In the vast world of investment opportunities, real estate has always been a coveted asset class. However, the barriers to entry have often been high. Enter Fundrise, a platform that’s revolutionizing the way we think about real estate investment. But is it worth the hype? Let’s dive in.

Why Choose Fundrise?

- Democratized Investing: Traditional real estate investments often require significant capital, making it challenging for the average individual to participate. Fundrise lowers this barrier, allowing you to start with a relatively small amount.

- Expert Management: Not a real estate guru? No problem. Fundrise’s team of professionals handles the selection of high-potential projects and the day-to-day management of properties. It’s like having a team of experts working for you.

- Diversification: Through Fundrise’s eREITs (electronic Real Estate Investment Trusts), you can spread your investments across various properties and geographic locations. This diversification can help mitigate risks and enhance potential returns.

How to Sign Up: Getting started with Fundrise is straightforward:

- Visit this link by clicking here and get a bonus amount of money when you sign up and start using it!

- Create an account by providing the necessary personal information.

- Choose your investment strategy based on your goals and risk tolerance.

- Fund your account, and you’re all set!

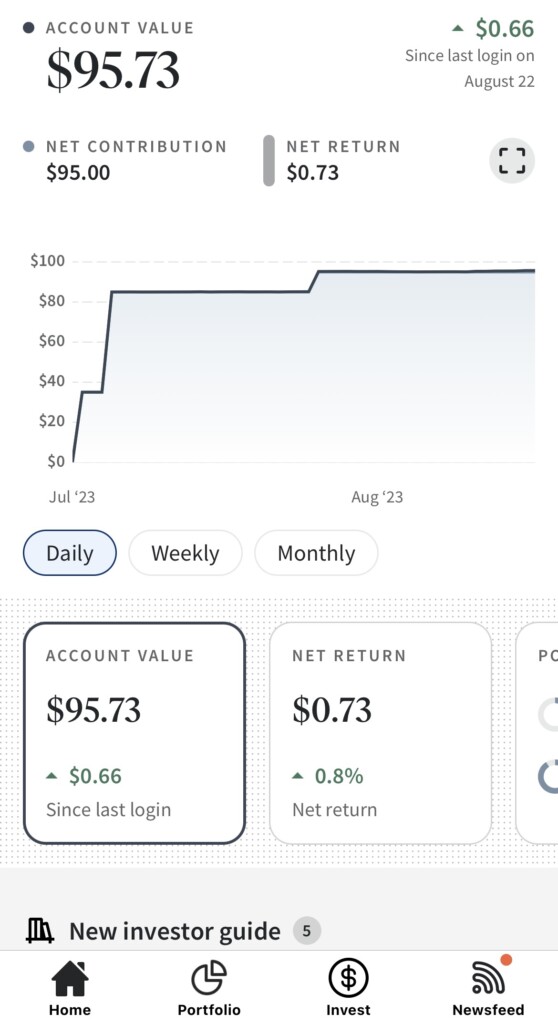

Initial Deposit: One of Fundrise’s standout features is its low minimum investment requirement. You can start with as little as $20, $500, or $5,000 for the Starter Portfolio. As you become more comfortable, you can upgrade to advanced plans, which might require higher initial deposits but offer more diversified portfolios.

Potential Earnings: Returns on Fundrise vary based on market conditions and the specific eREITs you invest in. Historically, Fundrise has delivered competitive returns compared to other investment avenues. While past performance doesn’t guarantee future results, the platform’s transparency and historical data can give you a good idea of potential earnings.

What Are You Investing In? When you invest with Fundrise, you’re primarily investing in eREITs and eFunds. These are specially curated portfolios containing various real estate projects, ranging from commercial developments to residential properties. The beauty of this approach is that you get exposure to multiple real estate projects, spreading out risks and opportunities.

Fundrise offers a unique opportunity for both novice and seasoned investors to delve into the world of real estate without the traditional hassles. With its user-friendly platform, expert management, and transparent approach, it’s no wonder many are turning to Fundrise as their go-to real estate investment solution. Whether you’re looking to diversify your portfolio or take your first step into real estate, Fundrise is worth considering.