Why Family Budgeting Matters More Than Ever

When we first started trying to get serious about our money, we were all over the place. One month we’d be okay, the next we’d be behind and scrambling. The turning point for us came when we stopped winging it and started using actual family budgeting tips that made sense for our lifestyle.

Budgeting as a family doesn’t mean you have to live like a monk. It means you start telling your money what to do before it disappears. Once we had a plan, even a loose one, the stress eased up and we finally felt like we were getting somewhere.

I used to think budgeting was restrictive, but I learned it’s actually freedom—the kind where you’re not worrying about how to pay for groceries on Friday. If you’re raising a family and money feels tight, these tips can help you breathe again.

Step-by-Step: How We Built a Simple Family Budget That Works

Forget complicated spreadsheets with 19 tabs. We started our family budget with just a pen, paper, and a real honest look at our income vs. expenses. Here’s what worked for us:

1. We Calculated Our Real Take-Home Pay

Not gross income. What actually hits your bank account after taxes and deductions.

2. We Listed Every Monthly Bill

Rent/mortgage, electric, internet, phone, car payments, insurance, streaming services—we wrote it ALL out.

3. We Looked at Our Variable Expenses

This included groceries, gas, eating out, kid stuff, pets, and random things like birthdays or school fees.

4. We Planned for Unexpected Costs

Flat tires. ER visits. Broken appliances. These things happen, and they blow your budget if you’re not ready.

5. We Assigned Every Dollar a Job

This part changed everything. No more guessing. Every dollar had a purpose—even the ones for fun.

One of the tools that helped was this Monthly Budget Planner PDF 📝 that made it super easy to track spending and adjust month to month.

Next we’ll dive into how low income families can still budget successfully without feeling like they’re failing.

Family Budgeting Tips for Low Income Families That Actually Help

If you’re working with a small income, I promise you’re not alone. We had months where we didn’t know how we’d stretch one paycheck into three meals a day, gas, and bills—but we learned a few tricks that saved our sanity.

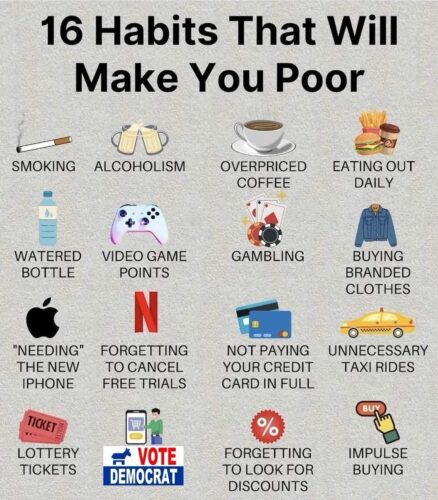

1. Prioritize Needs Over Wants

Sounds obvious, right? But tracking spending showed us how many small “wants” added up fast. We started saying no to little things so we could say yes to what mattered.

2. Use Cash Envelopes for Certain Categories

This one’s old school, but it works. Groceries and gas were easier to manage when we used actual cash. When the envelope was empty, we were done.

3. Meal Plan Around What’s on Sale

We built meals off the weekly ad instead of the other way around. It easily saved us $40–60 a week.

4. Use Budgeting Tools

If you’re on a tight income, using smart apps makes a difference. We like writing things out, but budgeting apps like Goodbudget or EveryDollar gave us a birds-eye view of where the money was going.

And honestly, this Debt Snowball Tracker PDF 📉 helped us stop feeling so overwhelmed by our debts by letting us track progress one bill at a time.

Budgeting With Kids: Making It a Family Conversation

The moment we included our kids (yes, even the little ones) in our financial conversations, everything shifted. It’s not about telling them money is scary—it’s about showing them how it works.

Talk Openly About Money (Age-Appropriate)

We explained to our kids that budgeting helps us afford the fun stuff and the necessary stuff. That meant fewer tantrums over “no” at the store.

Use Real Examples

We’d say things like: “We’re saving $20 a week for our vacation. That’s why we’re cooking at home tonight instead of going out.”

Get Them Involved

Our kids help with grocery planning. We’ll ask, “Should we get snacks or ice cream?” It teaches trade-offs early.

And when you’re looking for affordable family fun, you’ll love this guide to budget-friendly vacation ideas for families🌴—it’s full of ideas that won’t wreck your wallet.

