I’ve often pondered what would happen if everyone started with the same financial footing. Imagine this scenario: you give everyone $25,000 and let them loose for five years. My bet? Most of the people who are currently rich would find themselves wealthy again, and those who are broke would end up in the same position. Not all, but most.

This isn’t just a random guess. Over the years, I’ve noticed patterns in how different people manage their money. It’s not just about the amount you start with but about the habits, mindset, and financial literacy that play pivotal roles in determining one’s financial future. It’s like a game where the rules are more about how you play than what you start with.

Take the philosophy of “just do it,” for example. It’s about taking action and making informed decisions. This approach separates those who build wealth from those who lose it. It’s the mentality that drives success in investing, saving, and spending wisely. For a deeper dive into this mindset, check out Embracing the Just Do It Philosophy: What Does It Really Mean?.

In this article, I’ll explore why I believe that financial outcomes are largely determined by behaviors and education rather than just the initial capital. We’ll look at financial habits, literacy, mindset, and strategies that help some people thrive while others struggle. Understanding these factors can help anyone improve their financial health, regardless of their starting point.

The Role of Financial Habits

Financial habits play a crucial role in determining whether you build wealth or end up broke. Over the years, I’ve seen firsthand how the daily choices we make with our money set the foundation for long-term financial success or failure.

Good Financial Habits

Good financial habits are the bedrock of wealth accumulation. Here are some practices that can make a significant difference:

- Budgeting: Regularly tracking your income and expenses ensures you live within your means and can save for the future.

- Saving and Investing: Setting aside a portion of your income for savings and investments can help grow your wealth over time. The earlier you start, the more you benefit from compound interest.

- Debt Management: Avoiding high-interest debt and paying off balances promptly can save you from financial stress and unnecessary costs.

- Continuous Learning: Staying informed about financial trends, investment opportunities, and personal finance strategies keeps you ahead of the curve.

For those looking to develop and refine these habits, I highly recommend I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works (Second Edition). This resource offers a structured approach to mastering your finances and building solid habits.

Bad Financial Habits

On the flip side, bad financial habits can quickly erode your wealth and lead to financial ruin. Some common pitfalls include:

- Impulse Spending: Frequently making unplanned purchases can drain your finances and derail your budget.

- Ignoring Debt: Letting debt accumulate without a plan to pay it off can result in overwhelming interest payments and financial stress.

- Living Paycheck to Paycheck: Failing to save or invest leaves you vulnerable to financial emergencies and limits your long-term wealth-building potential.

Developing good financial habits requires discipline and a willingness to learn. It’s not just about earning more but managing what you have wisely. For those new to investing, tools like The Top 5 Investment Apps for Beginners: Start Growing Your Money Today can provide a solid starting point.

Understanding and implementing good financial habits is key to maintaining and growing wealth. These habits don’t change overnight, but with consistent effort, anyone can improve their financial situation and build a secure future.

The Influence of Financial Literacy

Financial literacy is a powerful tool that can make or break one’s financial success. It’s not just about knowing how to save or invest but understanding the broader principles of managing money, navigating financial products, and making informed decisions. Over the years, I’ve seen how financial literacy can transform lives, turning financial novices into savvy wealth builders.

Importance of Financial Education

Financial education is crucial for several reasons:

- Informed Decision-Making: Understanding financial concepts allows you to make better decisions about spending, saving, investing, and borrowing.

- Avoiding Pitfalls: Knowledge helps you steer clear of common financial mistakes, such as falling for scams, taking on high-interest debt, or making poor investment choices.

- Empowerment: Financial literacy empowers you to take control of your financial future, setting and achieving long-term goals.

Research consistently shows that people with higher financial literacy are better at managing their money and building wealth. For instance, a study by the National Bureau of Economic Research found that those with higher financial literacy were more likely to plan for retirement and have higher wealth accumulation.

Practical Tools and Resources

Access to practical tools and resources can significantly enhance financial literacy. For beginners, investment apps can be an excellent starting point. For example, The Top 5 Investment Apps for Beginners: Start Growing Your Money Todayoffers insights into accessible platforms that simplify investing.

