In the world of personal finance, two terms often dominate the conversation: saving and investing. While both are essential components of a sound financial strategy, they serve different purposes and offer different benefits. Let’s delve into the differences between saving and investing, and explore why one might be a better option for you than the other.

Understanding the Basics

Saving refers to setting aside a portion of your income in a safe and liquid form, such as in a savings account, money market account, or a certificate of deposit. The primary goal of saving is to preserve your capital and have funds readily available for short-term needs or emergencies.

Investing, on the other hand, involves committing money to an endeavor or asset, such as stocks, bonds, or real estate, with the expectation of generating an income or profit over time. The primary goal of investing is to grow your wealth over the long term.

The Benefits of Saving

- Liquidity: Savings are easily accessible, making them ideal for emergencies or short-term goals.

- Safety: Funds in savings accounts are often insured up to a certain limit, ensuring that your money is safe.

- Predictability: You know exactly how much money you have saved, without the fluctuations seen in investments.

The Benefits of Investing

- Potential for Higher Returns: Historically, investments, especially stocks, have provided a higher return than traditional savings accounts.

- Wealth Accumulation: Investing can significantly grow your wealth over time, thanks to the power of compound interest.

- Diversification: Investing allows you to spread your money across various assets, reducing the risk of a significant loss.

- Inflation Protection: The returns from investments often outpace inflation, ensuring that your purchasing power is preserved.

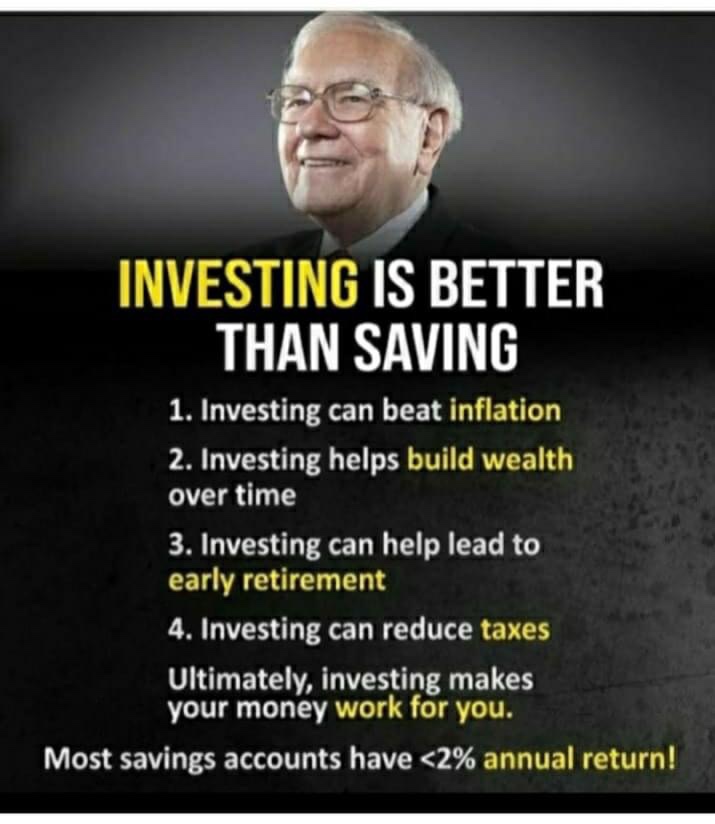

Why Investing Might Be Better Than Saving

- Combatting Inflation: The value of money decreases over time due to inflation. While savings might offer a small interest, it often doesn’t keep up with inflation rates. Investments, however, have the potential to offer returns that outpace inflation.

- Long-Term Growth: For long-term goals, such as retirement, investing offers the potential for growth that savings alone cannot provide.

- Passive Income: Certain investments, like dividend-paying stocks or real estate, can generate a steady stream of income.

Considerations and Risks

While investing offers numerous benefits, it’s not without risks. The value of investments can go up and down, and there’s a possibility of losing money. It’s essential to assess your risk tolerance and financial goals before diving into the world of investing.

Finding the Right Balance

For most people, a combination of both saving and investing is the best approach. It’s wise to have a savings cushion for emergencies and short-term needs, while also investing for long-term goals and wealth accumulation.

In conclusion, while saving is crucial for immediate needs and offers safety, investing is the key to building wealth over time. By understanding the differences and benefits of each, you can make informed decisions that align with your financial goals and risk tolerance.