Why Are Cars Considered Bad Investments?

I learned this lesson the hard way. I used to think buying a new car meant I was leveling up. I wanted the nice trim, the tech package, the feeling of pulling into a parking lot with something that still had that new car smell. It felt like a reward.

What I didn’t realize? The moment I drove off the lot, that “reward” became one of the worst financial decisions I’d ever made.

Cars are not investments—they’re expenses with a guaranteed loss. The second that odometer starts ticking, your car is bleeding value. Most new cars lose 15–25% in the first year alone. By year five, they’ve typically lost 50–60% of their original value. That’s not investing—that’s slow-motion wealth erosion.

I used to justify it because “it helped my credit score” or “I needed reliable transportation.” But let’s be real—there are plenty of reliable, used vehicles that don’t trap you in five years of payments. I started waking up to how the system was designed to keep me spending, not building. That’s exactly why I now question things like credit obsession, too—why credit scores are a joke breaks that down even further.

Buying a car isn’t just a financial hit—it’s a mindset trap. And for years, I was stuck in it.

The True Cost of Owning a Car

Most people only think about the monthly payment when they’re shopping for a car. That was me, too. I figured, “I can afford $450 a month, so this works.” But I completely ignored everything else that came with it.

Here’s what that “affordable” car actually cost me:

- $450/month payment

- Full-coverage insurance (an extra $100/month minimum)

- Taxes and registration every year

- Gas, oil changes, maintenance—none of which got cheaper

- And of course, interest. That $25,000 car? Ended up costing over $32,000 with financing.

All of that… for something that lost half its value before I even paid it off.

I started running the math and comparing it to where that money could have gone. And that’s when it hit me: I wasn’t just paying for a car. I was paying to stay stuck in the paycheck-to-paycheck cycle. It took some serious self-reflection to admit it, but owning that car was one of the reasons I stayed broke longer than I needed to.

This realization hit around the same time I started making changes—breaking free from living paycheck to paycheck became my focus. And that started with driving less car, and thinking way bigger.

How Car Payments Kill Your Wealth

When I finally sat down and looked at how much I’d spent on car payments over the years, I was sick to my stomach. Month after month, year after year, I was shelling out hundreds of dollars—money that could’ve been growing instead of disappearing.

