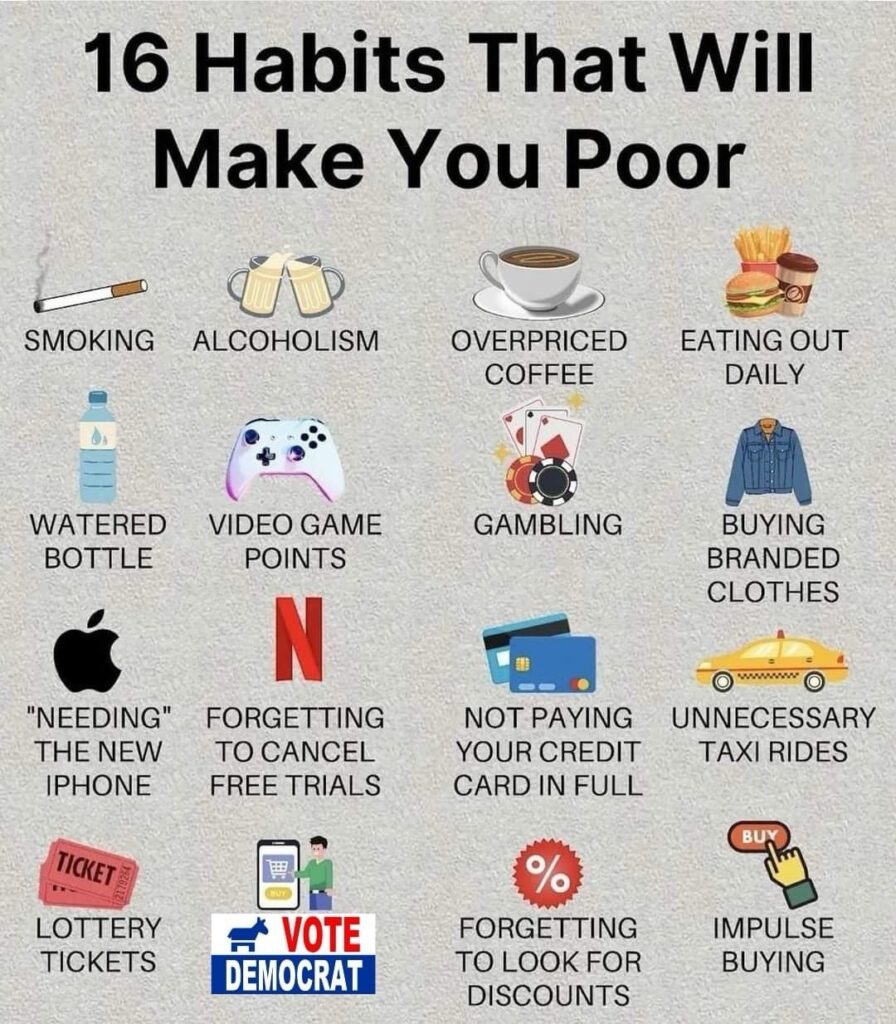

The Trap of Bad Money Habits

We’ve all got habits, some good, some bad. But when it comes to money, bad habits can keep you stuck in a financial rut for years without even realizing it. Maybe it’s grabbing overpriced coffee every morning or forgetting to cancel that free trial (that’s now charging you monthly). These little things may not seem like a big deal on their own, but they add up fast and can seriously impact your financial health over time.

The truth is, bad money habits can sneak up on anyone, and before you know it, you’re wondering where your paycheck went. But the good news? You can break free from these habits and start building a future that’s more financially secure. The key is to recognize those habits, understand why they’re holding you back, and replace them with better, smarter choices.

Whether it’s how you handle credit cards, how often you eat out, or the way you think about money in general, this article is going to walk you through some common bad money habits—and more importantly, how to kick them for good.

And once you do, you can start making your money work for you instead of the other way around. For a little inspiration on turning things around, check out How to Make Money Work for You: Build Wealth, Not Stress to get started on the right track.

Now, let’s dive into the details. First up, what exactly is a bad money habit?

What is a Bad Money Habit?

