Buying a home can be one of the biggest financial decisions you’ll ever make, but that doesn’t mean you need to overspend. When I bought my home, I was determined to do it for less money than I thought possible. I learned quickly that it is possible to buy a home for less money, but it requires a mix of smart strategies, patience, and knowing where to save. Whether you’re a first-time homebuyer or looking to upgrade, these tips can help you keep costs down without sacrificing the home you want.

1. Start with a Realistic Budget

One of the first things I did when I started the home-buying process was sit down and create a detailed, realistic budget. It’s easy to get caught up in the excitement of looking at homes, but if you don’t know exactly what you can afford, you might end up overspending. I made sure to account for not just the purchase price, but also closing costs, inspections, potential repairs, and other hidden expenses that can creep up.

By sticking to a realistic budget, I was able to avoid bad financial habits that could have led me to overspend or make poor decisions. If you’re looking to stay disciplined and avoid financial traps, this guide to breaking bad money habits helped me a lot during the process. It’s all about knowing your limits and planning accordingly.

2. Look for Homes Below Market Value

One of the biggest money-saving strategies I used was looking for homes priced below market value. It wasn’t always easy, but by being open to options like foreclosures, auctions, and homes that needed a bit of work, I found that I could save a significant amount upfront. Some of the homes I looked at needed some TLC, but that’s where the real savings came in.

I realized that buying a fixer-upper could save me thousands of dollars off the purchase price. With some sweat equity and a few DIY projects, I was able to increase the home’s value over time. It’s amazing how much value small improvements can add, and it didn’t take long for the home to feel like my own.

If you’re considering this route, here’s a great guide on DIY projects that helped me turn my home from a fixer-upper to something I’m proud of. It’s a great way to save upfront while also increasing your home’s long-term value.

3. Get Pre-Approved for a Mortgage

One of the smartest moves I made was getting pre-approved for a mortgage before I even started house hunting. This step not only helped me figure out exactly what I could afford, but it also gave me more leverage when it came time to negotiate with sellers. With a pre-approval letter in hand, I had a better idea of my budget, which helped me avoid looking at homes that were out of my price range.

Another advantage of getting pre-approved was the confidence it gave me when it came to making an offer. Sellers take you more seriously when they know you’re pre-approved, and I found that it made the whole process smoother. It also helped me stay disciplined and stick to my budget since I knew exactly what my limit was.

Skipping this step can lead to overestimating what you can afford, which can put you in a tough financial spot later. Getting pre-approved helped me stay realistic and make smarter decisions when it came time to make an offer.

4. Negotiate Closing Costs

I quickly realized that closing costs can be a significant expense when buying a home, but what I didn’t know at first is that these costs are often negotiable. During my home-buying process, I was able to negotiate with the seller to cover part of the closing costs, which saved me a good chunk of money upfront. It’s one of those things people don’t always think to ask for, but it can make a big difference.

Some lenders also offer lower-cost closing packages, so it’s worth shopping around and asking what’s available. I found that by being proactive and negotiating, I was able to avoid some unnecessary expenses. Plus, by understanding what I was being charged for, I could better determine where I could cut costs.

Looking back, it’s clear that negotiating was one of the smartest things I did. If you want to avoid the pitfalls that can come with home buying, especially those regrets that come up at 2 a.m., this guide on avoiding homebuyer regrets is a great resource. It’s all about being prepared and knowing what to ask for.

5. Shop Around for the Best Mortgage Rate

One thing I learned quickly was that even a small difference in your mortgage interest rate can save (or cost) you thousands of dollars over the life of the loan. I made sure to shop around and compare rates from different lenders, rather than going with the first offer I received. The difference between a good rate and an average one can add up significantly over 15 or 30 years, so it’s worth taking the time to look for the best deal.

I also found that my credit score played a big role in determining the mortgage rate I qualified for. I spent some time improving my credit before applying for a mortgage, which helped me secure a lower interest rate. It’s important to understand that your credit score isn’t the only factor, and it can be misleading at times. This article on why creditscores can be a joke opened my eyes to the truth behind credit scores and how to make them work in my favor.

By taking the time to shop around and improve my credit, I was able to secure a mortgage rate that saved me a significant amount of money over time. Don’t rush this part of the process—it’s worth it to do your homework.

