What Does It Mean to Make Money Work for You?

When I first heard the phrase “make money work for you”, I didn’t fully get it. Like most people, I thought making money meant working hard at a job and hoping for a raise. But over time, I realized that wasn’t the key to true financial freedom. Making money work for you is about setting up systems—whether it’s through investments, passive income, or smart money management—so your money keeps growing without you having to constantly trade your time for it.

I’m not saying I’ve got it all figured out, but I’ve come a long way from where I started. I used to live paycheck to paycheck, feeling like I’d never get ahead. Now, I’ve got multiple income streams and investments working for me, slowly building a more stable financial future. But I’m still learning, still growing, and still trying new strategies to get better.

If you’ve ever felt stuck in the grind, wondering how to get your money to work for you instead of the other way around, you’re not alone. This journey to financial freedom is a process, and it starts with understanding that your money can do more than just sit in a bank account. Whether it’s through passive income or investing in dividend stocks, the goal is to create a system where your money grows without you having to be constantly involved.

For example, one of the easiest ways I got started was with passive income, which we’ll dive into next. But if you’re curious and ready to jump in, you can start today by exploring building passive income, even with little to no funds, using strategies like those in this guide.

Understanding the Power of Passive Income

The biggest game-changer for me when I started trying to make my money work was learning about passive income. The idea that you could earn money without constantly putting in the time was eye-opening. For years, I had been stuck in the mindset that to make more money, I had to work harder and longer hours. But once I began exploring passive income, everything changed.

What Is Passive Income?

Passive income is money that keeps coming in, even when you’re not actively working for it. It’s about creating assets or systems that generate cash flow with little ongoing effort. This could be through dividend stocks, real estate, selling digital products, or even renting out a room. The key is that once you set up the system, the money starts flowing without you having to hustle every day.

For me, investing in dividend-paying stocks was my first taste of passive income. I didn’t have a ton of money to start, but I took the plunge using platforms like Robinhood. Each month, I’d see small amounts of dividend payouts, and it started to click—my money was growing on its own. If you’re looking to start earning from dividend stocks, you can sign up for Robinhood and get a free stock to begin your investment journey: Join Robinhood and get a free stock.

Did you know you can actually make money writing from home? We have a nice article on making money writing from home!

Different Types of Passive Income

There are a lot of ways to create passive income, and you don’t need a fortune to get started. Here are a few methods I’ve used or explored:

- Dividend Stocks: As I mentioned, dividend-paying stocks are a great way to generate steady passive income. The more you invest, the more dividends you receive, and reinvesting those dividends helps your wealth grow exponentially over time.

- Real Estate: If you own a property, renting it out can provide regular passive income. Even renting out a room in your home is a great way to earn extra cash without much effort.

- Digital Products: Selling digital goods like eBooks, courses, or photos can create a steady stream of income once the initial work is done.

The power of passive income is that it takes you out of the equation—at least partially. It allows you to stop trading your time for money and lets your money work for you. If you’re interested in learning more creative strategies to build passive income, check out Building Passive Income with Limited or No Funds.

