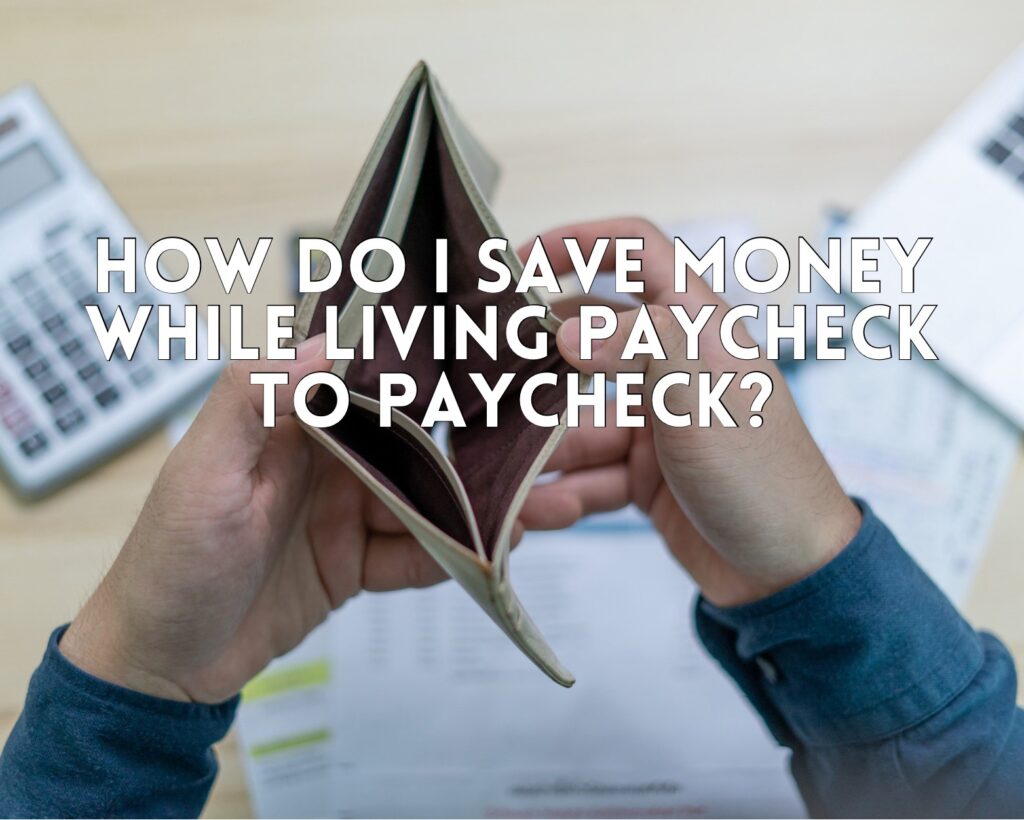

Living paycheck to paycheck is a reality for many, and the challenge of saving money under these circumstances can seem daunting. However, with the right strategies and mindset, it is possible to start building savings even on a tight budget. Here’s my personal journey and tips on how to save money in this situation.

Understanding Your Financial Situation

My Experience: When I first started living on my own, budgeting wasn’t my strong suit. I found myself living paycheck to paycheck, barely making ends meet. The turning point came when I sat down and thoroughly reviewed my finances. I realized that understanding where my money was going was the first step in taking control of my financial situation.

Tips:

- Track Your Spending: Keep a record of all your expenses for a month. This will give you a clear picture of where your money is going.

- Identify Unnecessary Expenses: Look for areas where you can cut back, such as dining out, subscriptions, or impulse purchases.

Creating a Budget

My Strategy: I created a budget that accounted for all my essential expenses like rent, utilities, groceries, and transportation. I allocated a small portion for discretionary spending but made sure to prioritize saving.

Tips:

- Use Budgeting Tools: Utilize budgeting apps or spreadsheets to keep track of your income and expenses.

- Set Realistic Goals: Make sure your budget is realistic and sustainable. It’s important to allocate some money for leisure to avoid burnout.

Saving Strategies

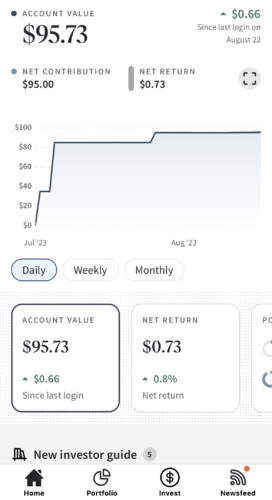

What Worked for Me: I started with small, achievable goals. I committed to saving a small amount from each paycheck, treating it as a non-negotiable expense.