6. Buy During the Off-Season

One of the best tips I followed was buying during the off-season, which for the real estate market usually means the fall or winter months. When I was house hunting, I noticed that there was a lot less competition during the colder months. With fewer buyers in the market, sellers were more motivated to negotiate, and I was able to secure a better deal than I likely would have during the spring or summer.

During the off-season, sellers who list their homes are often eager to close quickly, especially if their property has been sitting on the market for a while. This allowed me to negotiate not just the price, but also terms like closing costs, repairs, and even getting some appliances included in the sale.

It’s not just about timing the market perfectly, but taking advantage of the natural lulls in buyer activity. Buying during the off-season gave me leverage that simply wouldn’t have been there during the busier months. It’s a tip I would recommend to anyone who’s trying to buy a home for less money.

7. Consider a Smaller or Older Home

When I first started house hunting, I had my sights set on a bigger, newer home. But as I looked around, I realized that I could save a lot of money by considering smaller or older homes. Smaller homes typically come with a lower price tag, and they’re often more affordable to maintain. While an older home might not have all the modern updates, it gave me the opportunity to renovate and make it my own at a much lower cost.

One of the best things I did was embrace the idea of turning an older home into something special through some DIY upgrades. It wasn’t just about saving money upfront—it was about adding value over time. I found that small projects like upgrading the bathroom or kitchen can make a huge difference, both in comfort and resale value. This guide on creatinga rustic industrial bathroom vanity helped me make my older home feel more modern and personal, without breaking the bank.

By going smaller or older, you can find homes that are priced lower, and with a little creativity, you can still turn it into your dream home.

8. Focus on Location Over Size

One of the best pieces of advice I followed during my home-buying journey was to prioritize location over size. Initially, it’s easy to get caught up in wanting a bigger house, but I quickly realized that a smaller home in a great location can be far more valuable in the long run. Location impacts everything from your quality of life to the home’s future resale value.

By choosing a home in an up-and-coming neighborhood, I was able to get a lower price while still being close to amenities like schools, shops, and parks. Over time, as the area developed, my home’s value increased. I didn’t need the biggest house on the block—just one in the right spot.

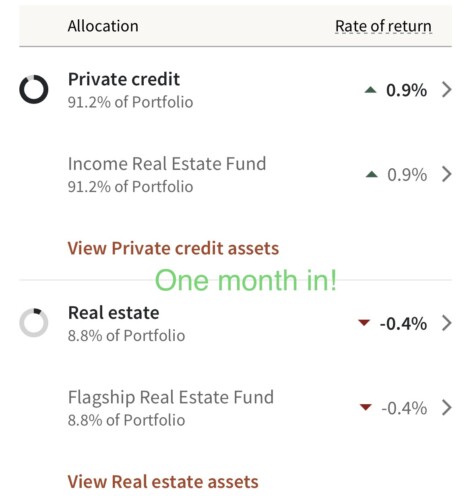

Plus, a great location means your home will appreciate more quickly, giving you a better return on your investment. If you’re looking for more tips on making smart money decisions when it comes to investments like this, this guide onmaking money work for you was a huge help for me. It reminded me that where you live can be just as important as the home itself.

Focusing on location helped me save money upfront, while also ensuring my home would grow in value over time.

9. Save on Home Inspections and Repairs

When buying a home, one of the costs that can sneak up on you is the home inspection. However, I found that by researching affordable but reputable home inspectors, I was able to save a bit of money while still getting a thorough inspection. It’s worth shopping around for different inspectors, as prices can vary widely.

In addition to saving on the inspection itself, I also made sure to negotiate repairs with the seller before closing. If the inspection revealed any major issues, I asked the seller to either fix the problems or lower the price to cover the cost of repairs. This tactic saved me a significant amount of money, and I was able to avoid unexpected repair costs after moving in.

For the smaller repairs or cosmetic updates, I took a DIY approach. This not only saved me money but also allowed me to customize the home the way I wanted. It’s amazing how much you can save by tackling some of the projects yourself rather than hiring contractors for everything. If you’re considering DIY improvements, this guide on increasing yourhome’s value with DIY projects was a lifesaver for me during this process.

