In a world where success is often measured by income, there’s a crucial financial truth many overlook: it’s not necessarily how much you earn that determines your financial stability and wealth, but how you manage and spend what you earn. This article delves into the how and why of this principle, offering insights into how smart spending habits can lead to a richer life, regardless of your salary.

How Spending Habits Impact Wealth

- Living Within Your Means: The foundation of financial stability is spending less than you earn. This practice allows you to save and invest, which are key to accumulating wealth. It’s not uncommon to see high earners with little savings due to extravagant spending habits.

- The Power of Budgeting: Effective budgeting helps you track and control your spending. It’s a tool for understanding where your money goes and making conscious decisions about what’s necessary and what’s not. Budgeting can turn a modest salary into a cornerstone for savings and investments.

- Avoiding Debt Traps: Poor spending habits often lead to reliance on credit cards and loans, creating a cycle of debt. By spending wisely and within your limits, you can avoid high-interest debt that eats away at your income.

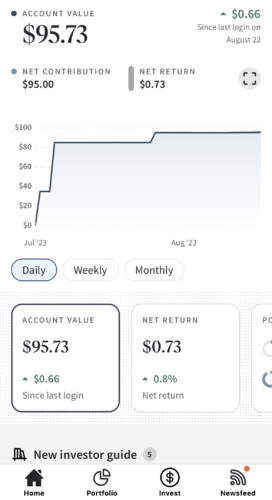

- The Compound Effect of Savings: Regular saving, even in small amounts, can grow significantly over time due to compound interest. This growth is more dependent on your saving habits than on the size of your initial salary.

- Prioritizing Needs Over Wants: Distinguishing between needs and wants is crucial. Luxuries and non-essential items can drain finances. Prioritizing needs ensures that you’re spending on what truly matters and contributes to your long-term financial well-being.

Why Spending Habits Are More Important Than Salary

- Salary is Not Always in Your Control: Economic factors, job markets, and personal circumstances can limit earning potential. However, you have more control over your spending habits, making them a more reliable tool for financial stability.

- Lifestyle Inflation: Higher salaries can lead to increased spending on luxuries, a phenomenon known as lifestyle inflation. Without disciplined spending, more income doesn’t necessarily translate to more savings.

- Long-Term Financial Goals: Achieving financial goals like retirement, owning a home, or funding education is less about how much you earn and more about how much you save and invest over time.

- Financial Security and Peace of Mind: Good spending habits lead to financial security, which brings peace of mind and reduces stress related to money issues.

- Wealth is Relative: Wealth isn’t just about having a lot of money; it’s about having enough to meet your needs and goals. Effective spending habits ensure that your salary, no matter its size, is working towards building your wealth.

While a high salary can certainly make it easier to accumulate wealth, it’s not the only path to financial richness. Good spending habits, budgeting, saving, and investing are the true determinants of financial success. By focusing on how you manage your money, rather than how much you earn, you can build a stable and prosperous financial future.

- Emergency Funds and Financial Resilience: One of the key aspects of smart spending is setting aside money for emergencies. This fund acts as a financial buffer against unexpected expenses, such as medical emergencies or job loss, ensuring that such events don’t derail your financial stability.

- Quality Over Quantity: Smart spending also involves choosing quality over quantity. Investing in high-quality items that last longer can be more economical in the long run, compared to frequently replacing cheaper, lower-quality products.

- Mindful Consumption: Conscious spending means being aware of the impact of your purchases on your financial goals and overall well-being. It involves questioning the necessity and value of each purchase, leading to more thoughtful and satisfying spending decisions.

- Leveraging Discounts and Deals: Wise spenders know how to make their money go further. They take advantage of sales, discounts, and loyalty programs, ensuring they get the best value for their money without compromising on their needs.

- Investing in Yourself: Smart spending isn’t just about saving money; it’s also about investing in areas that can improve your earning potential, such as education, skill development, and health.

Why a Bigger Salary Doesn’t Automatically Mean More Wealth

- Tax Implications: Higher salaries can sometimes mean a higher tax liability. Without careful financial planning, a significant portion of your income can go to taxes, reducing the actual amount available for saving and investing.

- Social Pressure and Keeping Up Appearances: Higher earners often feel pressure to maintain a certain lifestyle, whether it’s living in a more expensive neighborhood, driving a luxury car, or attending high-end social events. This pressure can lead to overspending and a failure to accumulate wealth.

- Neglecting Personal Finance Education: High earners sometimes neglect financial education, assuming that a high income will cover all needs. Without understanding personal finance, they may miss opportunities to grow their wealth through investments or tax-saving strategies.

The Path to True Wealth

True wealth is not just measured in dollar amounts but in financial security and the freedom it brings. Regardless of your salary, developing and maintaining smart spending habits is the key to building and sustaining wealth. By living within your means, prioritizing savings, investing wisely, and making informed spending choices, you can achieve financial independence and a rich, fulfilling life. Remember, it’s not always about how much you earn, but how effectively you use and manage what you have.