Why Even Bother with a Budget?

So you’re tired of living paycheck to paycheck, huh? Maybe you’ve got some big dreams like buying a house, starting a business, or just not stressing about money all the time. That’s where a budget comes in. It’s not just a bunch of numbers on a spreadsheet; it’s your game plan for financial freedom.

The Big Misconception: Budgets Are Restrictive

A lot of people think budgets are like financial diets that only allow you to eat ramen noodles and never have fun. That’s a load of crap. A good budget helps you figure out how to spend on what you love and cut back on the stuff you don’t care about.

The Basics: Income vs. Expenses

Alright, let’s start with the basics. You’ve got money coming in (hopefully), and you’ve got money going out (definitely). The first step in budgeting is to figure out how much you’re making and how much you’re spending. Grab your pay stubs, look at your bank statements, and get those numbers down.

The 50/30/20 Rule: A Good Starting Point

Ever heard of the 50/30/20 rule? It’s a simple way to break down your budget. You spend 50% of your income on needs, 30% on wants, and 20% on savings and debt repayment. It’s not set in stone, but it’s a good starting point to get you thinking about where your money’s going.

The Nitty-Gritty: Categorizing Expenses

Now that you’ve got a general idea, it’s time to dive into the details. Start categorizing your expenses. We’re talking rent, utilities, groceries, eating out, entertainment, the whole nine yards. Use an app or good ol’ pen and paper, whatever works for you.

The Reality Check: Track Your Spending

You might think you know where your money’s going, but trust me, you don’t. Not until you track every single dollar. Do it for a month. Write down everything you spend money on, no matter how small. You’ll probably be surprised at where some of your cash is slipping through the cracks.

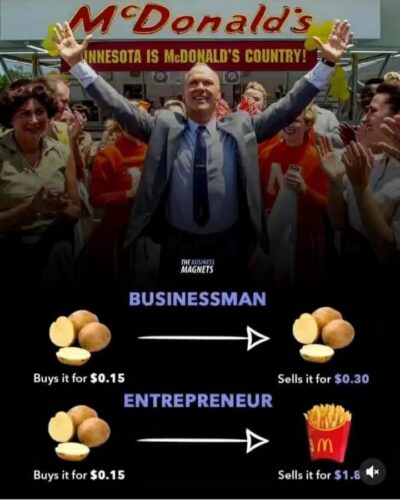

The Game Plan: Setting Goals

Now that you’ve got a clear picture of your spending, it’s time to set some goals. Want to pay off debt? Save for a vacation? Build an emergency fund? Your budget should help you get there. Assign a specific amount to each of your goals and work it into your budget.

The Flexibility Factor: Life Happens

Budgets aren’t set in stone. They’re more like guidelines. Life happens, and you’ve got to be able to roll with the punches. Car broke down? Unexpected medical bill? It’s okay to adjust your budget to deal with life’s curveballs.

The Accountability Aspect: Keep Yourself in Check

It’s easy to make a budget, but sticking to it? That’s where the rubber meets the road. Keep yourself accountable. Review your budget regularly, and if you mess up, don’t beat yourself up. Just get back on track as soon as you can.

The Tech Help: Budgeting Apps and Tools

In this day and age, there’s an app for everything, and budgeting is no exception. Apps like Mint, YNAB (You Need A Budget), and PocketGuard can help you track your spending and stick to your budget. They can even link to your bank accounts and credit cards to give you a real-time view of your finances.

The Human Element: Don’t Go It Alone

Budgeting can be tough, and it’s okay to ask for help. Whether it’s a financial advisor, a savvy friend, or an online community, sometimes getting an outside perspective can be super helpful. They can offer advice, keep you accountable, and provide moral support when the going gets tough.

The Long-Term View: Budgeting Is a Marathon, Not a Sprint

Here’s the thing: Budgeting isn’t something you do once and forget about. It’s an ongoing process. Your income will change, your expenses will change, your goals will change. And that’s okay. The important thing is to keep at it, make adjustments as needed, and stay committed to your financial well-being.

The Final Word: You’ve Got This

So there you have it, folks. Creating a budget that actually works is totally doable. It takes some effort, sure, but the payoff is huge. We’re talking less stress, more freedom, and a clear path to achieving your financial goals. So what are you waiting for? Get started on that budget and take control of your financial future.