How to Live Within Your Means (Without Feeling Miserable)

I used to think the phrase “live within your means” meant living a boring life with no fun, no joy, and certainly no Chick-fil-A runs. But I was wrong. Learning how to live within your means is actually how I started building real freedom in my life—freedom from debt, stress, and that sinking feeling at the gas pump when my card might get declined.

Let me walk you through how I turned things around, and how you can too.

Know What “Your Means” Actually Are

This might sound obvious, but I didn’t even know what my “means” were until I sat down and crunched the numbers. For most of us, that monthly paycheck feels like a green light to spend—until the bills start piling up.

Here’s what I did:

- Added up all my monthly income (after taxes).

- Listed every single monthly expense—even the “small” ones like subscriptions and snacks.

- Took a hard look at where my money was really going.

Once I knew how much I was spending vs. how much I should be spending, the problem was staring me in the face. I was living above my means and blaming everything but myself.

Build a Bare-Bones Budget First

Forget fancy budgeting apps or color-coded spreadsheets—start with a bare-bones budget. This is your “survival” budget: just the essentials.

My bare-bones budget included:

- Rent or mortgage

- Utilities

- Groceries

- Gas

- Minimum debt payments

No extras. No dining out. No new clothes. This wasn’t permanent—it was a reset.

If budgeting feels overwhelming, you might want to check out how to make extra money without a second job so you’re not stuck cutting everything out just to breathe.

Stop Trying to Impress People Who Aren’t Paying Your Bills

One of the biggest money traps I fell into was trying to look like I was doing better than I actually was. New clothes, expensive coffee, weekend getaways I couldn’t afford—it all added up fast. And for what? A few Instagram likes?

What helped me shift:

- I reminded myself daily: “They don’t care, and they’re not helping me retire.”

- I started tracking my “insecurity spending”—purchases I made just to look a certain way.

- I deleted apps that triggered my spending habits (looking at you, Amazon and DoorDash).

This mindset shift was huge in learning how to live below your means without feeling like I was missing out.

Automate Your Savings Like You Automate Netflix

If your bills can auto-draft from your account, why shouldn’t your savings?

I set up an automatic weekly transfer—even just $10 at first—into a high-yield savings account. I treated it like a non-negotiable bill. That tiny habit became a game-changer.

If you’re ready to go beyond just saving and start growing your money passively, Fundrise is one of the tools I started using. I didn’t need thousands of dollars or any landlord headaches. Just a few bucks and a long-term mindset.

Identify and Cut Out the Silent Money Leaks

I was shocked when I finally added up all my random charges—$7 here, $15 there. It’s easy to think “it’s just a few bucks,” but those silent money leaks drained my bank account faster than any big-ticket item ever did.

Sneaky budget killers I tackled:

- Monthly subscriptions I forgot about or didn’t use.

- Takeout meals “just this once” that happened 4 times a week.

- ATM fees, late fees, and interest on dumb stuff.

Once I found them, I canceled, paused, or swapped them out for free or cheaper alternatives. Why I’ll never rely on one income again also helped shape my mindset—adding income streams makes cutting expenses a lot less painful.

Start Living Below Your Means, Not Just “Within” Them

Here’s the truth: living within your means keeps you from going broke. But learning how to live below your means is how you actually start getting ahead.

Instead of spending every dollar I made, I aimed to live on 70% of my income. The rest? I split it between savings, investments, and a little fun money.

Simple ways I started living below my means:

- Drove a paid-off used car instead of financing something flashy

- Meal-prepped instead of eating out

- Waited 72 hours before making non-essential purchases

That 30% gap became the key to building wealth instead of just surviving.

Learn to Say “No” Without Feeling Guilty

Saying no to dinner invites, travel plans, or “let’s just split it” nights out used to make me feel lame. But eventually, I realized I was sacrificing my financial future just to avoid awkward moments. That wasn’t worth it.

