In today’s fast-paced world, finding ways to earn money without constant active effort has become more appealing than ever. Passive income, or earnings derived from ventures requiring minimal day-to-day involvement, presents a viable solution for those looking to enhance their financial stability and secure their future. From leveraging assets like real estate and cars to tapping into digital opportunities such as affiliate marketing and online courses, the possibilities are vast. This article explores 30 diverse passive income ideas, each offering a unique path to financial freedom and wealth accumulation.

1. Rent out a Room

Transform unused space into a steady income stream by renting out a room. Platforms like Airbnb make it easy to connect with potential renters, offering flexibility and control over your terms. Click here to read more in detail on this topic

2. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for each sale made through your referral. It’s a powerful way to monetize a blog or social media presence.

3. Dividend Stocks

Investing in dividend-paying stocks can provide regular income with the potential for capital appreciation. It’s a classic strategy for those looking to earn from the stock market passively.

4. Peer to Peer Lending

Peer-to-peer lending platforms allow you to lend money directly to individuals or businesses, earning interest on your loans as a form of passive income.

5. Sell an Online Course

If you have expertise in a particular area, creating and selling an online course can provide ongoing income as people continue to enroll.

6. Sell an E-book

Writing and selling an e-book is another excellent way to generate passive income. With digital platforms, your work can reach a global audience.

7. Start a YouTube Channel

Content creators can earn substantial income through ad revenue, sponsorships, and affiliate marketing by starting a YouTube channel focused on a niche they’re passionate about.

8. Drop-shipping Store

Drop-shipping involves selling products through an online store without handling inventory. When a customer makes a purchase, the order is fulfilled by a third-party supplier.

9. Buy a Profitable App

Acquiring an app that’s already generating revenue can be a quick way to start earning passive income, especially if the app continues to attract users.

10. Buy a Profitable Website

Similar to apps, websites with established traffic and revenue streams offer an immediate source of passive income. Look for sites with growth potential.

11. Cryptocurrency Mining

While it requires upfront investment in hardware, cryptocurrency mining can yield ongoing returns in the form of newly minted digital coins.

12. Hold Stocks Long Term

Long-term stock investments can grow in value over time, providing not only potential dividends but also capital gains.

13. Create an App

Developing an app that meets a specific need or interest can generate income through sales, subscriptions, or ads.

14. Rent Out Your Car

Car-sharing platforms enable you to rent out your vehicle during times you’re not using it, turning a depreciating asset into a source of income.

15. Start a Laundromat

A laundromat requires upfront investment but can offer a steady source of income with minimal daily management once established.

16. Vending Machines

Vending machines in strategic locations can provide regular cash flow with routine restocking and maintenance.

17. Start an ATM Business

Owning ATMs and placing them in high-traffic areas can earn you a fee for every transaction made.

18. Put Ads on Your Car

Companies will pay to advertise on your vehicle, turning your daily commute into a revenue-generating activity.

19. Crowdfunded Real Estate

Investing in real estate projects through crowdfunding platforms allows you to earn rental income and/or share in the profits from property sales.

20. Investing with Robo Advisor

Robo advisors offer a hands-off approach to investing, automatically managing a diversified portfolio for you.

21. Run Subscription Service

A subscription-based business model provides consistent, recurring revenue from customers who pay for ongoing access to products or services.

22. Invest in Royalty Income

Investing in intellectual property or creative works can yield royalties, providing a continuous income stream whenever the work is used or sold.

23. Rent Out Items You Have

From tools to party supplies, renting out items you own but seldom use can be an easy way to earn money.

24. Sell Products on eBay

Selling collectibles, vintage items, or anything in demand on eBay can turn into a profitable venture with the right strategy.

25. Sell Products on Amazon

Amazon’s vast marketplace offers immense potential for selling products directly to consumers, with options like FBA (Fulfillment by Amazon) to simplify logistics.

26. High Yield Savings Account

Placing your savings in a high-yield account can provide better returns than a regular savings account, making your money work for you.

27. Be a Silent Business Partner

Investing in a business as a silent partner allows you to benefit from profits without being involved in day-to-day operations.

28. Start a Car Wash

Automated car washes can generate revenue with minimal ongoing effort once they’re up and running.

29. Hire a Virtual Assistant

Outsourcing tasks to a virtual assistant can free up your time to focus on activities that generate income.

30. Sell Print on Demand T-shirts

With print-on-demand services, you can design and sell custom T-shirts without handling inventory, creating a scalable business model.

