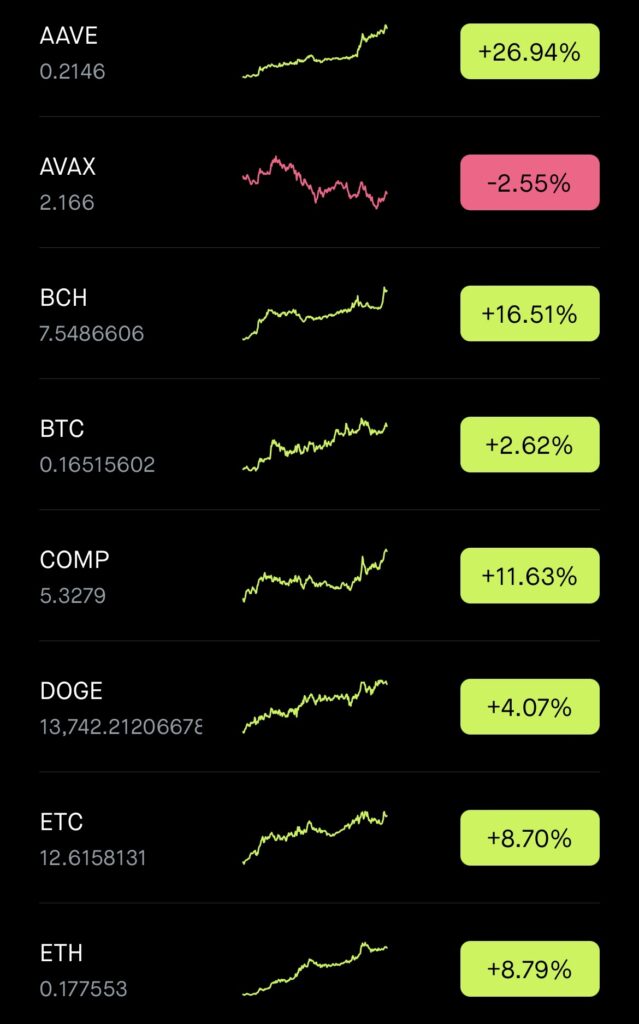

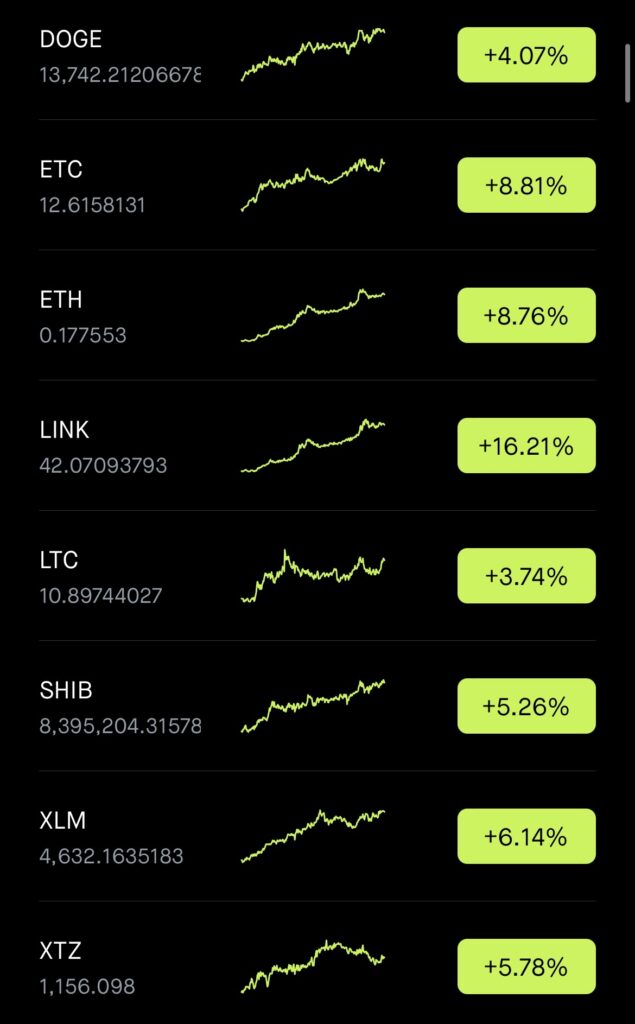

December 27, 2023, marks a significant day in the world of cryptocurrency, as several major digital currencies have experienced substantial gains. The market is abuzz with excitement as investors and enthusiasts witness a surge in values, highlighting the dynamic and often unpredictable nature of the crypto market. Let’s delve into the details of this remarkable day.

