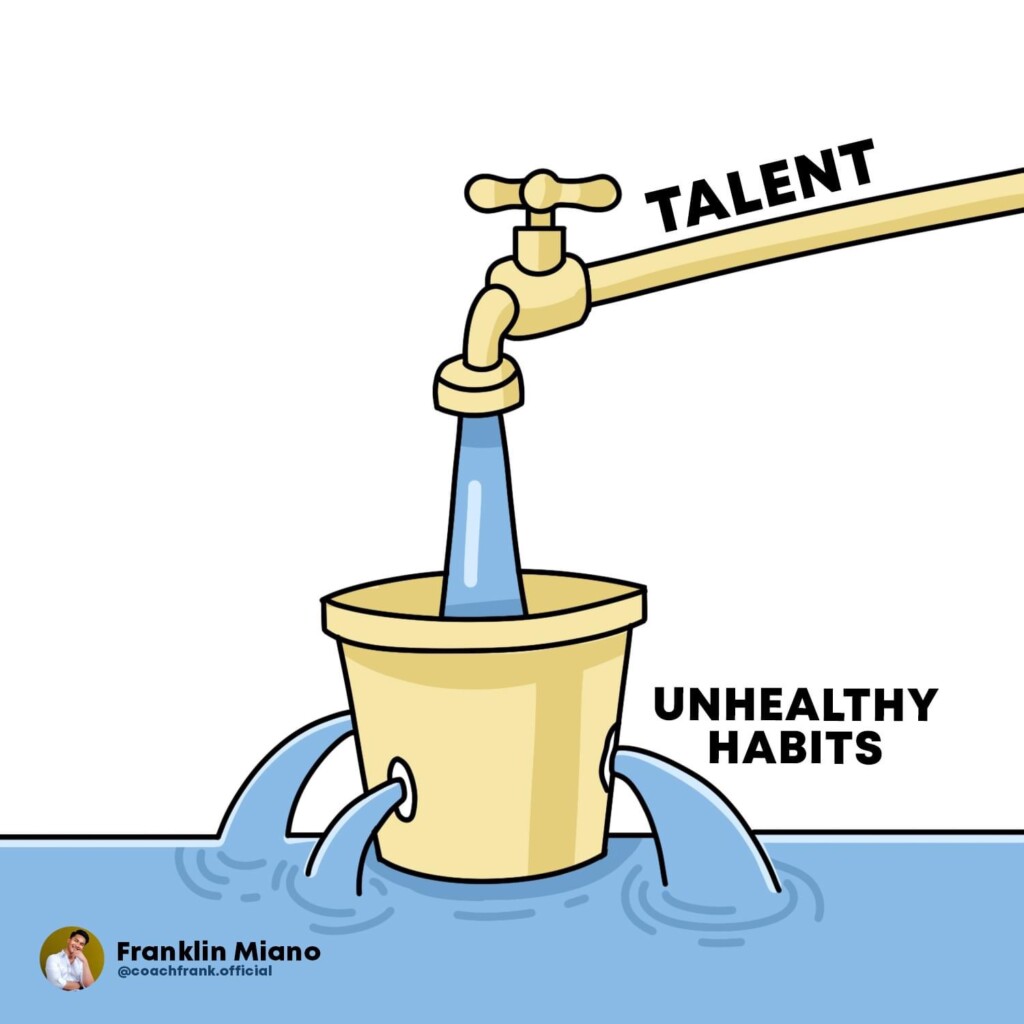

Just as talents require nurturing and dedication, so do the skills needed for building wealth and making sound investments. However, even the most strategic financial abilities can be jeopardized by the presence of unhealthy habits. In this article, we delve into the intricate link between financial talents and habits, exploring how certain behaviors can erode your wealth-building efforts and hinder your full financial potential. From procrastination to neglecting prudent financial practices, discover how to safeguard your financial talents from the detrimental impact of unhealthy habits.

Financial Talents: A Worthwhile Investment:

Cultivating Financial Skills: Just like honing a talent, mastering financial skills requires time, effort, and consistent learning. Whether it’s astute investing or effective budgeting, these abilities are built through intentional action.

Sowing the Seeds of Wealth: Building wealth involves calculated decisions and strategic planning. Each financial move contributes to your financial portfolio and long-term goals, reflecting the hard work invested.

The Detrimental Effects of Unhealthy Financial Habits:

Procrastination: A Silent Threat: Procrastination can plague financial decisions, delaying important actions such as setting up retirement funds or diversifying investments. Delayed decisions can diminish potential returns and complicate financial planning.

Neglecting Prudent Practices: Overlooking essential financial practices, such as regular budget assessment or underestimating the importance of emergency funds, can weaken your financial foundation.

Falling Prey to Distractions: Indulging in excessive spending or failing to monitor financial progress can divert attention from your wealth-building endeavors. These habits can compromise your long-term financial objectives.

Preserving and Amplifying Your Financial Talents:

Strategic Time Management: Prioritize consistent financial reviews and actions within your schedule. Set aside focused periods to evaluate investments, monitor your financial plan, and explore new opportunities.

Holistic Financial Well-Being: Adopt a comprehensive approach to financial well-being. Prioritize saving, investing, and managing debt while also ensuring you’re equipped to handle unexpected financial challenges.

Mindfulness and Strategic Focus: Practice mindfulness in your financial decisions. Stay present in the moment, avoiding impulsive decisions, and focus on aligning your actions with your long-term financial goals.

Seeking Expert Guidance: Leverage the expertise of financial advisors and mentors. Their insights can provide clarity, guidance, and accountability as you navigate the complex world of wealth-building.

Safeguarding Your Wealth-Building Endeavors:

Just as talents require careful cultivation, financial skills demand dedication and protection from the negative influence of unhealthy habits. By recognizing the pitfalls of behaviors like procrastination, neglecting prudent financial practices, and falling victim to distractions, you take a vital step toward preserving your financial talents. Through strategic time management, holistic financial well-being practices, and mindful decision-making, you can ensure that your financial endeavors remain on track and continue to flourish. Remember, it’s not just about possessing financial skills – it’s about nurturing and honing them with care and commitment, leading to a life of financial abundance and security.