Why You Can’t Rely on Banks for Financial Advice

Let’s get this out of the way: banks are not in the business of making you rich. They’re in the business of making money off your money—especially if you’re drowning in fees, relying on overdraft, or carrying debt on a bank-issued credit card.

I learned the hard way. I used to think if I walked into my local bank and asked for financial advice, I’d be walked out with a game plan. Instead, I got a brochure for a “rewards” credit card, a checking account with minimum balance fees, and a savings account that earned less than a penny a month.

That’s when I realized…

The advice banks give you is usually meant to benefit them.

Now, I don’t say this with bitterness. I say it with experience. That’s why I built Rich Money Mind—because most of us are stuck playing by rules we never wrote.

And it’s time to start asking the questions they hope we never bring up.

Important Banking Questions Nobody Told Me to Ask (But I Wish They Had)

I was in my late 20s before I asked my first serious question at a bank—and honestly, it was too late to avoid the mess I had already walked into.

Nobody warned me to ask these. But if they had? I’d have saved hundreds in fees and made smarter moves with my money years earlier.

Here are the questions I now ask every time I’m dealing with a new bank, credit union, or financial account:

- What are all your fees?

Not just the monthly ones. Ask about overdraft, minimum balances, transfers, and “inactivity” fees. Some banks will charge you for literally doing nothing. - What happens if I overdraft?

Some banks charge $35 per transaction. So if your card is hit three times in a day while your balance is low, you could owe over $100 in fees. - Are there hidden transfer limits or delays?

Ask how long it takes to move your money in and out, and whether there are caps. This is huge if you’re budgeting tightly or investing with platforms like Robinhood. - What’s the real interest on savings?

Is it 0.01%? If so, don’t waste your time unless you just need a safe spot for emergency funds. Consider higher-yield options or even apps that round up your purchases, like Acorns. - Do you offer any real budgeting help, or just credit products?

A bank that pushes loans and cards but offers zero real-life help is showing their hand. That’s not financial guidance—that’s a sales pitch. - Can I be notified before I overdraft or get hit with a fee?

Tech-forward banks and budgeting apps will send alerts. Old-school banks? Not so much. You’ll just get a statement and a fee. - Do you invest the money I deposit? Where does it go?

This question often stumps them, but it’s important—especially if you care where your dollars are being used behind the scenes.

If you’ve never asked these before, don’t worry—you’re not behind. You’re starting now, and that’s what matters.

Why I Left My Big Bank (And What I Use Now)

I stuck with my traditional big-name bank way too long—mostly because it’s what I was used to. I figured switching would be a hassle. But once I added up all the sneaky charges, I realized something:

I was paying a premium just to store my own money.

Between overdraft charges, monthly maintenance fees, and ATM fees (even on their own machines sometimes!), it was death by a thousand cuts. No real perks. No helpful tools. Just frustration.

So I finally made the switch.

These days, I use a combination of tools that actually work for me, not against me. I moved my spending to a no-fee online bank, use Acorns for automatic investing**, and manage my budget with this monthly planner.

I’ve saved hundreds since ditching the big bank.

I know where every dollar is going, and I’m earning instead of bleeding fees.

Are Credit Unions Actually Better?

Honestly? In many cases—yes.

Credit unions tend to be more transparent, have fewer junk fees, and actually care if you succeed financially. That’s because they’re member-owned, not profit-driven like corporate banks.

Here’s what I’ve found after using both:

- Better interest rates on savings and loans

- More personalized customer service

- Way fewer surprise fees

- More lenient lending if your credit isn’t perfect

But they’re not perfect. Some have outdated apps, limited locations, or slower processing. That’s why I use a mix. I keep a checking account at a local credit union and use online tools like Robinhood to make moves without being slowed down.

If you’re constantly wondering why your budget never works, switching banks could be the real fix—not another budgeting app or financial advice video.

What Your Bank Isn’t Telling You (But You Should Know)

Most banks love to advertise their “perks,” but they stay quiet about the stuff that actually costs you money or puts your financial future at risk.

Here are a few things I didn’t know at first (and wish I did):

- They make money off your debt. That’s right—credit cards, overdraft fees, and loans are their bread and butter. They want you to carry balances.