Moreover, understanding the dynamics of the stock market and long-term investment strategies is essential. The article From $14K to Millions: The Might of S&P 500 Returns highlights how disciplined investing in the stock market can lead to substantial wealth over time.

Continual Learning and Adaptation

Financial literacy isn’t a one-time lesson but a continuous process of learning and adaptation. Markets change, new financial products emerge, and personal circumstances evolve. Staying informed and adaptable is key to maintaining financial health.

For those who want a step-by-step guide to start investing, Unlock Your Investment Potential: A Step-by-Step Guide to Using the Robinhood Investing App provides a detailed approach to using modern investment tools effectively.

Understanding the basics of financial management and continuously seeking new knowledge can dramatically impact your financial trajectory. Financial literacy is a lifelong journey that pays off in more ways than one.

Mindset and Wealth Accumulation

One of the most critical factors in achieving and maintaining wealth is your mindset. Over the years, I’ve observed that the way people think about money profoundly influences their financial success. The difference between a wealthy person and someone who struggles financially often lies in their approach to money, risk, and opportunity.

The Rich vs. Poor Mindset

The mindset of wealthy individuals often includes:

- Long-Term Thinking: Wealthy individuals focus on long-term goals and investments, understanding that building wealth takes time and patience.

- Opportunity-Seeking: They view challenges as opportunities for growth and are more willing to take calculated risks.

- Continuous Learning: Wealthy people prioritize learning and self-improvement, constantly seeking new knowledge and skills to enhance their financial acumen.

- Positive Attitude: They maintain a positive outlook, believing in their ability to overcome obstacles and achieve their financial goals.

In contrast, those with a poor mindset might:

- Short-Term Focus: They often concentrate on immediate gratification rather than long-term benefits.

- Risk Aversion: Fear of loss can prevent them from taking necessary risks that could lead to financial growth.

- Fixed Mindset: They may believe their financial situation is unchangeable, limiting their potential for improvement.

- Negative Outlook: A pessimistic view can lead to missed opportunities and a lack of motivation to pursue financial success.

The Role of Mindset in Financial Decisions

Your mindset significantly impacts your financial decisions. For instance, choosing between investment tools like Robinhood and Acorns can depend on how you perceive risk and opportunity. The article The Battle of the Investment Apps: Robinhood vs. Acorns – Which One Reigns Supreme? explores how different mindsets might influence the choice of investment platforms.

Developing a Wealth-Building Mindset

Shifting to a wealth-building mindset involves several steps:

- Set Clear Goals: Define what financial success looks like for you and set achievable goals.

- Embrace Learning: Commit to continuous learning about personal finance, investing, and economic trends.

- Take Calculated Risks: Be willing to step out of your comfort zone and take risks that are well-researched and calculated.

- Stay Positive: Maintain a positive attitude and focus on solutions rather than problems.

Adopting a growth mindset can open up new opportunities and pathways to financial success. For those looking to start their investment journey, the guide Unlock Your Investment Potential: A Step-by-Step Guide to Using the Robinhood Investing App provides practical steps to begin investing with confidence.

Changing your mindset is not an overnight process, but with dedication and persistence, it can lead to significant improvements in your financial life. Embrace the journey, learn from every experience, and stay focused on your long-term goals.

Economic Behavior and Socioeconomic Status

Economic behavior and socioeconomic status are deeply intertwined, influencing how individuals handle money, perceive opportunities, and make financial decisions. Over my years of observing and studying financial habits, it’s clear that one’s background plays a significant role in shaping financial behavior.

Influence of Socioeconomic Background

Socioeconomic status impacts financial behavior in several ways:

- Access to Resources: Those from higher socioeconomic backgrounds often have better access to financial education, networks, and resources that can facilitate wealth-building.

- Exposure to Financial Concepts: Growing up in a financially literate environment can provide a foundational understanding of money management and investment strategies.

- Mindset and Expectations: Socioeconomic status can shape one’s expectations about money. Individuals from wealthier backgrounds might view wealth as attainable and normal, whereas those from lower socioeconomic backgrounds might see financial stability as a constant struggle.