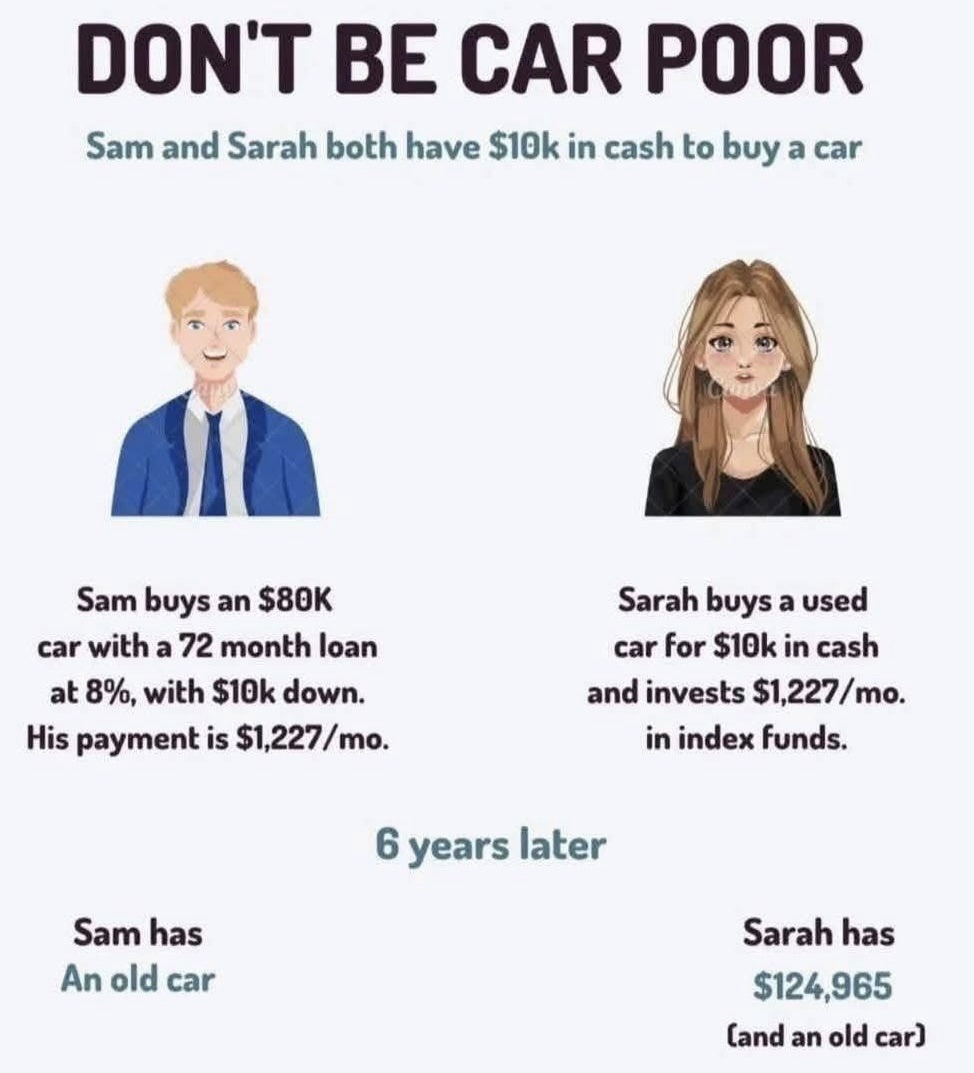

Let’s say your car payment is $500 a month (which is low for many people now). That’s $6,000 a year. Over five years, that’s $30,000. And that doesn’t even include the gas, insurance, and maintenance we already talked about.

Now here’s the kicker: If you had invested that $500/month instead—in something as simple as the S&P 500—you could’ve ended up with well over $40,000 in the same time. And that amount only compounds as time goes on.

That was the eye-opener for me. My car wasn’t just transportation—it was a wealth killer. Every shiny feature and unnecessary upgrade was a chunk of future freedom I gave away.

That shift in mindset helped me start thinking about money differently. Instead of spending on things that lose value, I started looking at what could actually grow it. I go deeper into that in how to build wealth and retire early, where I break down how I started re-routing my car payment into long-term wins.

What’s Smarter: Investing or Buying a New Car?

If I could go back, I’d ask myself this one question before signing that car loan: Would I rather drive a slightly older car, or retire 10 years earlier?

It sounds dramatic, but it’s real.

I’ve run the numbers over and over. Investing instead of financing a brand-new car is one of the most powerful moves you can make if you want to get ahead financially. I’m not talking about high-risk crypto or fancy stock picking—I’m talking simple, boring index investing that grows consistently over time.

Every time I see a $700 car payment, I see someone who just gave up a shot at long-term wealth. But I get it—I’ve been there. The urge to upgrade is real. But now? I’d much rather invest that cash into something that could turn $14,000 into over a million dollars with time and consistency.

I walk through that exact scenario in this article about how the S&P 500 builds wealth. It’s what made me realize I didn’t need a brand-new car—I needed a smarter plan.

Why Rich People Drive Cheap Cars

You ever notice how some of the wealthiest people you know drive the most average cars? I used to think rich folks always rolled up in flashy rides, but turns out—the really smart ones often do the opposite.

Here’s why a lot of millionaires skip the luxury wheels:

1. They understand depreciation.

Why drop $70,000 on something that loses half its value in a few years?

2. They value freedom over flash.

Expensive cars come with high payments, high insurance, and stress. That’s not freedom.

3. They reinvest the difference.

Instead of a car payment, they’re putting money into stocks, real estate, or businesses that grow.

I remember reading about Warren Buffett still driving a modest car well into his billionaire years. And I know regular people—six-figure earners—who choose to drive paid-off Hondas just so they can throw more into their investments.

That mindset shift hit me hard. If people with money are avoiding big car payments, why was I chasing them with a smaller income?

It’s the same reason I started focusing on long-term habits, not short-term status. I dug into this more when I started building my own wealth plan in this article about wealth-building habits. One of the biggest habits? Driving a car that fits your goals, not your ego.

Should You Buy a Cheaper Car and Invest the Rest?

