The world of cryptocurrency has opened up exciting avenues for earning passive income, and staking has become a popular method for investors to grow their holdings while actively participating in blockchain networks. Staking involves locking up a portion of your crypto assets to help secure transactions and validate new blocks, and in return, you receive rewards in the form of additional cryptocurrency. Let’s explore the concept of staking and take a closer look at some popular cryptocurrencies and how much they pay in staking rewards. Click here to read our article about learning more about staking and what it is and why to do it?

Staking Simplified: Staking is a relatively straightforward process that offers attractive returns over time. By holding and “staking” your cryptocurrency in a wallet or on a staking platform, you contribute to the network’s security and consensus mechanisms. In return, you earn rewards based on the amount of cryptocurrency you stake and the network’s staking rate. This method of earning passive income is gaining popularity due to its ease of use and the potential for substantial returns.

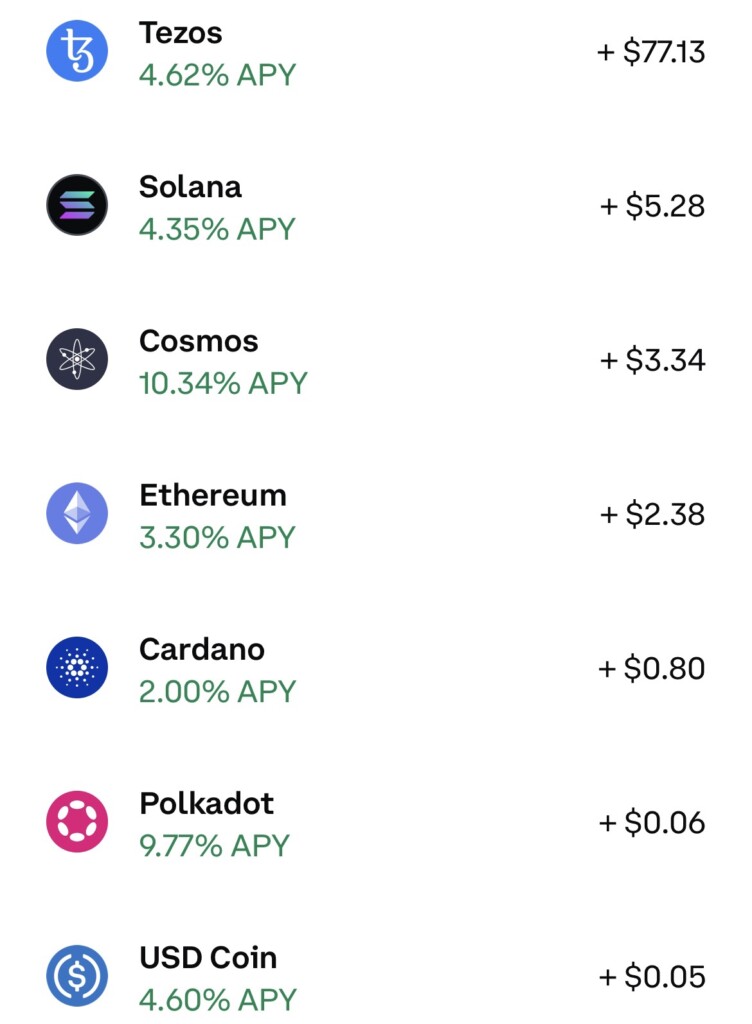

Popular Cryptocurrencies for Staking and Their Rewards:

- Polkadot (DOT): Staking DOT allows you to participate in the Polkadot network and earn rewards. Staking rates can vary, but DOT has historically offered competitive staking rewards.

- Tezos (XTZ): Tezos employs a proof-of-stake consensus mechanism, making it ideal for staking. Depending on the platform and the amount staked, you can earn varying percentages of your staked XTZ.

- Solana (SOL): Solana has gained attention for its fast transactions and scalability. Staking SOL can earn you rewards, and the staking rate can be appealing to investors.

- Cosmos (ATOM): Cosmos enables interoperability between different blockchains. Staking ATOM allows you to participate in network security and earn rewards based on the amount staked.

- Ethereum 2.0 (ETH): The transition to Ethereum 2.0 has introduced staking opportunities. Staking ETH contributes to the network’s shift to a proof-of-stake model and rewards participants.

- Cardano (ADA): Cardano’s staking allows you to earn rewards by delegating your ADA to a stake pool. Staking ADA supports the network’s decentralization and security.

- USD Coin (USDC): Even stablecoins like USDC offer staking opportunities. While the rewards may not be as substantial as other cryptocurrencies, staking USDC provides a way to earn passive income on a stable asset.

Is Staking Really That Easy? Yes, staking can be surprisingly user-friendly, especially when using reputable staking platforms or wallets. These platforms simplify the staking process, providing step-by-step guidance and user-friendly interfaces. All you need to do is select the cryptocurrency you want to stake, choose the staking option, and follow the instructions to delegate or lock up your assets.

However, it’s important to conduct thorough research before staking your assets. Different platforms and networks may have varying staking requirements, rewards structures, and potential risks. Be sure to choose trustworthy platforms, monitor your staking performance, and stay updated on any changes in network protocols.

Staking cryptocurrency is an accessible way to earn passive income while actively participating in blockchain networks. The list of cryptocurrencies available for staking is diverse, and each offers its unique rewards and benefits. While staking can indeed be easy, it’s essential to educate yourself on the specific details of each cryptocurrency and platform before diving in. With proper research and a well-informed approach, staking can become a valuable addition to your investment strategy.