maintenance Isn’t the Nightmare Everyone Thinks It Is

One of the biggest arguments I hear is, “But used cars break down more!” Sure, anything can happen, but modern vehicles are built to last way beyond 100,000 miles. I had a used Honda that hit 210,000 miles before I ever had a major issue.

The trick is this: buy a car with a good track record, and set aside a small maintenance fund each month. It’s still way cheaper than a car payment.

Want to take full control of your finances? Start with something like this simple monthly budget PDF download — it helped me keep every dollar in check, including for repairs.

New Cars Lose Value Fast — Like, Really Fast

Here’s what nobody tells you at the dealership: the second you drive that shiny new car off the lot, it loses around 10–20% of its value. After one year? You’re down almost 30% on average.

I made that mistake once. Never again.

Used cars, especially ones that are just 2–3 years old, have already taken that depreciation hit. That means you’re getting more car for less money, and it holds its value better moving forward.

It’s the same mindset I used when I finally asked myself why am I always broke? — turns out, it’s usually because I was losing money faster than I realized.

Buying Used Isn’t Just Smart — It’s Freedom

There’s a certain freedom that comes with owning your car outright. No payments. No lender. Just you, the keys, and no debt hanging over your head.

And when you invest the money you save on a used car instead of making payments? That’s where real wealth starts building.

Even putting what would’ve been your car payment into a Fundrise real estate account each month can completely flip your financial future. It’s not just about saving — it’s about redirecting your money toward growth.

Repairs vs. Reliability: Used Cars Aren’t What They Used to Be

People love to say, “But used cars break down more!” Honestly, that might’ve been true 20 years ago. Today? Not so much — especially if you’re smart about what you buy.

I’ve bought used cars that ran smooth for 100,000+ miles with just basic maintenance. You just have to do your homework, get a vehicle history report, and maybe take it to a mechanic before you buy.

The truth is, you can get a solid, low-mileage vehicle that’s just a few years old and still under warranty — and save thousands compared to new.

That’s more money you can put toward your family’s future or even toss into a beginner-friendly investment tool like Acorns and watch it grow.

Car Payments Are a Dream Killer

If you’ve ever had a $500+ car payment, you know what I mean. It doesn’t matter how “low” the interest rate is — a car payment is still draining your monthly cash flow.

I used to think it was normal to have a car payment. It’s not. It’s just common — and there’s a big difference.

Every time I’ve avoided a car payment, I’ve been able to put that money toward savings, investing, or debt payoff. Like using a debt snowball tracker to crush my balances faster instead of feeding the bank’s bottom line.

You don’t realize how powerful your money is until you stop handing it over to a lender every month.

What I Learned: Is It Smarter to Buy a New or Used Car?

After going through it myself — financing new cars, buying used ones outright, dealing with surprise repairs, and even calculating long-term investment returns — I can honestly say this:

Yes, it is smarter to buy a used car. Not just because it’s cheaper upfront, but because it opens the door to actual financial freedom.

A new car might smell nice and feel good for a little while, but a used car that’s paid off? That feels even better. That’s money not locked up in a monthly payment. That’s freedom to invest, save, or plan for something bigger.

If I could go back in time, I’d skip the brand-new dealership deals and instead focus on smart purchases backed by research, cash, and confidence.

Need help learning how to make those smarter moves with your money? Start with my favorite broke-beginner investing tips or use this monthly budget planner to make sure your next car decision doesn’t derail your entire budget.

Because trust me — no car is worth being broke over.