When I first started my journey in the construction industry, I quickly realized that managing cash flow was one of the most critical aspects of running a successful construction business. It’s not just about keeping the lights on; it’s about ensuring that every project is completed on time, within budget, and without financial stress. Effective cash flow management can mean the difference between thriving in the construction business and struggling to stay afloat. In this article, I want to share the importance of managing cash flow in construction and provide some practical tips and strategies that have helped me and can help you too.

What is Cash Flow Management in Construction?

When I think about the complexities of the construction industry, one of the first things that comes to mind is cash flow management. Simply put, cash flow management involves monitoring, analyzing, and optimizing the movement of money in and out of your business. In construction, this means ensuring that there is enough cash available to cover expenses like payroll, materials, and subcontractors, while also being able to handle unexpected costs.

Defining Cash Flow Management

Cash flow management in construction is all about balancing the timing of your cash inflows (money coming in) with your cash outflows (money going out). For example, when you start a new project, you might have a significant outflow of cash for initial expenses, while payments from clients might not come in until much later. This can create a gap that needs to be managed carefully to avoid cash shortages.

Challenges of Cash Flow Management in Construction

There are several unique challenges that construction companies face when it comes to managing cash flow:

- Delayed Payments:

- One of the biggest challenges is delayed payments from clients. Construction projects often involve multiple stakeholders and complex payment structures, which can lead to delays in receiving payments. This can strain your cash reserves and make it difficult to cover ongoing expenses.

- Variable Costs:

- Construction projects are notorious for having variable costs. Unexpected expenses, such as additional labor or material costs, can arise at any time. Without a solid cash flow management plan, these unexpected costs can quickly spiral out of control.

- Seasonal Fluctuations:

- Many construction businesses experience seasonal fluctuations in demand. This can lead to periods of high cash inflows followed by periods of low or negative cash flow. Managing these fluctuations requires careful planning and a good understanding of your cash flow patterns.

- Complex Billing Cycles:

- Construction projects often involve complex billing cycles, with progress payments, retainage, and final payments all coming at different times. Keeping track of these different payment milestones and ensuring timely invoicing is crucial for maintaining healthy cash flow.

By understanding these challenges and taking proactive steps to manage your cash flow, you can keep your construction business financially healthy and prepared for any surprises.

For those looking to strengthen their financial management skills, I recommend exploring strategies to attack your goals with confidence, as discussed in Beast Mode Over Scared Mode.

Why is Cash Flow Management Crucial for Construction Companies?

As I’ve navigated through various construction projects, I’ve come to understand that cash flow management is not just a financial task; it’s a lifeline for the entire operation. Without proper cash flow management, even the most promising projects can quickly turn into financial nightmares. Here’s why cash flow management is absolutely crucial for construction companies.

Impact on Project Success

1. Ensuring Timely Completion:

- One of the biggest advantages of effective cash flow management is ensuring that projects are completed on time. When you have a steady flow of cash, you can pay your workers, purchase materials, and cover other expenses without delay. This prevents costly interruptions and keeps your project on schedule.

2. Avoiding Work Stoppages:

- Lack of funds can lead to work stoppages, which not only delay the project but also increase costs. Effective cash flow management ensures that there are always enough funds available to keep the work going, avoiding costly halts and maintaining productivity.

Financial Health

1. Meeting Financial Obligations:

- Construction companies have numerous financial obligations, including payroll, supplier payments, equipment rentals, and more. Managing cash flow ensures that you can meet these obligations on time, which helps maintain good relationships with suppliers and employees.

2. Maintaining Creditworthiness:

- Consistent cash flow helps maintain your company’s creditworthiness. When lenders and suppliers see that you manage your finances well, they’re more likely to extend credit or offer favorable payment terms. This can be a significant advantage in managing large or multiple projects.

3. Preparing for Unexpected Expenses:

- The construction industry is fraught with unexpected expenses. Whether it’s a sudden increase in material costs or unforeseen site conditions, having a robust cash flow management plan means you’re better prepared to handle these surprises without jeopardizing the project or your business.

Long-Term Stability and Growth

1. Strategic Planning:

- Effective cash flow management allows you to plan strategically for the future. With a clear picture of your financial health, you can make informed decisions about taking on new projects, investing in new equipment, or expanding your business.

2. Investing in Growth:

- When your cash flow is stable and well-managed, you have the financial flexibility to invest in growth opportunities. This might include training for your team, adopting new technologies, or entering new markets.

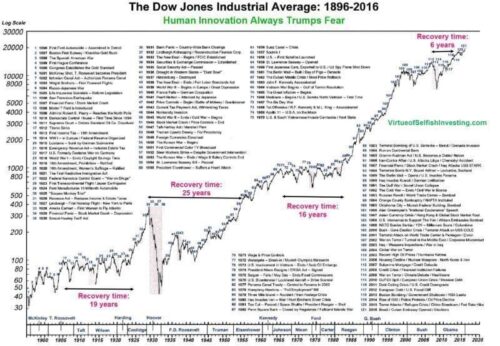

3. Resilience Against Market Fluctuations:

- The construction industry is often affected by economic cycles and market fluctuations. Strong cash flow management provides a buffer against these fluctuations, helping your company stay resilient during downturns.