Tips:

- Automate Savings: Set up an automatic transfer to your savings account on payday.

- Save Loose Change: Collecting loose change can add up over time. Consider using a digital app that rounds up your purchases and saves the difference.

Additional Income Streams

My Approach: I looked for ways to supplement my income. This included taking on freelance work and selling items I no longer needed.

Tips:

- Side Hustles: Consider part-time jobs or freelance work that fits your schedule.

- Sell Unused Items: Use online platforms to sell items that are in good condition but no longer needed.

Reducing Major Expenses

My Experience: I re-evaluated major expenses like rent and transportation. By moving to a more affordable apartment and using public transportation, I was able to save more.

Tips:

- Consider Housing Options: If possible, look for more affordable housing or consider getting a roommate.

- Reduce Transportation Costs: Use public transport, carpool, or bike to work if feasible.

Learning and Adapting

My Journey: The key to my financial improvement was a willingness to learn and adapt. I read financial blogs, sought advice, and continuously adjusted my budget and savings strategies.

Tips:

- Educate Yourself: Utilize resources like financial blogs, books, and podcasts.

- Stay Flexible: Be prepared to adjust your budget and strategies as your financial situation changes.

Relevant Articles from Rich Money Mind

- Understanding Capital Gains Taxes: Learn about capital gains taxes and how they can impact your savings and investment strategies.

- Black Friday: Seeking Real Deals, Not Just the Illusion of Savings: Discover how to spot true savings opportunities and avoid overspending during sales events.

In my journey towards financial stability, I quickly realized that there are fundamentally two ways to improve my financial situation: making more money or spending less. Both approaches have their challenges and benefits, and often, a combination of the two is the most effective strategy.

Making More Money: Expanding Income Sources

Personal Experience: I understood that relying solely on my primary job’s income was limiting. So, I started exploring ways to increase my earnings. This included taking on freelance projects, considering part-time work, and even exploring passive income opportunities.

Strategies:

- Leverage Your Skills: Use your existing skills to find freelance or part-time work. Websites like Upwork or Fiverr can be great platforms to start.

- Consider a Second Job: Depending on your schedule, a second job can be a viable option to boost your income.

- Passive Income Streams: Look into passive income sources like investing in stocks, real estate, or starting a side business that requires minimal ongoing effort.

Spending Less: Smart Budgeting and Cost-Cutting

My Approach: Reducing expenses was equally important. I scrutinized my spending habits and identified areas where I could cut costs without significantly impacting my quality of life.

Tips:

- Budget Wisely: Use a strict budget to control your spending. Allocate funds for necessities first, then savings, followed by discretionary spending.

- Cut Unnecessary Expenses: Cancel unused subscriptions, eat out less, and look for cheaper alternatives for services and goods.

- Be a Smart Shopper: Take advantage of sales, use coupons, and compare prices before making purchases.

Balancing the Two Approaches

Finding Equilibrium: Balancing making more money with spending less was key. While increasing income provided more financial breathing room, being disciplined about spending ensured that the extra money was used effectively.

Tips:

- Prioritize High-Interest Debt: If you have debt, especially high-interest debt, use additional income to pay it off quickly.

- Build an Emergency Fund: Before increasing spending or investing, build a solid emergency fund to cover unexpected expenses.

- Invest in Your Future: Consider using extra income for long-term investments, like retirement funds or education.

The Psychological Aspect

Mindset Matters: Adopting a mindset of financial responsibility and discipline was crucial. I had to constantly remind myself of my long-term goals to stay on track.

Tips:

- Stay Motivated: Keep your financial goals in mind. Visual reminders of what you’re saving for can be helpful.

- Seek Support: Discuss your financial goals with friends or family members who can offer support and advice.

Continuous Learning and Adaptation

My Learning Curve: I realized that financial management is an ongoing learning process. I stayed informed about personal finance strategies and continuously adapted my approach.

Tips:

- Educate Yourself: Regularly read financial blogs, books, and listen to podcasts to stay informed.

- Review and Adjust: Regularly review your financial plan and make adjustments as needed based on changes in your income, expenses, or financial goals.

In is not easy, not even close, have faith in yourself! saving money while living paycheck to paycheck is challenging but not impossible. It requires careful budgeting, a commitment to saving, exploring additional income sources, and continuously educating yourself about personal finance. Remember, every small step towards saving is a step towards financial stability and freedom. 💰📊👩💼🚀📈📚