Debt Payoff Calculator

Enter your credit card balances and APRs below, then click “Calculate Payoff Order” to get your debt payoff plan.

| Card Balance | APR (%) |

|---|---|

Dealing with credit card debt can be overwhelming, but it’s a challenge you can conquer. Welcome to our Debt Payoff Calculator, a powerful tool designed to help you take control of your financial future. In this article, we’ll explore the importance of paying off high-interest debt, understand how our calculator works, and provide you with expert tips on managing your credit card debt effectively.

Why Pay Off High-Interest Debt First: When it comes to credit card debt, the interest rates (APR) can significantly impact the total amount you owe. High APRs mean you’re paying more in interest charges, making it harder to reduce your debt. That’s why it’s essential to prioritize paying off high-interest debt first to save money in the long run.

How Our Calculator Works: Our Debt Payoff Calculator is user-friendly and straightforward. Follow these steps:

- Enter the outstanding balance for each of your credit cards.

- Input the respective APR for each card.

- Click the “Calculate Payoff Order” button.

The calculator will do the rest, ranking your cards from highest to lowest interest rate. This order provides a clear strategy for tackling your debt efficiently.

Creating Your Debt Payoff Strategy: Now that you have your personalized payoff order, it’s time to create a debt payoff strategy. Here’s a suggested approach:

- Focus on the card with the highest APR (top of the list) as your priority.

- Allocate extra funds toward this card while making minimum payments on others.

- Once the first card is paid off, move to the next one on the list.

- Repeat until you’ve paid off all your credit card debt.

Additional Tips for Managing Credit Card Debt:

- Create a monthly budget to track your income and expenses.

- Cut unnecessary expenses to free up more money for debt repayment.

- Consider transferring high-interest debt to a card with a lower APR (if available).

- Avoid accumulating more debt by using credit cards sparingly.

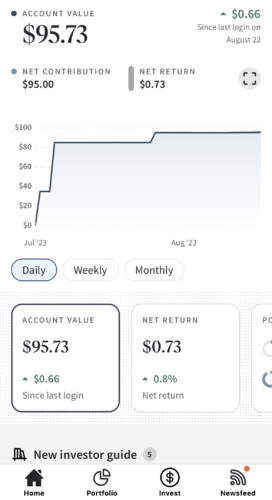

Take Action Today: Ready to take control of your credit card debt? Use our Debt Payoff Calculator and start your journey toward financial freedom. Additionally, explore our website for more valuable resources on budgeting, saving, and achieving your financial goals.

Conclusion: Managing credit card debt doesn’t have to be a daunting task. With the right strategy and tools like our Debt Payoff Calculator, you can make significant progress in paying off your debt and securing your financial future. Don’t wait; start today and empower yourself to master your credit card debt.