I started practicing honest responses like:

- “I’m on a budget right now, but let’s plan something cheaper.”

- “That sounds fun, but I’ve got some money goals I’m sticking to.”

- “Not this time—but maybe next month.”

Living on a budget doesn’t mean living like a hermit. It just means being real about priorities. And trust me, real friends respect that.

Build a Life That Doesn’t Require Escaping

I used to live for Friday nights and dread Monday mornings. That’s not living within your means—that’s surviving.

Once I started shifting my money habits, I felt less trapped. I worked toward a life I didn’t need constant “retail therapy” to cope with. It’s wild how much better life feels when you aren’t stressed every time your phone buzzes with a bank alert.

And I started stacking simple income streams like this weekend side hustle that made me $100. That gave me breathing room, which gave me peace, which gave me a life I didn’t need to escape from.

Automate Smart Financial Habits

One of the easiest changes I made? I took my own willpower out of the equation. I started automating my savings and bill payments so I couldn’t “accidentally” spend what I meant to save.

Here’s how I automated my way to living within my means:

- Set up auto-transfers to savings the day I got paid

- Scheduled bill payments to avoid late fees

- Used round-up investing apps like Acorns to save while I spent

- Let Robinhood handle my small investments automatically

It was like putting my financial goals on cruise control—and it worked. The less I had to think about it, the easier it got.

Stop Comparing Your Life to People Who Are Broke in Disguise

Scrolling through Instagram or TikTok, it looks like everyone’s on vacation, driving luxury cars, or remodeling their homes. But I’ve learned most people financing that lifestyle are actually living beyond their means.

I used to compare my simple, budget-conscious life to their highlight reels—and it made me feel behind. Until I realized: I’d rather have a boring bank statement than flashy debt.

Once I stopped playing that comparison game, it was a whole lot easier to live within (or below) my means—and actually be proud of it.

