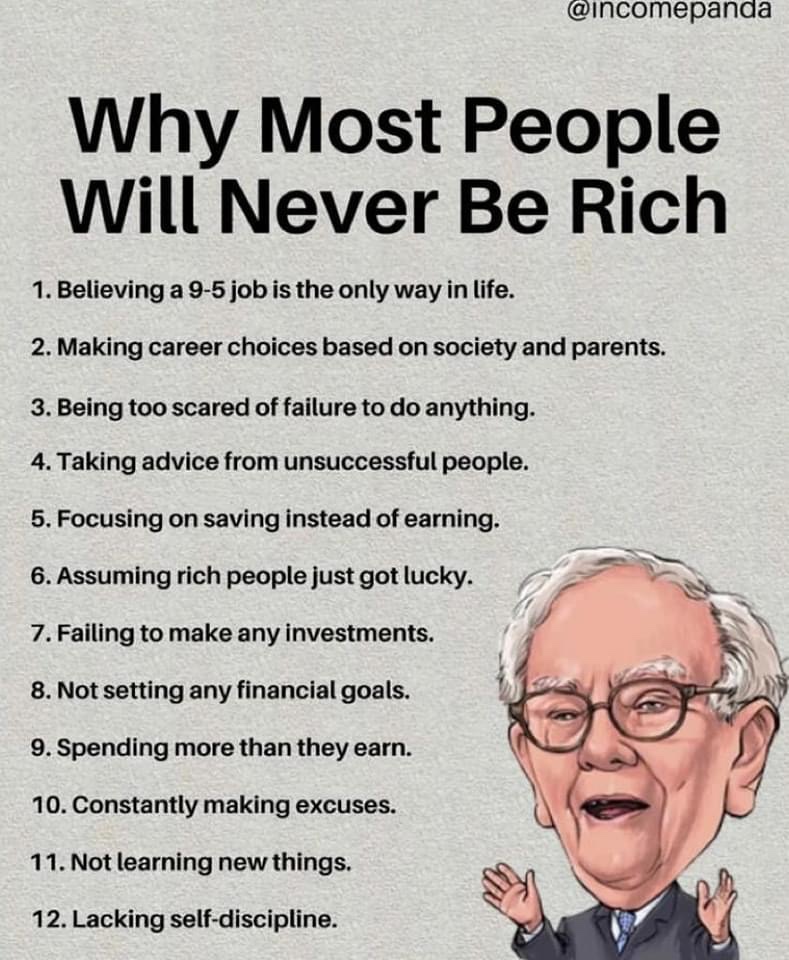

Achieving financial success is a goal many aspire to, yet the path can be fraught with misconceptions and mental barriers. The journey to wealth requires a combination of strategic thinking, wise choices, and a proactive approach. In this article, we’ll explore a range of common reasons that can prevent individuals from achieving financial abundance, offering insights into shifting mindset and behaviors for a brighter financial future.

The 9-to-5 Fallacy:

1. Belief in the 9-to-5 Paradigm: Embracing the notion that a traditional 9-to-5 job is the only path to financial stability can limit opportunities. Exploring alternative income streams and entrepreneurial ventures can unlock potential beyond the conventional.

The Investment Equation:

2. Neglecting Investment Opportunities: Failing to invest can hinder wealth accumulation. Overcoming the fear of investing and acquiring knowledge about various investment options can set the stage for future financial growth.

3. Short-Term Thinking: Focusing solely on immediate gains and ignoring long-term investment strategies can undermine the potential for compounded wealth over time.

Fear of Failure:

4. Fear of Taking Risks: Avoiding risk due to fear of failure can hinder progress. Embracing calculated risks and learning from setbacks can lead to valuable insights and growth.

5. Allowing Fear to Dictate Decisions: Letting fear of loss dictate choices can result in missed opportunities. Developing a risk-aware mindset and seeking professional advice can provide a balanced perspective.

Spending Habits:

6. Overspending and Consumer Debt: Spending more than one earns or accumulating consumer debt can trap individuals in a cycle of financial stress. Cultivating budgeting skills and focusing on needs over wants can lead to better money management.

7. Lifestyle Inflation: As income grows, it’s easy to succumb to lifestyle inflation by increasing spending habits. Being mindful of lifestyle choices and directing extra income toward savings and investments can break this cycle.

Career Choices:

8. Pursuing Income Over Passion: Choosing a career solely for monetary gain, without considering personal passions and interests, can lead to dissatisfaction and hinder long-term success.

9. Ignoring Skill Development: Stagnating in terms of skill development and refusing to adapt to changing job markets can limit earning potential. Continuously learning new skills and staying current in your field can open doors to advancement.

10. Reliance on a Single Income Stream: Relying solely on a single source of income can leave individuals vulnerable to financial setbacks. Exploring diverse income streams and side hustles can enhance financial stability.

Mindset Shift:

11. Fixed vs. Growth Mindset: Having a fixed mindset – believing that skills and talents are set in stone – can hinder growth. Embracing a growth mindset, where learning and effort lead to improvement, can fuel personal and financial progress.

Unlocking the Path to Financial Abundance:

While wealth accumulation is influenced by various factors, the way we think and approach life plays a crucial role. By recognizing and addressing mental barriers and misconceptions, individuals can reshape their mindset, make informed choices, and take proactive steps toward financial success. From embracing diversified income streams to investing wisely and cultivating a growth-oriented mindset, each shift contributes to a brighter financial future.