A bad money habit is any behavior that harms your financial health over time. It’s the kind of thing that might seem harmless in the moment but adds up to big problems down the road. You might think, “What’s one more lunch out?” or “I’ll just put this on my credit card and deal with it later.” But here’s the thing—those small choices stack up quickly.

Bad money habits can include:

- Eating out daily: Those lunch breaks or quick dinners at restaurants may seem convenient, but they drain your wallet fast.

- Overpriced coffee: Grabbing that $5 latte every morning may not feel like a huge deal, but it adds up over a month—and that’s money that could’ve gone into savings or paying off debt.

- Not paying off credit cards in full: Carrying a balance from month to month hits you with interest fees that keep growing, making it harder to dig out of debt.

- Forgetting to cancel free trials: This is a sneaky one. You sign up for a free trial and forget to cancel, only to find yourself hit with unexpected monthly fees.

Don’t forget to take a moment and check out this awesome, printable savings tracker! It can help ALOT!

These are just a few examples of bad money habits. The common thread? They take money out of your pocket that could be better used elsewhere, whether for savings, investing, or paying down debt.

Recognizing these habits is the first step. Once you know what you’re doing wrong, it’s easier to start fixing it. And trust me, once you break these habits, your bank account will thank you.

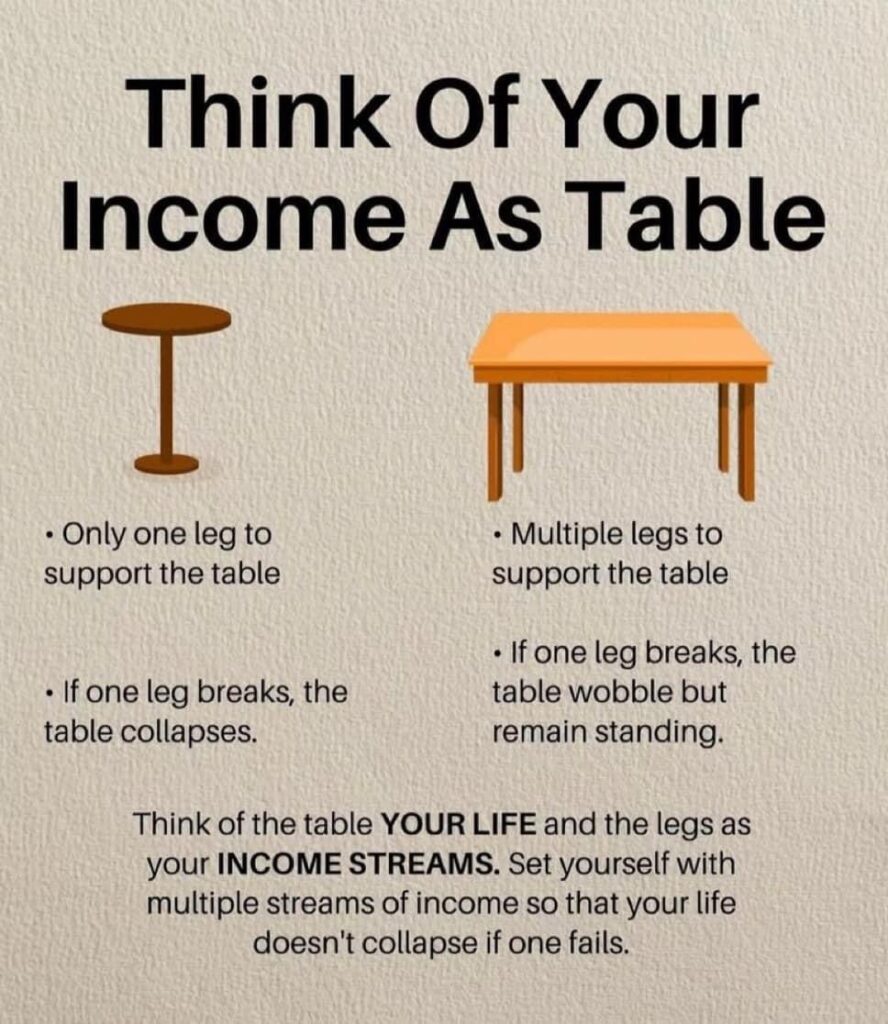

To start thinking bigger and building smarter habits, you might also want to learn how to create extra streams of income. Take a look at How to Create Multiple Streams of Income: A Step-by-Step Guide to get some ideas on how to make your money work harder for you.

