As an aspiring entrepreneur, one of the most crucial decisions you’ll make revolves around the legal structure of your business. The choice will influence your day-to-day operations, tax obligations, personal liability, and even the way you raise capital. This comprehensive guide will delve into the three common business entities: Sole Proprietorship, Limited Liability Company (LLC), and Corporation, helping you make an informed decision for your entrepreneurial journey.

UNDERSTANDING BUSINESS ENTITIES: AN OVERVIEW

Before diving into each structure, it’s vital to understand what a business entity means. Essentially, a business entity is a legal construct that defines how a business is recognized and operates within the legal and taxation systems of a jurisdiction. Each type offers distinct advantages and disadvantages, which vary based on factors like the nature of the business, the number of owners, financial considerations, and long-term business goals.

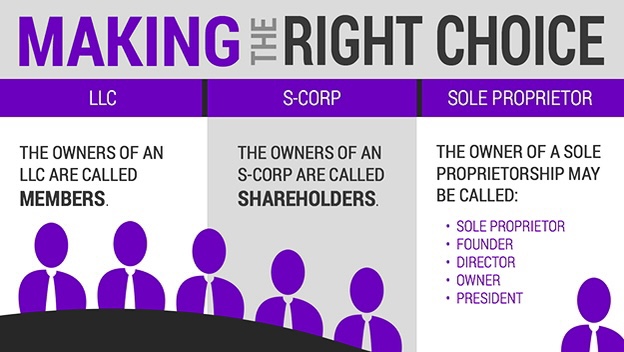

1. SOLE PROPRIETORSHIP: SIMPLICITY AT ITS CORE

A sole proprietorship is the most straightforward business entity. It is ideal for individuals who are the sole owners of their business and are looking for a hassle-free setup.

Advantages:

- Ease of Formation: No formal paperwork is required. Often, you only need a business name and requisite licenses.

- Direct Control: The owner has complete control over business decisions.

- Simplified Taxation: Business income and expenses are reported on the owner’s personal tax return.

Disadvantages:

- Unlimited Personal Liability: The owner is personally responsible for all business debts and liabilities.

- Difficulty in Raising Capital: Sole proprietorships might struggle to secure external funding.

2. LIMITED LIABILITY COMPANY (LLC): FLEXIBILITY WITH PROTECTION

An LLC offers the liability protection of a corporation combined with the tax flexibility of a partnership. It’s an excellent choice for medium-risk businesses and those that anticipate growth.

Advantages:

- Limited Liability: Members (owners) are protected from personal liability for business actions.

- Tax Flexibility: Profits and losses can be passed through to members without corporate taxation, avoiding double taxation.

- Management Flexibility: Members can decide how they want to manage the business.

Disadvantages:

- Complex Formation: Requires filing articles of organization and may involve state-specific regulations.

- Self-employment Taxes: Members might have to pay self-employment taxes on their share of profits.

3. CORPORATION: STRUCTURED AND ROBUST

A corporation is a separate legal entity from its owners and offers the highest level of protection from personal liability. It’s well-suited for larger businesses or those aiming to go public.

Advantages:

- Limited Liability: Shareholders (owners) are protected from personal liability.

- Raising Capital: Easier to raise funds through stock sales.

- Tax Benefits: Corporations can avail various tax deductions unavailable to other entities.

Disadvantages:

- Complex and Costly Setup: Incorporating requires more time, effort, and money. Annual reports and additional record-keeping are often mandatory.

- Double Taxation: Corporations are taxed on their earnings, and shareholders are taxed again on dividends.

OTHER CONSIDERATIONS IN MAKING YOUR CHOICE

- Nature of Business: A high-risk venture might benefit more from the protection an LLC or corporation offers.

- Number of Owners: Sole proprietorships are for individual owners, while LLCs and corporations can have multiple members or shareholders.

- Tax Implications: Each entity has a different tax structure, which can significantly impact your take-home profits.

- Future Growth and Investment: If you’re considering bringing in investors or going public in the future, a corporation might be more suitable.

The decision of selecting a business entity should never be made lightly. It requires careful consideration of both present circumstances and future aspirations. By understanding the pros and cons of a sole proprietorship, LLC, and corporation, you are well-equipped to make a decision that aligns with your business vision and goals. Always consider consulting with legal and financial professionals to ensure that you’re making the best choice for your unique situation.