Our Favorite Free Family Budgeting Tools and Apps

When we started taking budgeting seriously, I didn’t want to spend money just to figure out how to save money. That’s where free tools came in—and some of them are surprisingly powerful.

Budgeting Apps That Make It Easy

1. EveryDollar (Free Version): Super simple. Drag-and-drop categories. Great for beginners.

2. Goodbudget: Works like the envelope system but on your phone.

3. Mint: Tracks your accounts, bills, and spending patterns all in one place.

We also used printable tools like this Monthly Budget Planner PDF 📝 to physically write out our goals and spending, which helped us actually stick to the plan.

Spreadsheet Lovers—This Is For You

If you like total control, building a budget in Google Sheets or Excel is still one of the best options out there. Tons of free templates online. And it’s customizable for anything—low income, big family, even irregular income.

How to Stick to Your Family Budget Without Feeling Deprived

This part is where most people quit. The plan looks good on paper, but by week two, everyone’s grumpy and you’re ordering pizza again.

Here’s how we made it work without feeling like we were missing out on life:

1. Budget Some Fun

Yes, even when money’s tight. We added a “Family Fun” category—even if it was just $10 a week. That little bit helped us feel normal.

2. Celebrate Small Wins

Paid off a credit card? Had a no-spend weekend? Let your family know! Celebrating together helped keep everyone motivated.

3. Make It a Team Thing

We talked about what we were saving for. A new bike for the kids. A weekend away. Everyone had a reason to stay on track.

And when we needed some extra help organizing those goals, this Travel Budget Planner PDF ✈️ helped us keep our plans realistic and exciting.

Real-Life Budgeting for Low-Income Families

If your family’s living paycheck to paycheck, know this—you’re not alone, and budgeting is still possible. We’ve been there. It’s not about having a fancy spreadsheet; it’s about being real with what comes in and what goes out.

Here’s What Helped Us Most:

1. Prioritize Essentials: Rent, food, utilities, transportation. Everything else gets listed after that.

2. Use Cash-Only for Extras: Groceries, eating out, and gas are easier to manage when paid with actual cash or a prepaid card.

3. Track Every Dollar: Even $1 gas station snacks add up fast. Use a notebook, app, or even the Debt Snowball Tracker PDF 💸 to keep yourself honest and motivated.

There’s no shame in starting small. The key is starting.

True Family Budgeting Is a Team Effort

No matter your income level or goals, budgeting gets easier when you stop trying to do it alone. If you have a spouse or older kids, bring them in on the plan. Let them help choose the goals, make spending decisions, and celebrate wins.

We found that the more we communicated about money, the more peaceful things got at home. And when we looked at articles like Unforgettable Adventures on a Budget 🌴, it reminded us that budgeting isn’t about restriction—it’s about freedom.

Freedom from debt.

Freedom to dream.

Freedom to live smarter, together.

Questions Families Ask About Budgeting (That Deserve Better Answers)

How do I start budgeting when we have no savings?

Start with a bare-bones budget. List your income, subtract non-negotiable bills (like rent, food, utilities), and then see what’s left. Even if it’s $5–$10 a week, start putting something—anything—into a savings account or envelope. You can also try our Monthly Budget Planner PDF 📝 to visualize it all in one place.

What if my partner doesn’t want to budget?

That’s common. Try framing it differently: instead of “budget,” say “money plan” or “team goals.” Show how budgeting helps reach shared dreams like a vacation, a better car, or less stress. Make them part of the decision-making, not just the rule-following.

How do I manage unexpected expenses?

You will have emergencies. Car repairs, dental work, kids outgrowing shoes in two months—been there. Budget a small “miscellaneous” category each month or build an emergency fund over time using tools like the Travel Budget Planner✈️ (yes, it works for more than just trips).

How can we budget if income changes every month?

Use a baseline budgeting method. Figure out your lowest average monthly income from the past 6 months, and create your budget off that. When you earn more, use the extra for savings, debt, or fun—not your monthly bills.

Do family budgeting apps really help?

They can—especially ones built for shared households. Look into options like YNAB (You Need A Budget), EveryDollar, or Goodbudget. These help track, plan, and sync with your partner. And if you prefer printable tools, we’ve created helpful ones like this Debt Snowball Tracker PDF to knock out debt visually and stay motivated 💥.