The journey towards building wealth is both exciting and challenging, filled with potential for growth and achievement. Yet, as with any journey, there are pitfalls along the way that can lead to setbacks and missed opportunities. Let’s delve into the world of wealth-building and explore some of the most common mistakes that individuals often make, so you can sidestep them on your own path to financial success.

Mistake 1: The Quest for Quick Riches

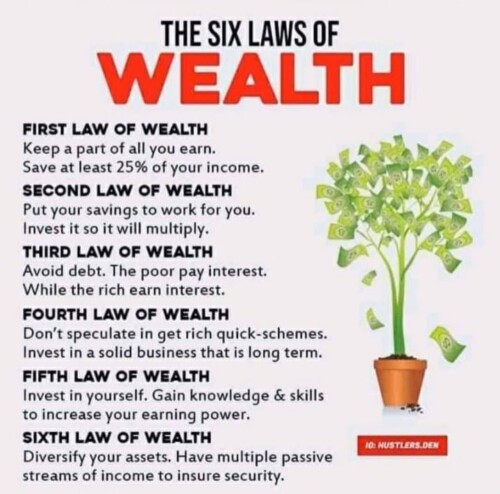

The allure of getting rich quick can be tempting, but it’s a trap that often leads to disappointment. True wealth-building is a gradual process that requires patience, discipline, and a long-term perspective. Avoid chasing after the promise of instant gains, as these often come with higher risks and the potential for significant losses.

Mistake 2: Diving in Without Research

Entering investment opportunities or ventures without proper research can be a recipe for disaster. Before committing your hard-earned resources, take the time to thoroughly understand the market, the risks involved, and the potential returns. Educate yourself, seek advice from professionals, and make informed decisions.

Mistake 3: Lack of Discipline

Consistency and discipline are key components of successful wealth-building. It’s easy to fall into the trap of overspending or deviating from your financial plan. To avoid this mistake, create a budget, stick to it, and cultivate disciplined saving and investing habits that will pay off over time.

Mistake 4: Failing to Diversify

Putting all your eggs in one basket can lead to financial vulnerability. A lack of diversification in your investments can expose you to unnecessary risks. Spread your investments across different asset classes to mitigate potential losses and ensure a more balanced portfolio.

Mistake 5: Trusting Blindly

Relying solely on someone else to manage your finances or investments without understanding the process is risky. While financial advisors and experts can provide valuable insights, it’s essential to be informed and engaged in your financial decisions. Understand where your money is going and actively participate in shaping your financial future.

Mistake 6: Ignoring Debt

Neglecting to manage and reduce debt can hinder your wealth-building efforts. High-interest debts can drain your resources and limit your ability to invest and save. Prioritize paying off high-interest debts and adopt a strategy to manage your liabilities effectively.

Mistake 7: Neglecting Emergency Funds

Life is full of unexpected twists and turns. Failing to set aside funds for emergencies can disrupt your financial progress. Establish an emergency fund that covers three to six months’ worth of living expenses to provide a safety net during challenging times.

Mistake 8: Overlooking Long-Term Planning

Short-term thinking can hinder your ability to achieve sustainable wealth. Develop a comprehensive long-term financial plan that encompasses your goals, retirement planning, estate planning, and more. Having a clear roadmap will help you stay on track and navigate the ups and downs of your financial journey.

Building wealth is a journey that requires careful consideration, patience, and strategic planning. By avoiding common mistakes such as seeking quick riches, neglecting research, lacking discipline, and relying blindly on others, you can pave the way for a more successful and fulfilling financial future. Remember that wealth-building is a gradual process that rewards those who approach it with wisdom, diligence, and a commitment to long-term growth.