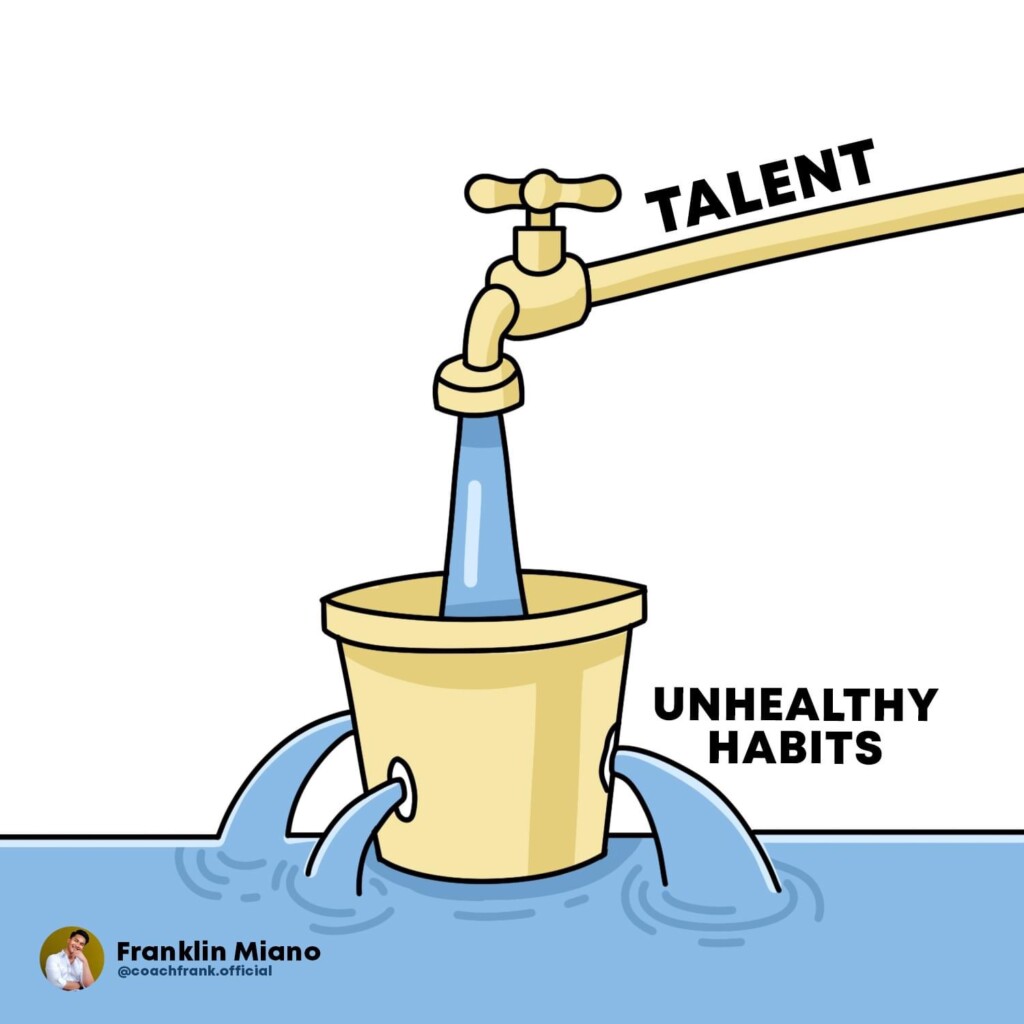

Know the Difference Between Wants and Needs

One mindset shift that changed everything for me was being brutally honest about what’s a want and what’s a need. It’s easy to convince yourself you need that daily coffee run, new pair of sneakers, or latest phone upgrade—but most of the time, that’s just impulse disguised as necessity.

Here’s how I sort it out now:

- Needs: Rent, groceries, utilities, basic transportation

- Wants: Streaming subscriptions, eating out, random Target runs

- In-betweens: Sometimes things like gym memberships or hobbies fall here—but I decide based on budget

The truth is, once I separated the two and built a habit around prioritizing needs, I found it way easier to live below my means without feeling deprived.

Create a Budget That Actually Works for You

I tried a dozen budgeting apps and spreadsheets before I found something that felt natural. What finally worked? Keeping it simple.

I started tracking what was coming in, what was going out, and gave every dollar a job. My method looked like this:

- 50% on needs

- 30% on wants

- 20% toward savings and debt payoff

It’s called the 50/30/20 rule, and while it’s not perfect for everyone, it was the first budget I could actually stick to. If you’re not sure how to start, check out these investing tips for broke beginners—because budgeting and investing go hand in hand when you’re building a new financial foundation.

Build in Guilt-Free Fun Money

Living within your means doesn’t mean never having fun—it just means being intentional about it.

I used to cut out all “fun” spending when trying to save, and every time, it backfired. I’d feel deprived, give up, and go on a spending spree. Sound familiar?

So now I build in a line item just for guilt-free spending:

- $25/week for whatever I want—coffee, snacks, a movie

- No tracking, no shame, just freedom within boundaries

That tiny buffer helps me avoid burnout, stick to my budget, and actually enjoy the process of getting my money right. And when I want to make a little extra to boost that fund, I check out things like these weekend money-makers.

Use Cash for Categories You Overspend In

I’ve always been a sucker for food delivery and gas station snacks—those categories used to wreck my budget.

So I went old-school: cash envelopes.

I’d pull out actual cash each week for:

- Food

- Gas

- Fun spending

Once it was gone, that was it. No overdraft, no cheating. This method helped me visually see how fast I was blowing through my money—and that awareness alone was enough to help me cut back without feeling restricted. It’s a powerful trick for living within a budget and actually staying on track.

Track Every Dollar (Even the Small Ones)

I used to ignore little purchases like a $4 coffee or a $7 app subscription… until I realized those “small” charges were quietly draining my bank account.