For those looking to further understand the importance of financial health and strategic planning, I found valuable insights in the article on why the rich stay rich.

Practical Tips for Managing Cash Flow in Construction

Managing cash flow in construction requires a combination of careful planning, regular monitoring, and strategic decision-making. Here are some practical tips that have helped me maintain healthy cash flow in my construction business.

1. Accurate Budgeting and Forecasting

One of the most critical aspects of managing cash flow is accurate budgeting and forecasting. Without a clear understanding of your financial needs and expectations, it’s easy to run into cash flow problems.

Creating a Detailed Budget:

- Start by creating a detailed budget for each project, accounting for all potential costs, including materials, labor, permits, and overhead. Ensure that your budget is realistic and includes a contingency fund for unexpected expenses.

Cash Flow Forecasting:

- Use cash flow forecasting to predict your future cash inflows and outflows. This involves projecting your income and expenses over a specific period, which helps you anticipate any potential cash flow gaps and plan accordingly.

For more insights into achieving financial success and the importance of hard work in planning, check out Unlocking Doors You Can’t Even See Yet.

2. Regular Monitoring and Review

Once you have a budget and cash flow forecast in place, it’s crucial to regularly monitor and review your financial performance.

Track Cash Flow:

- Keep a close eye on your cash flow by regularly updating your financial records. This includes tracking payments received, expenses incurred, and any changes to your budget or forecast.

Monthly Reviews:

- Conduct monthly reviews of your cash flow to identify any variances from your forecast. Analyze the reasons for these variances and adjust your budget or cash flow plan as necessary.

Adopting a proactive approach to managing your business finances can help you stay in control. Learn more about attacking your goals with confidence in Beast Mode Over Scared Mode.

3. Managing Receivables and Payables

Efficiently managing your receivables and payables is key to maintaining positive cash flow.

Prompt Invoicing:

- Ensure that you invoice clients promptly and follow up on overdue payments. The quicker you receive payments, the better your cash flow will be.

Flexible Payment Terms:

- Negotiate flexible payment terms with your suppliers. Extending payment terms can help you manage cash outflows more effectively, aligning them with your cash inflows.

Understanding financial management and credit scores can aid in managing cash flow. Discover why credit scores can be misleading in The Hidden Truth About Debt.

4. Maintaining a Cash Reserve

Having a cash reserve is essential for handling unexpected expenses and cash flow gaps.

Building a Cash Reserve:

- Aim to set aside a portion of your profits to build a cash reserve. This reserve acts as a financial safety net, providing you with the funds needed to cover unforeseen costs without disrupting your operations.

Using the Reserve Wisely:

- Use your cash reserve judiciously, tapping into it only when necessary. Replenish the reserve as soon as possible to ensure that it remains available for future needs.

Financial experiments and strategies can offer valuable lessons. Explore how the wealthy maintain their status in The $25,000 Financial Experiment.

By implementing these practical tips, you can significantly improve your cash flow management, ensuring that your construction projects run smoothly and your business remains financially healthy.

How Can Construction Companies Improve Cash Flow?

Improving cash flow in construction companies involves a combination of strategic planning, effective management, and leveraging technology. Here are some specific strategies that can help you enhance your cash flow and ensure the financial stability of your construction business.

Optimizing Project Scheduling

1. Efficient Project Planning:

- Effective project scheduling is crucial for managing cash flow. By planning your projects efficiently, you can ensure a steady flow of work and avoid costly delays. Break down your project into phases and schedule tasks in a way that maximizes productivity and minimizes downtime.

2. Phased Payments:

- Structure your contracts to include phased payments tied to project milestones. This ensures a steady inflow of cash throughout the project, reducing the risk of cash flow shortages. For example, you might arrange for payments at the completion of design, groundwork, construction, and final inspection phases.

Negotiating Better Payment Terms

1. Flexible Payment Terms with Suppliers:

- Negotiate favorable payment terms with your suppliers. Extended payment terms can help you align your cash outflows with your inflows, providing more flexibility in managing your finances. For instance, if you can arrange for 60-day payment terms instead of 30 days, you’ll have more time to receive payments from your clients before needing to pay your suppliers.

2. Early Payment Discounts:

- Offer discounts for early payments to your clients. This can incentivize clients to pay sooner, improving your cash flow. For example, you might offer a 2% discount if the invoice is paid within 10 days instead of the standard 30 days.

Implementing Technology Solutions

1. Cash Flow Management Software:

- Utilize cash flow management software to track and analyze your cash flow in real-time. These tools can provide insights into your financial performance, helping you make informed decisions. Software like QuickBooks or Procore can automate invoicing, expense tracking, and financial reporting.

2. Project Management Tools:

- Leverage project management tools to enhance scheduling, budgeting, and resource allocation. These tools can help you stay on top of your project timelines and budgets, ensuring that you manage your cash flow effectively.