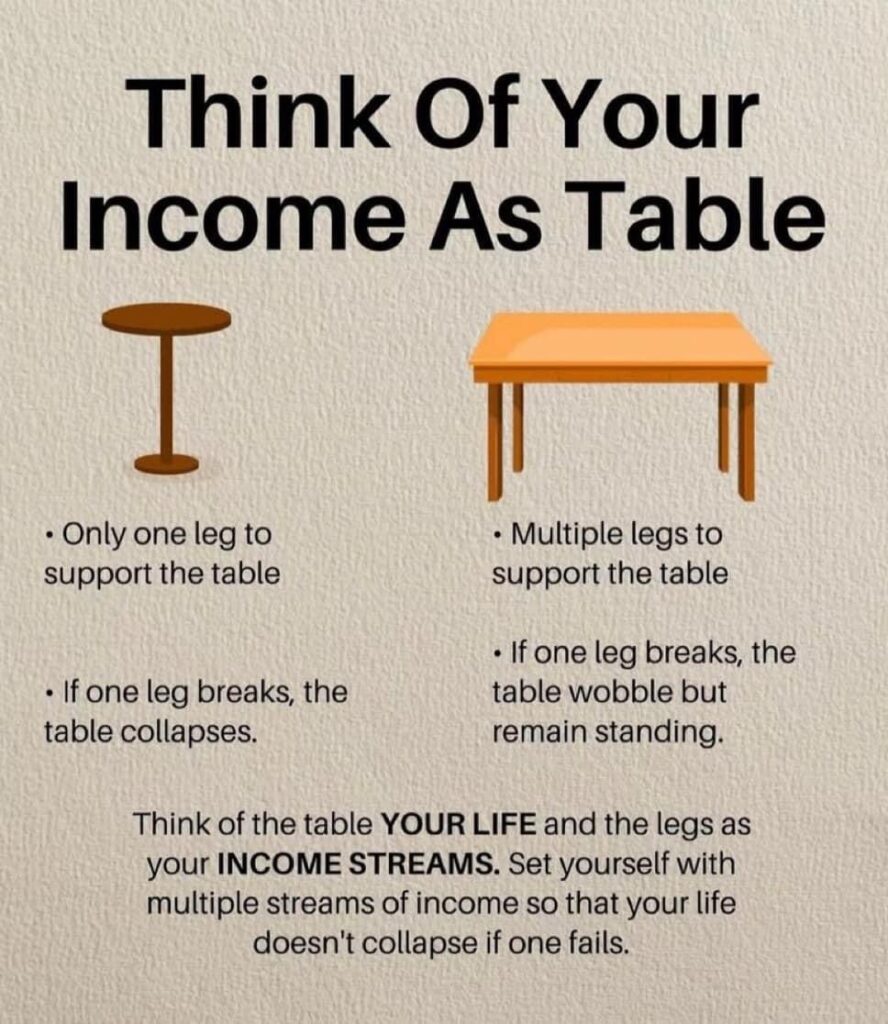

How to Create Multiple Streams of Income

One of the most important lessons I’ve learned on this financial journey is the importance of creating multiple streams of income. Relying on a single source of income—like a job—can feel risky, especially in today’s economy. If something happens to that income stream, you’re left with nothing to fall back on. That’s why building multiple income streams became a key part of making my money work for me.

Why You Need Multiple Streams of Income

Think of your income as a table with several legs. If one leg breaks, the table can still stand because of the other legs supporting it. This is how multiple streams of income work—if one source dries up or slows down, the others can keep you stable. For me, this meant I didn’t have to panic if something happened at my job or if one side hustle slowed down.

When I first started, I was juggling just one job, but over time, I began adding more streams, like freelance work, investing, and even some passive income streams. These different sources allowed me to stop relying solely on my day job and gave me more financial freedom.

Ways to Create Multiple Streams of Income

There are tons of ways to create multiple income streams, and you don’t have to do them all at once. Here are a few ideas to get started:

- Side Hustles: This could be anything from freelance work to selling products online. It’s a great way to bring in extra income alongside your main job.

- Passive Income: As we discussed earlier, things like dividend stocks or rental properties can keep generating income without a lot of daily effort.

- Investing: Putting your money into stocks, bonds, or real estate can help you build wealth over time.

Diversifying your income isn’t just smart—it’s essential for financial stability. I found that having multiple sources of income gave me peace of mind and the ability to take risks in areas where I wanted to grow. For more on creating multiple income streams, check out this step-by-step guide.

Investing Your Money Wisely

Once I realized that simply earning more wasn’t enough, I knew I needed to start investing. Making money work for you means putting it in places where it can grow on its own. For me, investing was intimidating at first, but once I got started, I saw how powerful it could be in building long-term wealth.

Why Investing Is Key to Growing Wealth

Investing is one of the most effective ways to let your money grow over time. Unlike saving, where your money sits and earns little to no interest, investing allows your money to compound and increase in value. The earlier you start, the more time your money has to grow.