AAVE Leads the Charge with Over 20% Gain

AAVE, a well-known player in the decentralized finance (DeFi) space, has seen an impressive surge, with its value skyrocketing by over 20% in just one day. This remarkable increase reflects growing investor confidence and interest in DeFi platforms, which have been gaining traction for their innovative approach to finance.

AAVE’s Role in the DeFi Ecosystem

AAVE is more than just a cryptocurrency; it’s an integral part of the DeFi ecosystem. As a lending platform, it allows users to lend and borrow cryptocurrencies without the need for a traditional financial intermediary. This innovative approach to finance has the potential to disrupt traditional banking and lending systems.

The Technology Behind AAVE

The technology underpinning AAVE is a significant factor in its long-term potential. Its open-source protocol is designed for scalability and security, two crucial aspects for any financial service. The platform’s ability to offer variable and stable interest rates also adds to its appeal, providing flexibility for users.

Market Adoption and User Base

The long-term success of any cryptocurrency is heavily dependent on its adoption and the growth of its user base. AAVE’s recent surge could be indicative of growing trust and interest in the platform. As more users engage with the platform and its features, it could lead to increased stability and growth.

Regulatory Environment

The regulatory environment for cryptocurrencies and DeFi platforms is a critical factor in their long-term viability. Positive regulatory developments could lead to greater adoption and stability for AAVE. Conversely, strict regulations could pose challenges.

Competition in the DeFi Space

The DeFi space is highly competitive, with numerous platforms offering similar services. AAVE’s ability to innovate and stay ahead of its competitors will be crucial for its long-term success. Its current position and performance are promising, but the platform must continue to evolve to maintain its relevance.

Risks and Volatility

Like all cryptocurrencies, AAVE is subject to market volatility and risks. Potential investors should be aware of these factors and consider them when evaluating AAVE as a long-term investment. Diversification and careful market analysis are key in managing these risks.

LINK and BCH Follow Suit

LINK, the digital asset of the Chainlink network, has also experienced a significant uptick, with an almost 17% increase in its value. This surge is indicative of the growing interest in decentralized oracle networks, which Chainlink provides, allowing for secure and reliable data feeds for complex smart contracts.

Similarly, Bitcoin Cash (BCH), a fork of Bitcoin, has seen a 17% rise. This increase further cements its position in the market as a viable alternative to Bitcoin, especially for those looking for faster transaction speeds and lower fees.

LINK (Chainlink): Bridging the Gap Between Smart Contracts and Real-World Data

LINK, the cryptocurrency of the Chainlink network, plays a pivotal role in the blockchain ecosystem. Chainlink is a decentralized oracle network that provides reliable, tamper-proof data for complex smart contracts on any blockchain.

Key Factors for Long-Term Viability:

- Real-World Application: Chainlink’s ability to securely and accurately feed real-world data into smart contracts makes it a valuable asset in the blockchain world. This functionality is crucial for the effective execution of smart contracts in various industries, including finance, insurance, and supply chain management.

- Partnerships and Integration: Chainlink has established numerous partnerships across different sectors, integrating with various blockchain projects. This widespread adoption is a strong indicator of its long-term potential.

- Innovation and Development: The continuous development and innovation within the Chainlink network, including enhancements in data security and oracle reliability, are vital for its long-term growth and adoption.

BCH (Bitcoin Cash): Aiming for Efficient Transactions

Bitcoin Cash emerged from a fork of Bitcoin, primarily focusing on increasing transaction speed and reducing transaction fees. It aims to be a viable digital currency for everyday transactions.

Key Factors for Long-Term Viability:

- Scalability and Efficiency: BCH’s main selling point is its scalability. By increasing the block size, it can process transactions more quickly and with lower fees compared to Bitcoin. This makes it an attractive alternative for users and merchants seeking efficient digital transactions.

- Adoption and Usability: The long-term success of BCH depends on its adoption as a medium of exchange. Its increased transaction speed and lower fees could make it more appealing for everyday use, both online and in physical stores.