Examples of Economic Behaviors

- Saving and Investment Habits: People from wealthier backgrounds tend to have a higher propensity to save and invest. They are more likely to seek out investment opportunities and utilize financial tools.

- Risk Tolerance: Wealthier individuals often have a higher risk tolerance, enabling them to invest in higher-risk, higher-reward opportunities. Conversely, those from lower socioeconomic backgrounds might be more risk-averse due to limited financial security.

- Spending Patterns: Economic behavior also varies in spending patterns. Those with more resources might invest in assets and education, while those with fewer resources might prioritize immediate needs and consumer goods.

For an in-depth look at how different financial tools can aid in investment, regardless of socioeconomic status, consider The Top 5 Investment Apps for Beginners: Start Growing Your Money Today. These tools can democratize access to investment opportunities, making it easier for everyone to start building wealth.

Breaking the Cycle

Breaking out of the limitations imposed by socioeconomic status requires a combination of education, mindset shift, and strategic behavior:

- Financial Education: Programs aimed at increasing financial literacy can empower individuals to make better financial decisions. Understanding basics like budgeting, saving, and investing is crucial.

- Mentorship and Networking: Connecting with mentors and building a supportive network can provide guidance, opportunities, and encouragement.

- Utilizing Resources: Leveraging available resources, such as investment apps and educational tools, can help bridge the gap between different socioeconomic groups.

For instance, learning how to effectively manage retirement savings can significantly impact long-term financial health. The article Unlocking Your Social Security at 62: A Strategy for Million-Dollar Return offers valuable insights into maximizing retirement benefits.

Understanding the impact of socioeconomic status on economic behavior is crucial for anyone looking to improve their financial situation. By addressing these influences and making informed, strategic choices, it’s possible to overcome economic barriers and achieve financial success.

Common Financial Mistakes

Navigating the financial landscape can be challenging, and it’s easy to make mistakes that can have long-lasting repercussions. Over the years, I’ve identified several common financial pitfalls that can derail even the best-intentioned plans. Recognizing and avoiding these mistakes is crucial for maintaining and building wealth.

Common Mistakes That Lead to Financial Ruin

- Impulse Spending: One of the most prevalent financial mistakes is succumbing to impulse purchases. This behavior can quickly drain your finances and disrupt your budget.

- Ignoring Debt: Failing to address high-interest debt can lead to spiraling interest payments and financial stress. It’s essential to prioritize debt repayment to avoid long-term financial damage.

- Lack of Emergency Savings: Not having an emergency fund can leave you vulnerable to unexpected expenses and force you into debt.

- Poor Investment Choices: Making uninformed or speculative investments can result in significant losses. It’s important to research and understand investment opportunities before committing your money.

- Inadequate Retirement Planning: Neglecting to save for retirement can jeopardize your future financial security. Starting early and understanding retirement savings options is critical.

For those looking to maximize their retirement benefits, Unlocking Your Social Security at 62: A Strategy for Million-Dollar Return provides valuable insights into strategic planning for the future.

Personal Stories and Examples

Here are some personal anecdotes and examples of these mistakes:

- Impulse Spending: I once bought a high-end gadget on a whim, only to realize later that it wasn’t necessary. This experience taught me the importance of sticking to a budget and making thoughtful purchases.

- Ignoring Debt: Early in my career, I accumulated credit card debt and didn’t prioritize paying it off. The interest quickly added up, creating financial stress. It wasn’t until I focused on debt repayment that I regained financial stability.

- Lack of Emergency Savings: During an unexpected medical emergency, not having an emergency fund forced me to rely on credit cards, which added to my debt burden.

Tips to Avoid Financial Pitfalls

Avoiding these common mistakes requires discipline, planning, and continuous learning:

- Budget and Plan: Create and stick to a budget that aligns with your financial goals. Regularly review your spending and adjust as necessary.

- Prioritize Debt Repayment: Focus on paying off high-interest debt first and avoid accumulating new debt whenever possible.

- Build an Emergency Fund: Aim to save at least three to six months’ worth of living expenses in an easily accessible account.