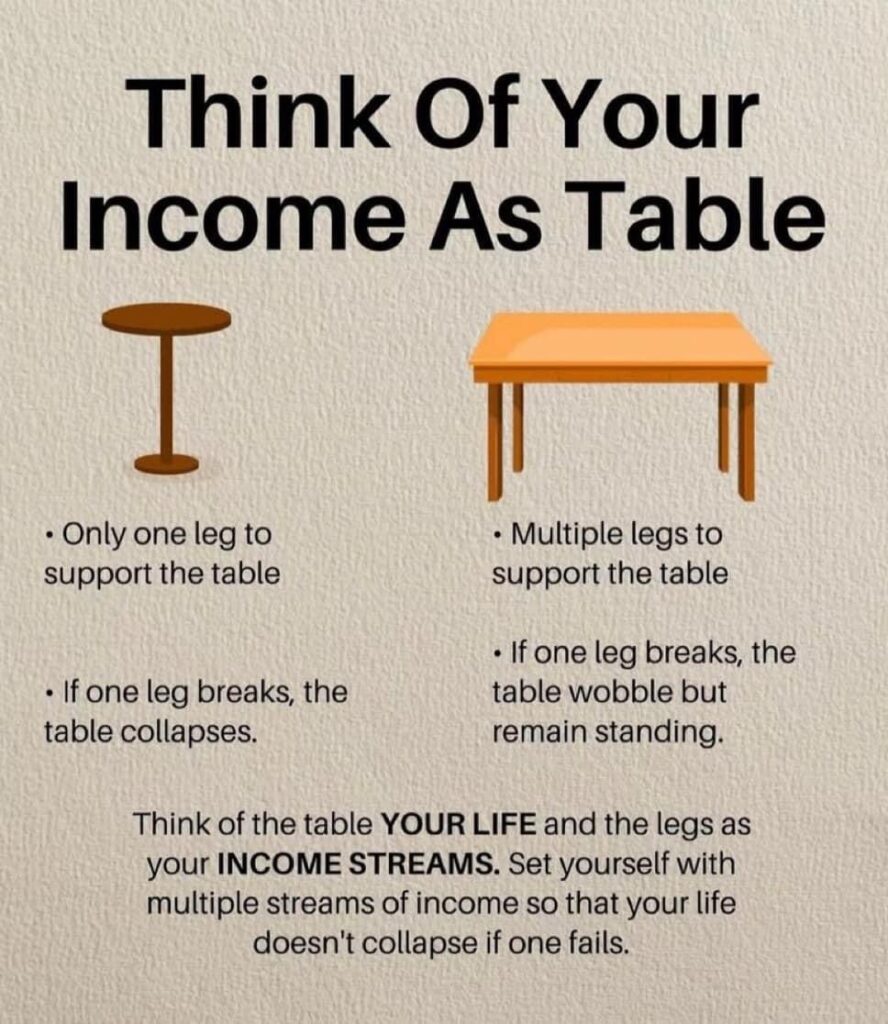

Each of these passive income ideas offers a unique pathway to financial freedom, allowing you to diversify your income streams and build wealth over time. By carefully selecting the right opportunities based on your interests, skills, and resources, you can create a robust portfolio of passive income sources that pave the way to a more secure financial future.

Note: each of the topics above, if you click them, you will be taken to another dedicated article on that specific passive income method so you can learn so much more about it! Don’t miss out!

How Can Passive Income Change Your Life?

Imagine this: waking up each morning knowing your bank account has grown overnight, not from the 9-5 grind, but from income streams you’ve set up once and now they’re paying you back – that’s the magic of passive income. It’s like having a silent business partner that works tirelessly, allowing you more freedom, security, and the ability to pursue what truly matters to you. Let’s talk about how passive income can be a game-changer in your life, just between friends.

Financial Freedom

First off, passive income can lead you to financial freedom. This doesn’t mean owning a yacht or a mansion (though it’s not out of the question), but it does mean having enough income to cover your living expenses without actively working for it. Imagine not living paycheck to paycheck, being able to save more, invest more, and not breaking a sweat when unexpected bills pop up.

More Time for What You Love

Passive income buys you time. Instead of clocking in extra hours at work, you could be spending time with your family, picking up a new hobby, or traveling. It’s about being present for life’s moments without the constant worry of making ends meet.

Stress Reduction

Let’s be real, financial stress is a beast. It keeps you up at night and can affect your health, relationships, and quality of life. Passive income can help tame this beast. Knowing you have a steady flow of income, regardless of what happens at your day job, can provide peace of mind and significantly reduce stress.