What is a Bad Money Mindset?

A bad money mindset is just as dangerous—if not more—than bad money habits. It’s the way you think about money that keeps you stuck in the same financial patterns, even if deep down you know they’re not working for you. The problem with a bad money mindset is that it shapes your financial decisions in ways that can hold you back for years.

Here are a few examples of bad money mindsets:

- “I’ll never have enough money, so why bother saving?”: This is a defeatist mindset that leads to giving up before you even try. If you don’t believe you can improve your financial situation, you’ll never take steps to do so.

- “I deserve this, even if I can’t afford it.”: Treating yourself isn’t bad in moderation, but constantly spending money you don’t have because you “deserve it” is a fast track to debt.

- “I’ll just deal with it later.”: Whether it’s credit card debt or paying off a bill, putting off financial responsibilities because they seem overwhelming is a recipe for disaster. This mindset piles up stress and interest along the way.

These mindsets are the foundation for bad money habits. When you believe that money is always going to be a struggle, or that you can’t change your situation, you’re much more likely to make poor financial decisions. But when you flip that mindset, you start to see opportunities instead of limitations.

Developing a wealth-building mindset means focusing on abundance, taking control of your finances, and making intentional choices about where your money goes. It’s about realizing that with the right habits and mindset, you can create a better financial future.

Want to dig deeper into how to break free from a limiting mindset? Check out Beast Mode Over Scared Mode: How to Attack Your Dreams for some powerful motivation to start thinking big and taking action.

What is Bad Financial Behavior?

Bad financial behavior is when your actions with money are actively working against your long-term financial stability. It’s not just about overspending or forgetting to save—bad financial behavior involves a pattern of decisions that keep you in debt, deplete your savings, and prevent you from building wealth. Even if you earn a good income, bad financial habits can sabotage your future.

Here are some common bad financial behaviors that keep people broke:

- Not paying off credit card balances: If you’re only making the minimum payment on your credit cards, interest fees can quickly pile up. Over time, you end up paying way more for the things you’ve already bought.

- Impulse buying: Whether it’s buying a new gadget, branded clothes, or just grabbing items you don’t need, impulse buying leads to wasted money that could have been saved or invested.

- Forgetting to cancel subscriptions: Sign up for a free trial and forget about it? You’re probably being charged monthly for services you don’t even use. Those small fees add up fast.

- Gambling or buying lottery tickets: While gambling and playing the lottery might seem like harmless fun, they are habits that can drain your finances and give you nothing in return.

Each of these behaviors might seem small on its own, but they add up over time, draining your resources and preventing you from reaching your financial goals.

The impact? You stay stuck in a cycle of debt, or worse, you continue making the same financial mistakes without realizing how much they’re holding you back. Breaking bad financial behaviors is essential to building a more secure and wealthier future. The key is to recognize the patterns, make a plan to correct them, and focus on smarter financial decisions.

If you’re feeling like credit card debt is constantly weighing you down, check out Why Credit Scores Are a Joke: The Hidden Truth About Debt to learn how credit debt can be a trap that keeps you stuck.

How to Break Bad Financial Habits

Breaking bad financial habits isn’t easy, but with the right plan and mindset, you can turn things around. It’s all about recognizing where you’re going wrong, creating a strategy to fix it, and staying committed to long-term change. Here are some practical steps you can take to start breaking those habits that are holding you back.

1. Track Your Spending

You can’t fix what you don’t measure. Start by writing down every dollar you spend for a month. This will help you see exactly where your money is going and highlight any unnecessary expenses. Whether it’s that daily coffee, impulse buys, or subscriptions you’ve forgotten about, tracking your spending is the first step in gaining control.

2. Set Clear Financial Goals

Having specific goals will motivate you to stick to better financial habits. Whether it’s saving for a down payment, paying off debt, or building an emergency fund, make your goals measurable and realistic. For example, instead of saying “I want to save money,” try setting a goal like “I will save $200 per month.”

