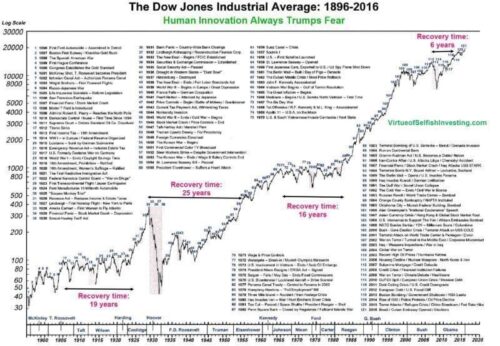

The stock market, with its complex dynamics and historical richness, offers invaluable lessons for investors. Analyzing 120 years of stock market history reveals patterns, trends, and strategies that can guide investment decisions. Here are 15 critical lessons drawn from over a century of market activity:

Lesson 1: The Power of Long-Term Investment

Short-term stock market returns can be volatile and unpredictable. However, history shows that over the long run, stock investments tend to yield robust returns. This underscores the importance of patience and a long-term perspective in investing.

Lesson 2: The Rule of Doubling

On average, the stock market has offered investors the opportunity to double their money every 10 years. This remarkable trend highlights the potential of stock investments for wealth accumulation over time.

Lesson 3: Stocks vs. Bonds in the Long Run

For holding periods of 20 years or more, stocks have consistently outperformed bonds and have never fallen below inflation. This makes stocks a less risky option than bonds in the long term.

Lesson 4: Market Timing vs. Time in the Market

Attempting to time the market can be a futile exercise. The key to successful investing is the duration of time spent in the market, not timing the market’s ups and downs.

Lesson 5: Adapting to Change

In a world where industries are rapidly evolving, companies that are highly exposed to these changes can be risky investments. It’s crucial to invest in businesses that can adapt and thrive amidst change.

Lesson 6: Historical Patterns

While history doesn’t exactly repeat itself, it often rhymes. Understanding historical patterns can provide valuable insights but should be applied with caution, as each market cycle can have unique characteristics.

Lesson 7: Let Winners Run

A common mistake in investing is selling winning stocks too early and holding onto losing ones. Successful investing often involves letting your winners run and cutting losses on underperformers.

Lesson 8: The Advantage of Low Prices

Low stock prices present great buying opportunities for investors. Purchasing stocks at a discount can lead to significant gains as markets rebound.

Lesson 9: Earnings vs. Cash Flow

Invest in companies that effectively convert earnings into free cash flow. Earnings can be subject to accounting interpretations, but cash flow is a more concrete indicator of a company’s financial health.

Lesson 10: Stock Prices and Earnings Growth

Over the long term, stock prices tend to follow the trajectory of a company’s earnings growth. This correlation underscores the importance of investing in companies with strong, sustainable earnings growth.

Lesson 11: The Equity Premium

The equity premium, or the excess return of stocks over government bonds, has averaged between 3% and 3.5% over the past 200 years. This premium is a key consideration for long-term investment strategies.

Lesson 12: Small Cap Performance

Historically, small-cap stocks have outperformed larger stocks. Between 1926 and 2006, the smallest decile of stocks achieved a higher compound annual growth rate (CAGR) compared to the S&P 500.

Lesson 13: The Value of Cheaper Stocks

Stocks with lower price-earnings ratios have historically outperformed the broader market. This trend suggests that value investing, or buying undervalued stocks, can be a successful strategy.

Lesson 14: The IPO Caution

Investing in Initial Public Offerings (IPOs) has generally underperformed compared to the index. A buy-and-hold strategy on IPOs has shown to be less effective, indicating the higher risk associated with newly public companies.

Lesson 15: The Stock Market as an Economic Indicator

The stock market often acts as a leading indicator for the economy, with a typical lead time of about six months. Market trends can provide early signals of economic shifts, both positive and negative.

Delving Deeper: Further Insights from Stock Market History

The stock market’s rich history provides a treasure trove of lessons for investors. By delving deeper into these lessons, we can gain a more nuanced understanding of how to navigate the market’s complexities and optimize investment strategies.

Understanding Market Cycles

Market cycles are a fundamental aspect of stock market behavior. Over the past 120 years, the market has experienced numerous cycles of booms and busts. Recognizing the signs of these cycles can help investors make more informed decisions about when to buy, hold, or sell stocks.

Diversification as a Risk Management Tool

Diversification is a key lesson from stock market history. By spreading investments across different sectors, asset classes, and geographies, investors can reduce risk and mitigate the impact of market volatility. Historical data shows that a well-diversified portfolio typically yields more stable and consistent returns.

The Impact of Global Events

Global events such as wars, economic crises, and pandemics have significant impacts on the stock market. Studying how the market has reacted to past events can provide insights into potential strategies for navigating future crises.