Opportunities for More Risks

With a safety net of passive income, you can afford to take more risks. Always dreamed of starting your own business? Want to invest in a high-risk, high-reward venture? Passive income gives you the financial backing to chase these dreams without risking your entire livelihood.

Retirement Ready

Passive income is retirement’s best friend. The traditional retirement age is getting later and later, but with passive income, you could retire earlier and more comfortably. It’s about building up enough income streams that you can live off of without depleting your savings or relying solely on social security.

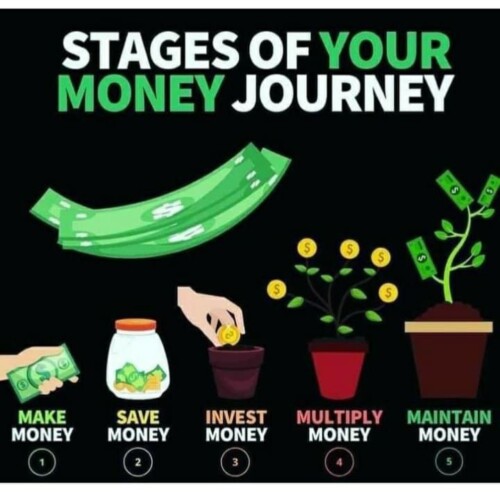

How to Get There

Getting to a place where passive income changes your life isn’t overnight magic. It requires upfront work, a bit of risk-taking, and a lot of learning along the way. Whether it’s investing in dividend stocks, starting a side hustle, or buying property to rent out, the key is to start. And remember, it’s okay to start small. Even an extra $100 a month can be a stepping stone to bigger things.

Friend to Friend: It’s Worth It

From one friend to another, the journey to earning passive income is worth every bit of effort. It’s not just about the money; it’s about what the money can bring to your life. More freedom, less stress, and the ability to live on your own terms. So, why not take that first step? Your future self will thank you for it.

Why Aren’t More People Building Passive Income Streams?

It’s a question that puzzles many: If passive income has the potential to change lives by providing financial security, freedom, and flexibility, why doesn’t everyone jump on the opportunity? Let’s break down some of the hurdles and misconceptions that might be holding people back from diving into the world of passive income.

Lack of Awareness or Understanding

Firstly, not everyone is aware of what passive income is or the vast array of options available to generate it. The concept of earning money without actively working for it every day might seem too good to be true to some, leading to skepticism and inaction. Education and exposure to success stories can play significant roles in changing this perception.

Initial Effort and Time Investment

While the income is passive once the streams are established, there’s usually significant upfront work involved. Whether it’s writing a book, setting up a rental property, or creating an online course, these endeavors require time, effort, and sometimes an initial financial investment. This initial barrier can be daunting, especially for those already juggling busy schedules.

Fear of Failure

The fear of losing money or failing is a powerful deterrent. Many passive income strategies, particularly investment-related ones, carry inherent risks. The possibility of a negative outcome can prevent people from taking the first step, especially if they lack the financial cushion to absorb potential losses.

Financial Constraints

For some, the idea of passive income is appealing, but financial constraints limit their ability to invest in opportunities that require upfront capital. This could range from purchasing property to investing in stocks or starting a business. Without disposable income to invest, these individuals might feel stuck on the sidelines.

Misconceptions About Wealth and Income

There’s a common misconception that building wealth through passive income is only for the rich. This belief can make the idea of developing passive income streams seem unattainable for the average person. However, many strategies require minimal to no startup capital, such as affiliate marketing or creating digital products.

Overwhelmed by Options

The sheer number of passive income ideas can be overwhelming. For someone new to the concept, deciding where to start can be a challenge. Without clear guidance or a personal interest in a specific area, potential earners may suffer from analysis paralysis, unable to choose a path forward.

Comfort with the Status Quo

Finally, many people are comfortable with their current financial situation, even if it means living paycheck to paycheck. The prospect of changing one’s lifestyle, learning new skills, and stepping out of their comfort zone can be more intimidating than the allure of financial freedom.

Bridging the Gap

Overcoming these barriers requires a mindset shift, education, and sometimes, a leap of faith. Starting small, seeking mentorship, and gradually building confidence through experience can make the process less daunting. Remember, every journey to passive income begins with a single step, and the rewards, as many can attest, are well worth the effort.

In essence, building passive income streams is not just about financial gain; it’s about reshaping your life to prioritize freedom, security, and personal fulfillment. While the path isn’t always easy or straightforward, the destination—a life where you’re not solely dependent on a 9-5 job for income—is compelling enough to consider taking the plunge.