Once I started tracking every single dollar, I saw patterns I didn’t even know existed:

- Too many $5 convenience stops

- Auto-renew subscriptions I forgot about

- Rounding errors that added up to $50+ per month

Now I log every purchase manually using a notes app. It’s simple, it keeps me mindful, and it helps me stick to the plan. If you’re serious about learning to live on a budget, don’t underestimate the power of daily tracking—even if it’s just a few cents here and there.

Stop Lifestyle Creep Before It Starts

When I got my first raise, I thought, “Finally—I can breathe a little.” But instead of using that extra money to save or invest, I slowly started spending more:

- Upgraded my phone

- Ate out more

- Subscribed to more streaming services

Before I knew it, I was back in the same paycheck-to-paycheck cycle, just with slightly nicer stuff.

That’s lifestyle creep, and it’s sneaky. Now, whenever I make more, I lock in at least 50% of the increase for savings or investments right away. That way, I get ahead—without falling into the trap of living above my means again.

If you want to make your extra income work for you instead of against you, check out how I make money doing almost nothing to inspire smarter financial moves.

Choose Housing You Can Actually Afford

This one was hard to admit—but for a long time, my rent was way too high for my income. I thought I “deserved” a nicer place, but the truth is: it was keeping me broke.

Once I downsized to a smaller, more affordable apartment, everything changed:

- I could finally save consistently

- I wasn’t stressing over every little bill

- I had money left at the end of the month

Housing is usually the biggest budget buster, and living beneath your means starts with being honest about what you can really afford—not what looks good on Instagram.

Start Investing Even If You’re Broke

I used to think investing was only for rich people. But then I discovered you can start with just $5 or $10. No joke.

That realization changed everything. Now I’m investing consistently, even when money is tight. I use a few tools that make it super simple:

- Acorns rounds up spare change and invests it for me

- Robinhood lets me buy stocks and crypto with zero fees

- Fundrise gives me access to real estate income without being a landlord

If you’re serious about living well on a budget, investing—even a few bucks a week—can help you break out of survival mode and actually build wealth.

Don’t Try to Impress Anyone

I used to spend money just to look like I was doing well—new shoes, nicer car, eating at trendy spots. But that mindset was keeping me broke, stressed, and stuck.

The truth? Most people aren’t paying attention anyway. And if they are, they’re probably broke too.

Once I let go of trying to impress anyone, I felt free:

- I bought things because I needed or loved them—not to flex

- I stopped chasing trends

- I focused on my own financial goals, not someone else’s opinion

If you’re always broke, ask yourself: Am I spending to feel better—or to actually live better?

And if that hits home, you’ll probably relate to this honest piece I wrote: Why am I always broke?

Build in Breathing Room

Living within your means doesn’t mean you can’t enjoy life—it just means you plan for enjoyment on purpose.

I now build a small “fun fund” into my monthly budget. That way:

- I don’t feel deprived

- I can grab takeout or a concert ticket guilt-free

- I still stick to my goals

Even $20 a week set aside for fun gives you freedom without sabotage. That little buffer helps you avoid budget burnout—and it’s part of what helps me actually stay consistent long-term.

Start Living Within Your Means Today, Not Tomorrow!

If you’re anything like I was, learning how to live within your means feels like trying to breathe underwater. Every paycheck disappears, your savings stays empty, and you’re stuck wondering what you’re doing wrong.

But I promise you—it’s not about being perfect. It’s about being honest with yourself, getting a grip on your habits, and realizing that living below your means isn’t punishment… it’s freedom.

When I started doing these things consistently—budgeting smarter, cutting the junk, investing early, not living to impress anyone—I finally broke the cycle. It wasn’t overnight, but it was real.

And if you’re tired of the paycheck-to-paycheck grind, this article will help you even more:

👉 Why I’m Never Relying on One Income Again

At the end of the day, learning how to live within your means is one of the most powerful money habits you can ever build. It sets the stage for everything else—saving, investing, and eventually building wealth that doesn’t just look good… it feels good too.