- Educate Yourself: Continuously learn about personal finance and investment strategies to make informed decisions. Resources like The Top 5 Investment Apps for Beginners: Start Growing Your Money Today can help you get started with investing.

- Plan for Retirement: Start saving for retirement early and explore various retirement accounts and strategies to ensure financial security in your later years.

Understanding these common financial mistakes and learning how to avoid them is a critical step toward achieving long-term financial success. By making informed decisions and adopting good financial habits, you can significantly improve your financial health.

Strategies for Wealth Retention

Building wealth is only part of the equation; retaining it is just as crucial. Over the years, I’ve observed that the strategies used by wealthy individuals to maintain and grow their wealth are rooted in disciplined financial practices and informed decision-making. Here are some key strategies that can help ensure long-term financial stability.

Key Strategies for Maintaining Wealth

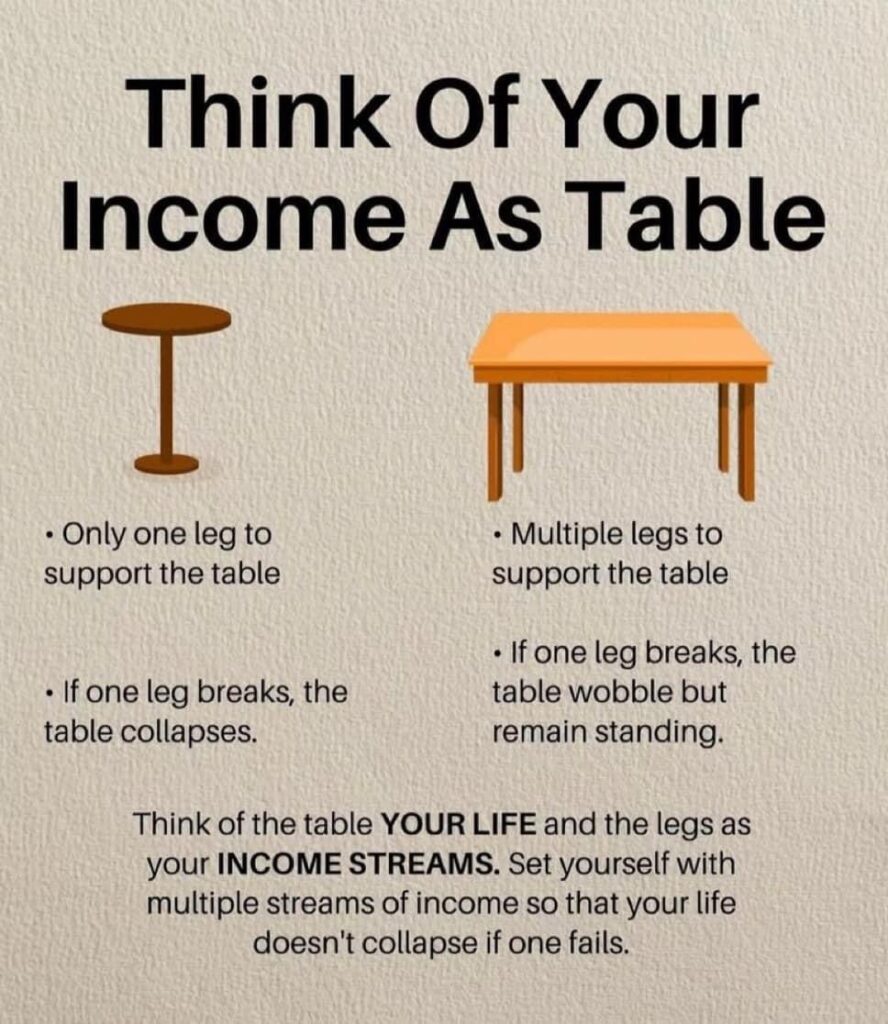

- Diversification: Spreading investments across various asset classes reduces risk and can lead to more stable returns. This includes a mix of stocks, bonds, real estate, and other investments.

- Continuous Learning: Staying informed about financial markets, new investment opportunities, and economic trends helps you make better financial decisions.

- Reinvesting Profits: Instead of spending all your returns, reinvest a portion to continue growing your wealth. Compound interest can significantly boost your long-term financial position.