When I began, I didn’t have much to invest, but even small amounts in the stock market or dividend stocks can add up over time. One of my favorite strategies has been investing in index funds or ETFs like those tracking the S&P 500. These funds spread your money across hundreds of companies, which reduces risk while still giving you solid returns over time.

Long-Term Investment Strategies

If you’re serious about making your money work for you, it’s important to think long-term. I started with a focus on investments that could grow steadily over time, such as:

- Stocks: Whether it’s individual stocks or index funds, investing in the stock market can be a great way to build wealth. Stocks typically offer higher returns than other forms of investment, but they come with more risk.

- Real Estate: While buying property requires more upfront cash, rental properties or even real estate investment trusts (REITs) can generate income through appreciation and rent. It’s a great way to earn passive income if you’re able to manage it well.

If you’re just starting and want to dip your toes in investing, platforms like Robinhood make it easy to begin with as little as $1. Plus, you can earn dividends—payouts from companies just for owning their stock. Get started with a free stock on Robinhood by signing up here: Join Robinhood and get a free stock.

The Importance of Diversification

One lesson I’ve learned along the way is that you should never put all your eggs in one basket. Diversifying your investments—spreading your money across different assets—helps manage risk. That way, if one investment underperforms, your other investments can keep your portfolio strong.

By investing wisely and diversifying, you can set your money on autopilot, allowing it to grow without your constant attention. It’s not about making quick money, but about long-term growth that brings you financial freedom.

Reinvesting Your Earnings for Compounded Growth

One of the biggest “aha” moments for me was understanding the power of reinvesting earnings. When you make money from investments—whether it’s dividends, stock market gains, or real estate income—it’s tempting to take that cash and spend it. But I realized that if I reinvested that money instead of spending it, it would snowball, allowing me to build wealth even faster. This is the magic of compound growth.

What Is Compound Growth?

Think of compound growth like a snowball rolling downhill. As it rolls, it picks up more snow and gets bigger and bigger. The same goes for your money. When you reinvest your earnings, those earnings start generating their own returns, creating a compounding effect over time. It’s like your money starts working overtime for you without any extra effort.

For example, when I started investing in dividend stocks, instead of spending the payouts I received, I reinvested them back into buying more shares. Over time, not only did I own more shares, but my future dividend payouts grew as well. It’s a simple strategy, but the long-term results are powerful. Even small amounts reinvested consistently can lead to significant growth over time.

Reinvesting in Stocks and Real Estate

Reinvesting doesn’t just apply to stocks. If you’re earning income from rental properties, reinvesting that money into property improvements or even into another property can help you grow your passive income. It’s all about putting the money you make back to work so that it continues to grow.

The same principle applies if you’re investing in the stock market. Many platforms, like Robinhood, make it easy to automatically reinvest dividends into additional shares. By setting it and forgetting it, you allow your investments to grow steadily without having to lift a finger. If you’re not already using Robinhood, it’s a great platform to start your reinvesting journey—get a free stock when you sign up.

The Long-Term Impact of Reinvesting

What I love about reinvesting is that it’s a strategy anyone can use, regardless of how much money you’re starting with. The longer you reinvest, the bigger the impact. It’s like planting a tree: at first, you might not notice much change, but after a few years, you’ll have something solid that’s growing on its own.

The key is patience. The more consistent you are with reinvesting your earnings, the faster you’ll see your wealth grow. It’s a slow burn, but the long-term rewards are worth it.

Mindset Shift: Stop Working for Money, Make It Work for You

One of the hardest but most important changes I made on my financial journey was shifting my mindset. For years, I believed the only way to make more money was to work harder, take on more hours, or get another job. But that way of thinking kept me stuck in a cycle of working for money, instead of making my money work for me. Once I realized that my time wasn’t the only thing that could generate income, everything started to change.

The Shift: From Worker to Investor

The first big shift was recognizing that money is a tool. Instead of trading hours for dollars, I began to see money as something I could put to work. Whether through investments, side hustles, or creating passive income streams, I realized that my money could grow on its own, without me grinding every day. It was a relief knowing that I didn’t have to hustle endlessly to see progress.