By negotiating and being proactive with repairs, I was able to cut down on upfront costs and make the home my own, all while staying within budget.

10. Avoid Overbidding in Competitive Markets

One of the most important lessons I learned during my home-buying experience was to avoid getting caught up in bidding wars, especially in a competitive market. It’s easy to let emotions take over when you find a home you love, but overbidding can quickly blow your budget. I made sure to set a strict limit on what I was willing to pay, and I stuck to it.

In hot markets, sellers often receive multiple offers, and it’s tempting to offer more than the asking price to win the home. However, overbidding not only increases your purchase price but can also lead to higher property taxes and insurance premiums down the road. Instead, I focused on finding homes within my budget and being patient until I found the right one. There were a few times when I had to walk away from a house I liked, but in the end, it paid off.

Staying disciplined helped me avoid the regret of overpaying and allowed me to purchase a home for less than I initially expected. If you’re worried about making costly mistakes during the process, this guide on avoiding homebuyer regretswas extremely helpful for keeping me grounded and focused on making smart financial choices.

How to Reduce Costs When Buying a Home

When I was buying my home, I knew I wanted to reduce costs wherever possible. One of the biggest ways to do this was by being strategic in my approach. First, I made sure to keep a close eye on all the additional expenses that come with buying a home, like closing costs, moving expenses, and initial repairs. By staying on top of these, I was able to save money and avoid unexpected surprises.

I also looked for homes that needed a little work but were structurally sound. By focusing on cosmetic updates rather than major repairs, I found that I could buy a home for less upfront and invest in the improvements over time. In addition to the big savings, I also negotiated with the seller on price and repairs after the inspection, which helped cut down on costs even further.

For those looking to keep costs down, it’s all about being proactive and negotiating wherever possible. Don’t be afraid to ask for things like closing cost assistance or a price reduction for repairs. The more you negotiate, the more you can save.

How Much Should I Save When Buying a Home?

Saving for a home can feel overwhelming, but having a clear plan made all the difference for me. Before I even started looking at houses, I set a savings goal based on the down payment, closing costs, and extra expenses like home inspections and moving costs. Many experts suggest saving at least 20% of the home’s purchase price for a down payment, but it’s also essential to have additional savings for closing costs, which typically run between 2% to 5% of the home’s price.

In addition to the down payment and closing costs, I also made sure to have an emergency fund in place for any unexpected repairs or surprises that might come up after moving in. By setting a clear savings goal and working toward it consistently, I was able to reduce stress during the buying process and feel more secure in my purchase.

If you’re looking for smart ways to build up your savings, this guide on making money work for you provided helpful tips on growing my savings and building a solid financial foundation for homeownership.

How to Aggressively Save Money to Buy a Home

When I decided I wanted to buy a home, I knew I needed to save aggressively. To do this, I started by cutting unnecessary expenses, setting a strict budget, and prioritizing saving over spending. One of the most effective strategies I used was automating my savings—each month, a portion of my paycheck went directly into a separate savings account, so I wasn’t tempted to spend it.

I also looked for ways to increase my income, like taking on side jobs or freelance work. By boosting my earnings and keeping my spending in check, I was able to save faster than I initially thought possible. Another tip I found helpful was creating smaller, achievable goals within my larger savings target. For example, I set monthly goals to hit certain savings milestones, which kept me motivated throughout the process.

It’s not always easy to save aggressively, but by making sacrifices in the short term, I was able to reach my savings goal and get one step closer to owning a home.

Is It Possible to Buy a Home for Less Money?

Absolutely. With the right approach, it’s possible to buy a home for less money without sacrificing quality or your must-haves. I went into the process thinking I’d have to compromise on a lot of things, but by following these 10 strategies, I found a home that worked for me financially and personally. From setting a realistic budget to negotiating costs and finding the right location, each step helped me save money and feel more confident in my decision.

Buying a home is one of the biggest investments you’ll ever make, but that doesn’t mean you have to overspend. By staying disciplined, knowing where to negotiate, and being patient, you can absolutely buy a home for less money than you might think. If you’re starting your home-buying journey, I hope these tips help guide you in the right direction and save you as much as they saved me. Happy house hunting!