The Role of Technological Innovation

Technological advancements have consistently driven market growth and transformation. Investing in companies at the forefront of innovation can be a lucrative strategy, as seen in the rise of tech giants over recent decades. However, it’s important to balance this with an understanding of the risks involved in tech investments.

The Influence of Government Policies

Government policies, including fiscal and monetary policies, play a crucial role in shaping market dynamics. Interest rates, tax policies, and regulatory changes can all have significant effects on stock prices. Keeping abreast of policy changes and understanding their implications is crucial for investors.

Behavioral Finance

Behavioral finance teaches us that human emotions and psychology significantly influence investment decisions. Understanding common biases and emotional responses can help investors make more rational, objective decisions.

The Importance of Financial Literacy

A key takeaway from stock market history is the importance of financial literacy. Educated investors are better equipped to understand market trends, interpret financial news, and make informed decisions.

Ethical and Sustainable Investing

There’s a growing trend towards ethical and sustainable investing. Companies that prioritize environmental, social, and governance (ESG) factors are increasingly seen as attractive investments. Historical data suggests that such companies not only contribute positively to society but can also offer strong financial returns.

Common Questions About Stock Market History and Investing

How do market cycles affect individual investors? Market cycles, characterized by periods of growth and decline, significantly impact investment strategies. Understanding these cycles can help individual investors make informed decisions about when to enter or exit the market, and how to adjust their portfolios to mitigate risk during downturns and capitalize on growth periods.

Is it better to invest in individual stocks or mutual funds? This depends on your investment goals, risk tolerance, and level of expertise. Individual stocks can offer higher returns but come with higher risk and require more active management. Mutual funds provide diversification and are managed by professionals, making them a good choice for those who prefer a more hands-off approach.

How important is diversification in investing? Diversification is crucial in investing as it spreads risk across different assets, sectors, and geographies. A diversified portfolio is less likely to suffer significant losses during market downturns and can lead to more stable long-term returns.

Can past stock market performance predict future results? While past performance can provide valuable insights, it is not a guaranteed predictor of future results. Market conditions, economic factors, and global events continuously evolve, affecting future market performance.

What role does technology play in modern investing? Technology plays a significant role in modern investing. It provides investors with easy access to market data, analysis tools, and online trading platforms. Technological advancements also drive growth in certain sectors, presenting new investment opportunities.

How should investors react to market volatility? During periods of market volatility, it’s important for investors to stay calm and stick to their long-term investment strategies. Making impulsive decisions based on short-term market fluctuations can lead to significant losses.

What is the impact of inflation on stock investments? Inflation can erode the real value of investment returns. However, stocks have historically outperformed inflation over the long term, making them a good hedge against inflation compared to other asset classes like bonds or savings accounts.

Is it wise to invest during economic downturns? Investing during economic downturns can be wise if done cautiously. Market downturns often present opportunities to buy stocks at lower prices. However, it’s important to research and invest in financially strong companies that are likely to recover and grow when the economy rebounds.

How do interest rates affect the stock market? Interest rates have a significant impact on the stock market. Rising interest rates can reduce consumer spending and corporate profits, leading to lower stock prices. Conversely, lower interest rates can stimulate economic growth, boosting stock market performance.

Understanding the complexities of the stock market and its history is crucial for making informed investment decisions. While past trends and patterns can offer guidance, each investor’s strategy should align with their individual goals, risk tolerance, and market conditions.

Expanding Financial Knowledge with Rich Money Mind

At Rich Money Mind, we are dedicated to providing insights and strategies to help you navigate the financial world confidently. Our articles not only cover investment strategies, like those learned from 120 years of stock market history, but also offer guidance on various aspects of personal finance. Here are some articles from our website that can further enrich your financial journey:

Navigating Cryptocurrency Trends

In “Crypto Currency Soars on December 27, 2023: A Day of Remarkable Gains”, we delve into the dynamics of the cryptocurrency market, highlighting its potential for significant gains. This article is essential for understanding the volatility and opportunities within the crypto market.

Strategies for Debt Management

Our article “5 Surprising Ways to Legally Get Out of Debt” explores legal and effective strategies for managing and overcoming debt. It’s a valuable resource for anyone looking to improve their financial health and achieve debt freedom.

Breaking the Paycheck-to-Paycheck Cycle

In “Breaking Free from Living Paycheck to Paycheck: A Personal Journey”, we share insights and personal experiences on escaping the cycle of living paycheck to paycheck. This article offers practical tips and motivational advice for gaining financial independence.

Rich Money Mind is committed to helping you transform your mindset to become wealthy and financially savvy. Whether you’re interested in stock market investment, cryptocurrency, debt management, or breaking free from financial constraints, our articles provide the knowledge and motivation you need to succeed. Visit Rich Money Mind to explore more content and embark on a journey toward financial empowerment and success.