- Most “free checking” accounts aren’t really free. They sneak in minimum balance requirements, inactivity fees, or overdraft “protection” that does more harm than good.

- Their financial advisors often work on commission. So when they recommend a savings product or investment, it may benefit them more than you.

If you’ve ever asked yourself “why am I always broke?”, take a look at where your money is sitting—and what it’s silently draining each month.

Smart Alternatives to Traditional Banking

Once I realized my bank wasn’t helping me, I started exploring better tools—and it changed everything.

Here’s what I use now:

- Robinhood – For buying and selling stocks and crypto with zero commissions. Super easy to get started, and you get a free stock just for joining.

- Acorns – Automatically rounds up my spare change and invests it. Great for hands-off investing with almost no effort at all.

- Fundrise – This one’s for real estate investing without becoming a landlord. Just invest and watch your account grow over time. Here’s what I use.

And to make sure my budget’s tight, I rely on tools like this monthly budget planner and this debt snowball tracker.

These aren’t just apps—they’re part of a system that’s helped me finally get ahead instead of feeling like I’m treading water.

How I Ask the Right Questions Before Opening Any New Account

After getting burned a few times, I stopped blindly trusting the brochures and fine print. Now, any time I’m considering a new bank or account, I run through a list of real questions most people forget to ask:

- Are there monthly maintenance fees? Even $5/month adds up over the year.

- What happens if I overdraft? Some banks still charge insane fees even with overdraft protection.

- Is there a minimum balance requirement? Some accounts will punish you if you dip too low.

- Can I access my money easily? Mobile apps, transfers, and customer service all matter.

And most importantly—what are the hidden fees? Spoiler: there usually are some.

Learning to ask these questions saved me from falling into the same trap again. If you’ve been stuck in a loop of busted budgets that never work, this is where to start fixing it.

Common Mistakes Most People Make When Banking

Let’s be real—I’ve made all of these. And once I stopped, my money actually started going further.

- Sticking with the same bank just because you always have. Loyalty doesn’t pay when it comes to banks.

- Assuming the bank’s “financial advisor” is looking out for you. Nope. Many are just glorified salespeople.

- Overdrafting instead of budgeting smarter. If you’re constantly overdrafting, you don’t need overdraft protection—you need a realistic monthly budget.

- Ignoring better tools. There are so many better options today. Apps like Acorns do more than your bank ever will—and with less hassle.

Making these mistakes doesn’t mean you’re bad with money. It means you’ve been using the wrong system. When I finally changed mine, I started getting real traction—and even started investing with just $10.

How Your Bank Makes Money Off You (And Why That Should Matter)

Once I realized banks aren’t just places to stash cash—they’re businesses—I started paying attention differently. And here’s the deal: your bank makes money off your money, even when you’re losing it.

- Overdraft fees are a gold mine for banks.

- Monthly fees? They charge you just to hold your own money.

- Credit cards and loans are where they really rake it in—especially if you only make minimum payments.

- Low interest savings? They loan your money out at high interest and give you pennies back.

That’s when I decided to stop playing their game and started looking into smarter moves like earning money through real estate passively with Fundrise and learning how to actually live within my means.

What to Do If You Feel Trapped by Fees and Debt

I’ve been there—logging into my bank account only to see a string of charges, overdrafts, and late fees. It’s suffocating. But getting out of that trap is possible, and here’s what worked for me:

- Switch to a no-fee account. They’re out there, and way better than the old-school banks.

- Use a budgeting tool that actually helps. This printable budget PDF is what helped me reset my habits.

- Automate small savings. Even $5/week adds up. That’s where Acorns was a game-changer.

- Start tracking debt the right way. I used this debt snowball tracker to finally stop the bleeding.

You don’t need to be perfect—you just need to take back control. And it starts by asking better questions… even the uncomfortable ones.

Final Banking Tips That Changed How I Handle My Money Forever

Over the years, I picked up some simple but powerful tips that flipped the way I look at banks—and money in general.

- Ask about fees before opening anything. Don’t assume it’s free. Ask them what they charge if you overdraft, ifyou drop below a balance, if you transfer too much.

- Always read the fine print. Banks bury fees in fancy terms—catch them before they catch you.