- Market Position and Community Support: BCH’s position in the market, alongside the support and development from its community, plays a crucial role in its long-term viability. The cryptocurrency needs to maintain its relevance and utility in an increasingly competitive market.

COMP and Other Cryptocurrencies Join the Rally

Compound (COMP), another major DeFi player, has not been left behind, registering a 12% increase. This gain underscores the burgeoning interest in the DeFi sector, which has been revolutionizing lending and borrowing in the crypto space.

Moreover, several other cryptocurrencies have seen gains of over 5%, signaling a broad positive trend in the market. This widespread increase is a clear indication of the bullish sentiment currently dominating the crypto world.

The significant gains seen in the crypto market on December 27, 2023, are a testament to the volatile yet potentially lucrative nature of cryptocurrency investments. As digital currencies like AAVE, LINK, BCH, and COMP soar, they highlight the ever-evolving landscape of the crypto world. While such surges bring excitement, they also remind investors of the need for careful analysis and understanding of market trends in this rapidly changing domain.

The Case for Crypto: Why It’s a Worthy Investment Despite Skepticism

Cryptocurrency has been a subject of intense debate since its inception. While skeptics highlight its volatility and regulatory uncertainties, proponents see it as a revolutionary investment opportunity. Despite the naysayers, there are compelling reasons why cryptocurrency remains a good investment for many.

Decentralization and Autonomy

One of the core appeals of cryptocurrency is its decentralized nature. Unlike traditional currencies controlled by governments and central banks, cryptocurrencies operate on decentralized networks using blockchain technology. This autonomy from central authority not only reduces the risk of inflation but also offers a level of security and transparency that traditional financial systems struggle to match.

Potential for High Returns

Cryptocurrency has shown the potential for high returns on investment. While it’s true that the crypto market is volatile, this volatility can work in favor of investors, offering the possibility of significant gains. Early investors in major cryptocurrencies like Bitcoin and Ethereum have seen substantial returns, drawing more interest to the market.

Diversification of Investment Portfolio

Investing in cryptocurrency can be an effective way to diversify an investment portfolio. Diversification is a key strategy in risk management, and the inclusion of crypto assets can help spread risk. Cryptocurrencies often show little correlation with traditional asset classes like stocks and bonds, providing a hedge against market downturns in other sectors.

Technological Innovation and Future Potential

The technology behind cryptocurrencies, particularly blockchain, has transformative potential. Blockchain technology is finding applications in various sectors, including finance, healthcare, supply chain management, and more. Investing in cryptocurrency is, in a way, investing in this technological innovation and its future potential.

Increasing Mainstream Adoption

Cryptocurrencies are gradually gaining acceptance in mainstream finance. More businesses are accepting crypto payments, and financial institutions are beginning to offer crypto-related services. This growing adoption is a sign of the increasing legitimacy and staying power of cryptocurrencies.

Accessibility and Inclusivity

Cryptocurrencies offer an accessible and inclusive financial system. They can be particularly beneficial in regions with unstable currencies or limited access to traditional banking. The ease of making cross-border transactions with cryptocurrencies opens up global financial markets to a broader audience.

While investing in cryptocurrencies comes with risks, the potential rewards make it an attractive option for many investors. The key is to approach crypto investment with a well-informed strategy, understanding the market dynamics and technological underpinnings. As with any investment, it’s important to only invest what you can afford to lose and to diversify your portfolio. Despite the skepticism, the unique advantages of cryptocurrencies — from high return potential to technological innovation — make them a noteworthy addition to the modern investment landscape.

Why Solana Is So Impressive: A Look at Its Performance

This article delves into the impressive performance of Solana in the cryptocurrency market. It’s a testament to the potential strengths and growth opportunities within the crypto space, offering valuable insights for those considering investments in emerging cryptocurrencies.

5 Surprising Ways to Legally Get Out of Debt

Understanding financial management, including debt reduction strategies, is crucial for anyone looking to invest in cryptocurrencies. This article provides practical tips for improving financial health, which is essential for making informed investment decisions.

Breaking Free from Living Paycheck to Paycheck: A Personal Journey

This piece offers inspiration and strategies for achieving financial independence. For potential crypto investors, understanding how to break free from financial constraints is key to exploring investment opportunities like cryptocurrencies.