3. Pay Off Credit Card Balances in Full

One of the most damaging financial habits is carrying a balance on your credit cards. If possible, commit to paying off your balance in full each month to avoid interest fees. This will not only save you money but also improve your financial discipline.

4. Automate Your Savings

To avoid the temptation of spending what’s left in your checking account, set up automatic transfers to your savings account. This way, you save first and spend what’s left, instead of the other way around.

5. Pause Before You Purchase

Impulse buying can wreck your budget. Next time you’re tempted to make a spontaneous purchase, pause and ask yourself: Do I really need this? Can I afford it? Waiting even 24 hours can help you avoid buying something unnecessary.

Breaking these habits won’t happen overnight, but by taking small, consistent steps, you can make a huge difference in your financial future. And if you’re feeling motivated to really take charge and attack your financial dreams, you might want to dive into Beast Mode Over Scared Mode: How to Attack Your Dreams to help fuel your drive.

Other Bad Money Habits to Avoid

Sometimes it’s the small, everyday habits that slowly drain your bank account without you even realizing it. While the big stuff like credit card debt and impulse buying can have a huge impact, these smaller habits can quietly chip away at your financial health over time. Let’s take a look at some of the most common bad money habits you should avoid.

1. Buying Branded Clothes and the Latest Tech

It’s tempting to always go for the latest fashion or the newest iPhone, but constantly upgrading your wardrobe or tech comes at a steep price. The truth is, most of the time, you’re paying for the brand name, not necessarily the quality or need. Take a step back and ask yourself if buying the newest thing is worth the financial hit.

2. Gambling and Lottery Tickets

The odds of winning the lottery or hitting it big at the casino are slim to none. Yet, many people throw away money on lottery tickets or gambling in the hope of quick riches. The reality? This habit can drain your finances fast, and you’re more likely to lose money than gain it.

3. Forgetting to Look for Discounts

If you’re not taking advantage of discounts, coupons, or rewards programs, you’re leaving money on the table. Whether it’s grocery shopping, clothes, or electronics, there are almost always deals or discounts available. Make it a habit to search for promo codes or sales before making any purchase.

4. Overpaying for Bottled Water & Coffee

It’s easy to overlook the cost of small, everyday purchases like bottled water or coffee. But these tiny costs add up quickly. Instead of buying bottled water, invest in a reusable water bottle. As for coffee, brewing it at home can save you a significant amount over the course of a year.

5. Unnecessary Taxi Rides or Rideshares

With rideshare apps like Uber or Lyft, it’s easy to book a ride for convenience. But, taking unnecessary rides—especially for short trips—can drain your bank account. Whenever possible, walk or use public transportation to save money.

These habits might seem harmless on their own, but when combined, they can make a big dent in your finances over time. By being mindful of these habits and making small changes, you’ll start to see your financial situation improve.

And if you’re ready to take control and start building real wealth, consider signing up for Robinhood and get a free stock today to kickstart your investment journey.

Take Control of Your Financial Future

Breaking bad money habits is one of the most important steps you can take toward financial freedom. While it might feel overwhelming at first, the key is to start small, stay consistent, and focus on long-term change. By identifying and addressing the habits that are quietly draining your wealth—whether it’s overspending on coffee, not paying off credit cards, or constantly upgrading your gadgets—you can start to see significant improvements in your financial health.

Here’s the reality: good financial habits lead to wealth-building, while bad habits keep you trapped in a cycle of paycheck-to-paycheck living. The great news is, you have the power to break those habits, shift your mindset, and make smarter financial choices that set you up for success.

So, whether it’s tracking your spending, setting up automated savings, or simply pausing before making a purchase, every step counts toward a more secure and wealthy future. Remember, wealth isn’t just about making more money—it’s about managing what you have wisely.

Ready to take your financial goals to the next level? Check out How to Make Money Work for You: Build Wealth, Not Stress and How to Create Multiple Streams of Income for more tips on building a financial foundation that lasts.

It’s time to ditch the bad habits, adopt a better money mindset, and start building the future you deserve.