- Split your checking and savings at different banks. I started doing this so I wouldn’t be tempted to dip into savings, and it worked.

- Never trust a bank to teach you how to build wealth. They profit when you stay in debt. That’s why I started reading real-life investing guides like this one on how to start investing with just $10.

If you’re relying on a bank to guide your finances, you might already be losing the game.

Extra Banking Questions Most People Don’t Think to Ask

Here are some real-deal questions you should be asking your bank—but probably never have:

- What happens if I lose my job? Can they waive fees during hardship?

- Do you report overdrafts or missed payments to credit bureaus?

- Can I get notifications before fees hit or when I’m close to my limit?

- What interest am I really earning on my savings—and how often is it compounded?

- Can I get everything in writing? Always protect yourself.

I learned the hard way that not asking these questions can cost you hundreds. If you’re trying to build wealth, these are the basics.

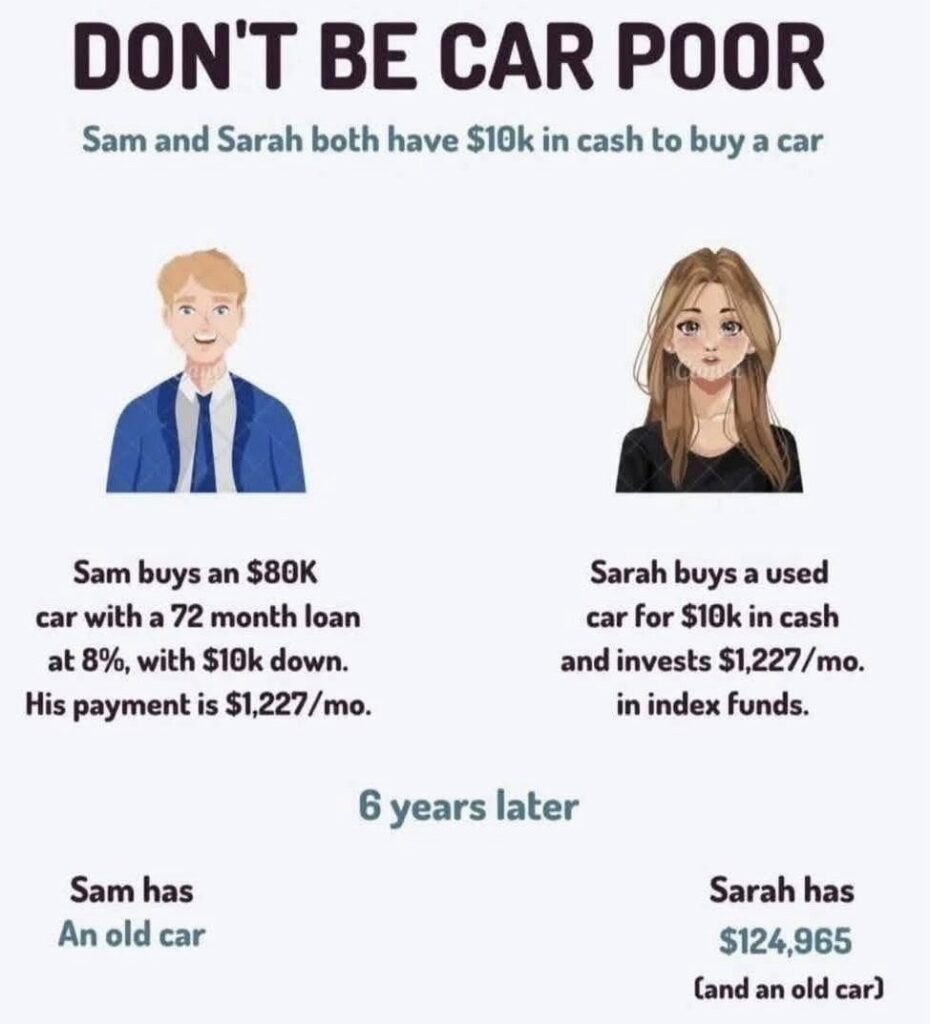

And if you’re serious about getting ahead, you’ll also want to read this: Why buying a car keeps you broke—it’ll shift how you see spending completely.