Why Should I Even Think About Investing with Little Money?

So you’re not rolling in dough, but you’ve got dreams, right? Maybe you want to buy a house, start a business, or just have a nice cushion for the future. Investing can help you get there, even if you’re starting small.

Is It Even Possible to Invest with Little Money?

Heck yeah, it is! Gone are the days when you needed thousands of bucks to start investing. Nowadays, you can get in the game with as little as $5. Seriously.

Robo-Advisors: The Easy Button for Investing

If you’re new to the investing world, robo-advisors are a great place to start. Apps like Betterment and Wealthfront make it super easy. You answer a few questions about your financial goals, and they’ll do the rest. The best part? You can start with just a few bucks.

Stock Market Apps: Buy Fractional Shares

Ever wanted to own a piece of a big-name company like Apple or Amazon but couldn’t afford a whole share? Apps like Robinhood and Cash App let you buy fractional shares for as little as $1. It’s a cool way to dip your toes into the stock market without going broke.

Retirement Accounts: The Long Game

If your job offers a 401(k) and you’re not taking advantage of it, you’re leaving free money on the table. Many employers match your contributions up to a certain percentage. Even if you can only contribute a small amount, it adds up over time thanks to compound interest.

Peer-to-Peer Lending: Be the Bank

Platforms like LendingClub and Prosper let you lend money to individuals or small businesses online. You can start with as little as $25, and you’ll earn money back with interest. It’s a different way to invest, and it’s worth checking out.

Real Estate Crowdfunding: Own a Piece of the Pie

Think you need to be a millionaire to invest in real estate? Think again. Sites like Fundrise let you invest in real estate projects with as little as $500. You’ll earn money through rental income and property appreciation.

What About Risk? Is This a Gamble?

All investments come with some level of risk, but that’s where diversification comes in. Don’t put all your eggs in one basket. Spread your money across different types of investments to reduce risk.

Any Final Tips for a Beginner Investor?

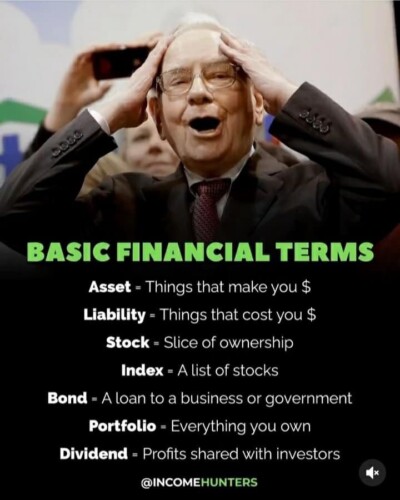

Do your homework. Read up on investing basics, and don’t be afraid to ask questions. Start small and increase your contributions as you get more comfortable. And remember, the best time to start investing was yesterday. The second best time is now.

So, What’s Stopping You?

There you have it, folks. Investing with little money is not only possible, but it’s also easier than ever. So why wait? Start growing that nest egg today, and your future self will thank you.

The Power of Consistency: Keep Adding to the Pot

One of the best ways to grow your investments over time is to keep adding to them, even if it’s just a small amount. Think of it like a snowball rolling down a hill; it starts small but gains size and momentum as it goes. So set up automatic contributions if you can. Even $20 a month can make a big difference in the long run.

Emergency Fund: Your Financial Safety Net

Before you go all-in on investing, make sure you’ve got an emergency fund stashed away. Life happens, and you don’t want to be forced to pull your investments out early because of an unexpected expense. Aim for at least three to six months’ worth of living expenses in a savings account. Once that’s set, you can invest with peace of mind.

Tax Implications: Uncle Sam Wants His Cut

Don’t forget about taxes. Certain types of accounts, like Roth IRAs, offer tax benefits that can help your money grow faster. But other investments, like regular stock trading, come with tax implications. Keep this in mind when you’re deciding where to put your money, and consider talking to a tax pro to get the lowdown.

The Learning Curve: Keep Educating Yourself

Investing is a journey, not a destination. The more you learn, the better you’ll get at it. So keep reading, watch some YouTube tutorials, or even take an online course. The more you know, the more confident you’ll feel, and the better decisions you’ll make.

Investment Tracking: Keep an Eye on Your Money

Once you’ve got some skin in the game, it’s important to keep track of how your investments are doing. Use apps or spreadsheets to monitor your portfolio’s performance. If something’s not working, don’t be afraid to make changes. But also remember, investing is a long-term game. Don’t freak out over short-term ups and downs.

So, Are You Ready to Take the Plunge?

Alright, we’ve covered a lot of ground here. From robo-advisors and stock market apps to retirement accounts and real estate crowdfunding, there are plenty of ways to start investing with little money. The key is to start now and learn as you go. So what are you waiting for? Your future financial freedom is calling.