- Professional Advice: Consulting with financial advisors, tax professionals, and other experts can provide valuable insights and help optimize your financial strategies.

- Frugality: Even wealthy individuals practice frugality. Living below your means ensures that you have more resources to invest and save.

- Emergency Fund: Maintaining a robust emergency fund protects you from unforeseen expenses and financial shocks, allowing you to avoid liquidating long-term investments.

For those interested in maximizing their investment returns, From $14K to Millions: The Might of S&P 500 Returnshighlights the benefits of long-term investment strategies.

Personal Finance Tips for Growth

Here are some practical tips that have helped me maintain and grow my wealth:

- Automate Savings and Investments: Setting up automatic transfers to savings and investment accounts ensures consistent contributions without the temptation to spend.

- Regular Portfolio Review: Periodically reviewing and rebalancing your investment portfolio helps maintain your desired level of risk and performance.

- Tax Efficiency: Utilize tax-advantaged accounts like IRAs and 401(k)s, and consider strategies like tax-loss harvesting to minimize your tax burden.

- Stay Disciplined: Avoid emotional decision-making, especially during market volatility. Stick to your long-term investment plan.

Using modern investment tools can simplify the process of managing and growing your wealth. For a step-by-step guide on using a popular investment app, check out Unlock Your Investment Potential: A Step-by-Step Guide to Using the Robinhood Investing App.

Importance of Continuous Learning

Wealth retention requires staying updated on financial trends and continuously learning. The financial world is dynamic, and new opportunities and risks emerge regularly. Leveraging resources like investment apps can make a significant difference. For example, The Battle of the Investment Apps: Robinhood vs. Acorns – Which One Reigns Supreme?provides a comparison of tools that can aid in informed decision-making.

Adopting these strategies can help you not only retain but also grow your wealth over time. Consistency, discipline, and a commitment to learning are the cornerstones of long-term financial success.

The Importance of Financial Education and Mindset

Reflecting on the hypothesis that if everyone started with $25,000, most of the wealthy would remain wealthy and most of the broke would remain broke, it becomes clear that financial success is deeply rooted in habits, education, and mindset. Through my personal journey and observations, I’ve learned that it’s not just the initial amount of money that matters, but how you manage, grow, and think about it.

Recap of Key Points

- Financial Habits: Developing and maintaining good financial habits such as budgeting, saving, and investing are crucial for long-term wealth accumulation. Avoiding common pitfalls like impulse spending and neglecting debt is essential.

- Financial Literacy: Continuous learning about personal finance and investing significantly impacts financial outcomes. Utilizing resources and tools can make complex financial concepts more accessible and actionable.

- Mindset: A growth mindset, characterized by long-term thinking, willingness to take calculated risks, and a positive outlook, is a significant driver of financial success.

- Socioeconomic Influences: While socioeconomic status plays a role in financial behavior, breaking the cycle through education and strategic planning is possible.

- Wealth Retention: Strategies such as diversification, reinvestment, professional advice, and frugality help in maintaining and growing wealth over time.

The Path Forward

Financial education and a positive mindset are the cornerstones of financial success. Regardless of your starting point, adopting disciplined financial habits and continuously seeking knowledge can transform your financial future. Embrace the journey of learning and growth, and remember that every step you take towards better financial management is a step towards long-term success.

For those looking to dive deeper into effective financial strategies and tools, I recommend exploring these resources:

- Embracing the Just Do It Philosophy: What Does It Really Mean?

- I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works (Second Edition)

- The Top 5 Investment Apps for Beginners: Start Growing Your Money Today

- Unlock Your Investment Potential: A Step-by-Step Guide to Using the Robinhood Investing App

- From $14K to Millions: The Might of S&P 500 Returns

- Unlocking Your Social Security at 62: A Strategy for Million-Dollar Return

- The Battle of the Investment Apps: Robinhood vs. Acorns – Which One Reigns Supreme?

By leveraging these insights and tools, you can set yourself on a path to financial independence and success. Remember, the journey to wealth is not just about the money you start with but how you manage and grow it over time.