Success, wealth, and financial freedom are aspirations shared by many. They often go hand in hand with entrepreneurship, business ventures, and strategic investments. However, achieving these goals requires more than just ambition and opportunity. One key element that sets individuals apart is their level of preparedness. In this article, we will explore the significance of being prepared and how it contributes to success, wealth creation, and financial independence. We will delve into various areas, including personal finance, career growth, investment strategies, and the importance of a proactive mindset.

- Embracing the Entrepreneurial Mindset: To embark on a journey toward success and wealth, it is essential to adopt an entrepreneurial mindset. Being prepared starts with a deep understanding of your goals, vision, and the risks involved. Entrepreneurs are diligent in assessing opportunities, identifying potential challenges, and crafting strategic plans to mitigate risks. This proactive approach enables them to seize opportunities and make informed decisions, ultimately leading to wealth accumulation and financial independence.

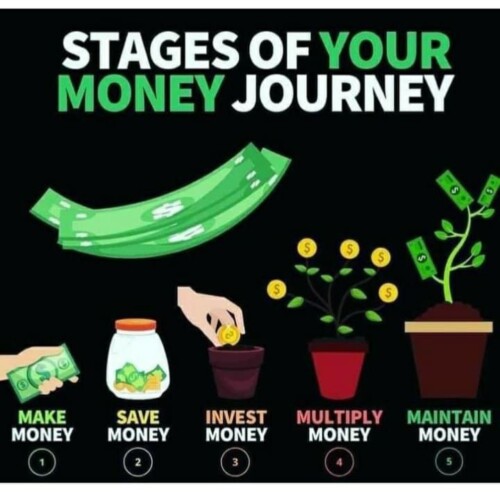

- Personal Finance and Money Management: Financial success is rooted in effective money management. Preparing for financial success involves creating and adhering to a budget, setting financial goals, and maintaining discipline in spending habits. By taking control of personal finances, individuals can allocate resources wisely, save for investments, and build a solid foundation for long-term wealth creation.

- Investing for Wealth: Investment is a vital component of building wealth. Being prepared in the realm of investment means educating oneself about the stock market, real estate investing, and other investment opportunities. It involves understanding risk tolerance, diversification, and investment strategies that align with your financial goals. A prepared investor has a well-thought-out plan, regularly monitors their investments, and adapts to market changes, ultimately paving the way for financial growth and passive income streams.

- The Importance of Financial Planning: Financial planning is crucial for individuals aiming to achieve success and wealth. It involves setting short-term and long-term financial goals, creating a roadmap, and regularly reviewing and adjusting the plan as circumstances change. Being prepared in financial planning allows for a clearer vision of the steps needed to reach financial milestones, such as buying a house, starting a business, or retiring comfortably.

- Career Growth and Advancement: Being prepared in the context of career growth involves continuous learning, skill development, and seeking new opportunities. To achieve success in the professional sphere, individuals must stay informed about industry trends, cultivate a growth mindset, and be open to acquiring new skills. By proactively preparing for career advancement, individuals can position themselves for promotions, salary increases, and greater financial stability.

- Continuous Financial Education: Financial education is a lifelong journey. Being prepared requires staying informed about changes in tax laws, investment opportunities, and personal finance strategies. By dedicating time and effort to financial education, individuals can make informed decisions, avoid common pitfalls, and seize opportunities for financial growth.

Success, wealth, and financial independence are attainable goals for those who embrace preparation as a guiding principle. Whether it’s adopting an entrepreneurial mindset, managing personal finances, making strategic investments, or planning for the future, being prepared is a cornerstone of achieving long-term success. By incorporating these principles into our lives and continuously seeking knowledge and growth, we can unlock the doors to success and build a prosperous future.

Remember, success and wealth are not merely products of luck or chance but the result of intentional preparation and action.