After ditching the expensive car mindset, I made one of the smartest money moves I’ve ever made: I bought a used car that I could afford in cash—and put the rest into investments.

Here’s why that decision changed everything for me:

The math just made sense:

- I paid $7,500 for a solid, used car

- Skipped the $500+ monthly payment

- Insured it for way less

- And invested what would’ve been that car payment into index funds and digital income streams

I still drive that same car today. It gets me where I need to go, costs nearly nothing each month, and helps me stay focused on real financial goals instead of showing off for strangers.

If you’re in a place where you’re debating whether to go for a flashier ride or something simple, I promise you—the payoff from investing that difference is way bigger than anything you’ll feel behind the wheel of a brand-new SUV.

I explained how I manage that mindset (and how I make extra money without piling on another job) in this article about avoiding second jobs. A cheaper car is one of the easiest ways to free up money to invest or save—and it starts paying you back immediately.

Why This Is One of the Most Expensive Mistakes I Made

Looking back, buying that new car wasn’t just a bad money move—it was a setback I felt for years. And not just financially.

Here’s what that one decision cost me:

- Tens of thousands of dollars I could’ve invested

- The chance to build a stronger emergency fund

- Time—because I had to work more to cover the costs

- Peace of mind—because those monthly payments added constant pressure

But what really stings? The opportunity cost. That money could’ve been used to start a side hustle, fund a business idea, or build a passive income stream. Instead, it went into something that literally lost value every single day.

That’s why I share stuff like how I get paid to be lazy—because there are smarter, lower-effort ways to use your money that don’t leave you broke, stressed, and stuck.

I don’t beat myself up over it anymore, but I do talk about it often—because I know I’m not the only one who thought buying a car meant I was “doing well.” Truth is, it meant I was buying into the trap.

Buy Less Car, Build More Wealth

If there’s one thing I wish I knew sooner, it’s this: You don’t need a new car to look successful. What you really need is a plan that leads to actual financial freedom.

Here’s what I do now:

- I drive a used car that’s paid off

- I invest what would’ve gone to car payments

- I focus on stacking income streams and growing assets

- I stay humble—and stay in control

And here’s the crazy part: once I stopped caring what other people thought about my car, I started getting ahead faster than ever before.

That’s what really made me commit to building multiple streams of income. I talk about that shift in why I’ll never rely on one income again. That mindset—combined with smarter money moves like not overpaying for vehicles—completely changed the game for me.

If you’re on the fence about buying that “dream car,” I’ll leave you with this: drive something that lets you sleep well, invest more, and build your real dream instead.

Common Questions About Cars and Staying Broke

Is it ever okay to finance a car?

If your goal is to build wealth, financing a car should be a last resort—not your go-to. If you absolutely must finance, aim for something used, low-interest, and well below what you’re approved for. Never base your car choice on what the dealer says you “can afford.” Base it on what won’t mess up your financial goals.

What’s a good rule for how much to spend on a car?

One rule I follow now is the 10% rule: spend no more than 10% of your gross annual income on a vehicle. So if you make $50,000 a year, look for a solid used car around $5,000. It sounds extreme to some, but that’s the point—extreme choices lead to extreme freedom.

Is leasing better than buying?

In almost every case, leasing is worse. You’re renting a depreciating asset and giving it back at the end. Plus, you’re often stuck with mileage limits and fees. Leasing gives the illusion of luxury without any of the long-term gain. You’re better off buying used and keeping what you own.

But I need a reliable car—how do I balance that with saving money?

Totally fair. I’ve found the sweet spot is buying a 3–5-year-old vehicle that’s past the steepest part of depreciation but still reliable. Think Honda, Toyota, Subaru—brands known for long life. You can find certified pre-owned options or private sellers with clean titles and maintenance history.

What should I do if I already have an expensive car and regret it?

Been there. You have options:

- Sell it and downsize—if the numbers work and you’re not too far upside-down

- Refinance at a lower interest rate to ease the monthly burden

- Commit to paying it off early, and don’t buy another car for a long time

Even if you made a tough call before, you can still shift directions now. I started my turnaround by realizing I didn’t need to keep digging. I just needed to stop and build better habits from that moment forward.