3. Mobile Applications:

- Use mobile applications to manage on-site expenses and time tracking. This ensures that all costs are recorded accurately and promptly, providing a clearer picture of your cash flow situation.

Streamlining Financial Processes

1. Regular Financial Reviews:

- Conduct regular financial reviews to assess your cash flow status and make adjustments as needed. This proactive approach can help you identify potential cash flow issues before they become critical.

2. Automating Invoicing and Payments:

- Automate your invoicing and payment processes to reduce delays and errors. Automated systems ensure that invoices are sent out promptly and follow-up reminders are issued for overdue payments.

3. Cost Control Measures:

- Implement cost control measures to manage expenses effectively. Regularly review your budget and look for areas where you can cut costs without compromising the quality of your work.

Leveraging External Resources

1. Financial Advisors:

- Consult with financial advisors who specialize in the construction industry. They can provide valuable insights and strategies for managing cash flow and improving financial health.

2. Educational Resources:

- Continuously educate yourself and your team on best practices for cash flow management. Attend workshops, webinars, and courses to stay updated on the latest trends and strategies.

For a deeper understanding of strategic financial planning and unlocking potential benefits, I recommend reading about Unlocking Your Social Security at 62.

By implementing these strategies, you can improve your cash flow management, ensuring that your construction company remains financially stable and ready to take on new projects.

Tools and Resources for Cash Flow Management in Construction

Effective cash flow management requires the right tools and resources. Leveraging technology and expert advice can significantly enhance your ability to manage finances and ensure the stability of your construction business. Here are some essential tools and resources that can assist in cash flow management for construction companies.

Software Solutions

1. Cash Flow Management Software

- Using dedicated cash flow management software can help you track and analyze your cash flow in real-time. These tools offer features like automated invoicing, expense tracking, and financial reporting, making it easier to manage your finances.

Recommended Tools:

- QuickBooks: This widely-used accounting software offers robust cash flow management features, including real-time tracking, budgeting, and forecasting.

- Procore: A comprehensive construction management software that includes financial management tools to help you keep track of project costs and cash flow.

2. Project Management Tools

- Project management tools can enhance scheduling, budgeting, and resource allocation, ensuring that your projects stay on track and within budget. These tools also help you manage cash flow by providing visibility into project timelines and expenses.

Recommended Tools:

- Buildertrend: An all-in-one construction management software that helps with project scheduling, budgeting, and communication.

- CoConstruct: Designed for custom builders and remodelers, CoConstruct offers project management, financial management, and client communication tools.

3. Mobile Applications

- Mobile apps can help you manage on-site expenses and time tracking, ensuring that all costs are recorded accurately and promptly. This provides a clearer picture of your cash flow situation and helps you make informed decisions.

Recommended Apps:

- Tsheets by QuickBooks: A time tracking app that integrates with QuickBooks for seamless payroll and expense management.

- Expensify: An expense management app that allows you to track receipts and manage expenses on the go.

Financial Advisors

1. Industry-Specific Advisors

- Consulting with financial advisors who specialize in the construction industry can provide valuable insights and strategies for managing cash flow. These advisors understand the unique challenges faced by construction companies and can offer tailored advice.

Finding Advisors:

- Look for advisors with experience in construction finance.

- Seek recommendations from industry peers or professional associations.

Educational Resources

1. Workshops and Webinars

- Attending workshops and webinars on cash flow management and financial planning can help you stay updated on the latest trends and best practices. These events often feature industry experts who share their knowledge and insights.

Recommended Sources:

- Construction Financial Management Association (CFMA): Offers a variety of educational resources, including webinars, conferences, and publications focused on construction financial management.

- National Association of Home Builders (NAHB): Provides workshops, courses, and certification programs on various aspects of construction management, including financial management.

2. Online Courses

- Enrolling in online courses on cash flow management and construction finance can provide you with in-depth knowledge and practical skills. These courses are often self-paced, allowing you to learn at your own convenience.

Recommended Platforms:

- Coursera: Offers courses on financial management, budgeting, and construction project management from top universities.

- Udemy: Provides a range of courses on construction finance, cash flow management, and project management.

Books and Publications

1. Books on Construction Finance

- Reading books on construction finance can provide comprehensive insights and strategies for managing cash flow. These publications often include case studies and practical examples that can help you apply the concepts to your own business.

Recommended Reads:

- “Construction Accounting and Financial Management” by Steven J. Peterson: A comprehensive guide to financial management in the construction industry.

- “Financial Management and Accounting Fundamentals for Construction” by Daniel W. Halpin and Bolivar A. Senior: Offers practical advice and techniques for managing construction finances.

Leveraging Online Articles

In addition to these tools and resources, online articles can provide quick insights and tips for managing cash flow. For example, understanding the financial strategies behind successful home improvement projects can offer valuable lessons. Check out Low-Cost High-Value Home Improvement Projects for inspiration.

By utilizing these tools and resources, you can enhance your cash flow management capabilities, ensuring that your construction business remains financially stable and ready to take on new challenges.