This shift didn’t happen overnight. It took time to unlearn the idea that wealth comes only from hard work. Of course, hard work is part of the process, but the real game-changer is learning how to make smart financial moves that allow your money to grow on its own.

Learning from Failure

Changing your mindset doesn’t mean everything will work out perfectly the first time. In fact, failure can be a big part of the learning process. For example, I’ve faced setbacks, made investments that didn’t pan out, and tried side hustles that didn’t take off. But I didn’t give up. Instead, I kept pushing, knowing that with every failure, I was one step closer to figuring out what works. It’s important to see these failures as part of the journey.

Take inspiration from others who’ve faced failure and still come out successful. One story that sticks with me is Andy Reid, the NFL coach who was fired and labeled a failure, but used that experience to push himself toward incredible success. His journey is a reminder that you can turn setbacks into stepping stones toward financial freedom. You can read more about Andy Reid’s Path to Success if you’re looking for motivation.

Adopting a Long-Term Mindset

Once you stop focusing on short-term gains and start thinking about long-term growth, you begin to make decisions differently. Instead of chasing quick money, I started investing in things that would build over time, like stocks, real estate, and business ventures. I realized that wealth isn’t built overnight—it takes time, patience, and a mindset that’s focused on the bigger picture.

It’s easy to get caught up in the day-to-day hustle, but shifting to a long-term mindset is key. When you understand that each investment, each step forward is building something bigger down the line, it’s easier to stay consistent and avoid impulsive financial decisions.

Taking Action: How to Start Making Money Work for You

If there’s one thing I’ve learned on this journey, it’s that taking action is the most important step. You don’t need to wait until you have everything figured out or a large amount of money saved up. You can start making your money work for you with small, practical steps today. Whether you’re just starting out or already on your way, these actions will help you build momentum.

1. Start Investing – Even Small Amounts

One of the easiest ways to get your money working is through investing, and you don’t need a fortune to start. I began with small amounts, investing in dividend stocks and index funds. Over time, even small investments can grow into something substantial. Platforms like Robinhood make it easy to start with as little as $1, and they even offer a free stock when you sign up, which is how I got my foot in the door. If you want to start building your portfolio, you can join Robinhood and get a free stock today.

2. Create a Passive Income Stream

Passive income doesn’t mean you need to quit your job or invest a ton of money upfront. You can start by selling digital products, renting out a spare room, or even earning dividends from stocks. The key is to set up systems that continue earning without much day-to-day involvement. One of my first passive income streams was selling photos online, which brought in money over time with little effort after the initial setup.

For more creative ways to start building passive income even with limited funds, you can explore Building Passive Income with Limited or No Funds.

3. Diversify Your Income

One income stream is not enough if you’re looking for financial security. Start thinking about how you can diversifywhere your money is coming from. Maybe you pick up a side hustle, start freelancing, or explore rental properties. The more income streams you have, the less pressure you’ll feel if one of them slows down or disappears.

If you’re curious about different ways to generate multiple streams of income, I found this guide on creating multiple streams of income incredibly useful when I was starting out.

4. Reinvest and Compound Your Growth

The magic of wealth building lies in compounding. By reinvesting your earnings—whether it’s dividends, rental income, or business profits—you’re allowing your money to grow exponentially. I made the mistake early on of taking my profits and spending them, but when I started reinvesting those earnings, that’s when I began to see serious growth.

Setting up automatic reinvestment options with platforms like Robinhood can make this process easy and hands-off, letting your money grow without extra work on your part.

5. Shift Your Mindset

Lastly, remember that building wealth is as much about mindset as it is about actions. You have to shift from thinking you need to constantly trade time for money and start seeing money as a tool that can work for you. Every small investment, every passive income stream, and every reinvestment is part of building something bigger for your future. It’s about financial freedom, and the steps you take today will pay off down the road.

It’s easy to feel overwhelmed, but taking small steps now can have a massive impact in the long run. Whether you’re investing in stocks, setting up a passive income stream, or simply adjusting your mindset, each action brings you closer to making your money work for you.

Ready to get started? Don’t wait. Start with a small investment, create that extra stream of income, and let the compounding begin. Your future self will thank you!