Why Retirement Savings Matter

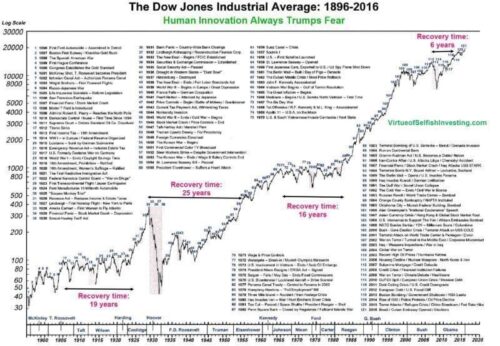

Let’s get real for a second—retirement might seem like a lifetime away, but the sooner you start saving, the better off you’ll be. Why? Because time is your best friend when it comes to growing your money. But when it comes to retirement savings, you’ve probably heard terms like 401(k) and IRA thrown around and wondered what the heck they mean. Don’t worry; you’re not alone. This guide will break it down for you in plain English.

The Basics: What’s a 401(k) and What’s an IRA?

First things first, 401(k) and IRA are both types of retirement accounts, but they’re not the same thing. A 401(k) is a retirement plan offered by your employer, while an IRA (Individual Retirement Account) is something you set up on your own.

401(k): The Workplace Wonder

A 401(k) is like the VIP of retirement accounts if you’re working a full-time job. Your employer sets it up, and you decide how much of your paycheck you want to contribute. The best part? Many employers will match your contributions up to a certain percentage. That’s free money, folks!

IRA: The Lone Ranger

An IRA is more like a solo act. You set it up yourself, and you’re in charge of contributing money. There’s no employer match because, well, there’s no employer involved. But the good news is you have more control over where your money is invested.

The Tax Factor: Traditional vs. Roth

Both 401(k)s and IRAs come in two flavors: Traditional and Roth. The main difference is how they’re taxed.

Traditional 401(k) and IRA

With a Traditional 401(k) or IRA, you contribute money before it’s taxed. That means you get a tax break now, but you’ll have to pay taxes when you withdraw the money in retirement.

Roth 401(k) and IRA

With a Roth, it’s the opposite. You contribute money that’s already been taxed, so you won’t get a tax break now. But the upside is that you won’t have to pay taxes when you withdraw the money in retirement.

Contribution Limits: How Much Can You Save?

Both 401(k)s and IRAs have limits on how much you can contribute each year. For 401(k)s, the limit is much higher—usually around $19,500 per year if you’re under 50. IRAs have a lower limit, typically around $6,000 per year.

The Employer Match: The 401(k) Advantage

One of the biggest perks of a 401(k) is the employer match. If your employer offers to match your contributions, take advantage of it. It’s essentially free money that can supercharge your retirement savings.

Investment Options: More Choices with an IRA

When it comes to investment options, IRAs usually offer more flexibility. With a 401(k), you’re limited to the investment options chosen by your employer, which might not always be to your liking. With an IRA, you’re free to invest in almost anything you want, from stocks and bonds to mutual funds.

Early Withdrawals: The Rules and Penalties

Life happens, and sometimes you need to tap into your retirement savings early. But be careful—both 401(k)s and IRAs come with penalties for early withdrawals. You’ll usually have to pay a 10% penalty, plus taxes, if you withdraw before age 59½.

The Bottom Line: Which One is Right for You?

So, which is better—a 401(k) or an IRA? The answer is, it depends on your situation. If your employer offers a 401(k) with a good match, it’s hard to pass up that free money. But an IRA offers more control and flexibility, which might be better if you’re a hands-on investor.

The Golden Rule: Diversify Your Savings

Here’s a pro tip—why not have both? Having both a 401(k) and an IRA gives you the best of both worlds: the employer match from the 401(k) and the flexibility of the IRA. It’s a win-win!

Start Saving Now

The key takeaway here is to start saving for retirement as soon as you can, whether it’s through a 401(k), an IRA, or both. The sooner you start, the more time your money has to grow, thanks to the magic of compound interest. So don’t wait—your future self will thank you.