Bitcoin, often referred to as digital gold, has been a topic of intense discussion over the past decade. From financial experts to everyday consumers, everyone seems to have an opinion on this cryptocurrency. But beyond the hype and speculation, there are solid reasons to consider investing in Bitcoin. Here’s why:

1. Digital Gold: Much like gold, Bitcoin is seen as a store of value. Its limited supply (only 21 million Bitcoins will ever exist) makes it a deflationary asset. This scarcity, combined with increasing demand, has historically driven its price upwards over the long term.

2. Decentralization: One of Bitcoin’s most significant features is its decentralized nature. Unlike traditional currencies controlled by governments and central banks, Bitcoin operates on a decentralized network of computers. This means it’s not subject to government monetary policies or inflation, making it a hedge against currency devaluation.

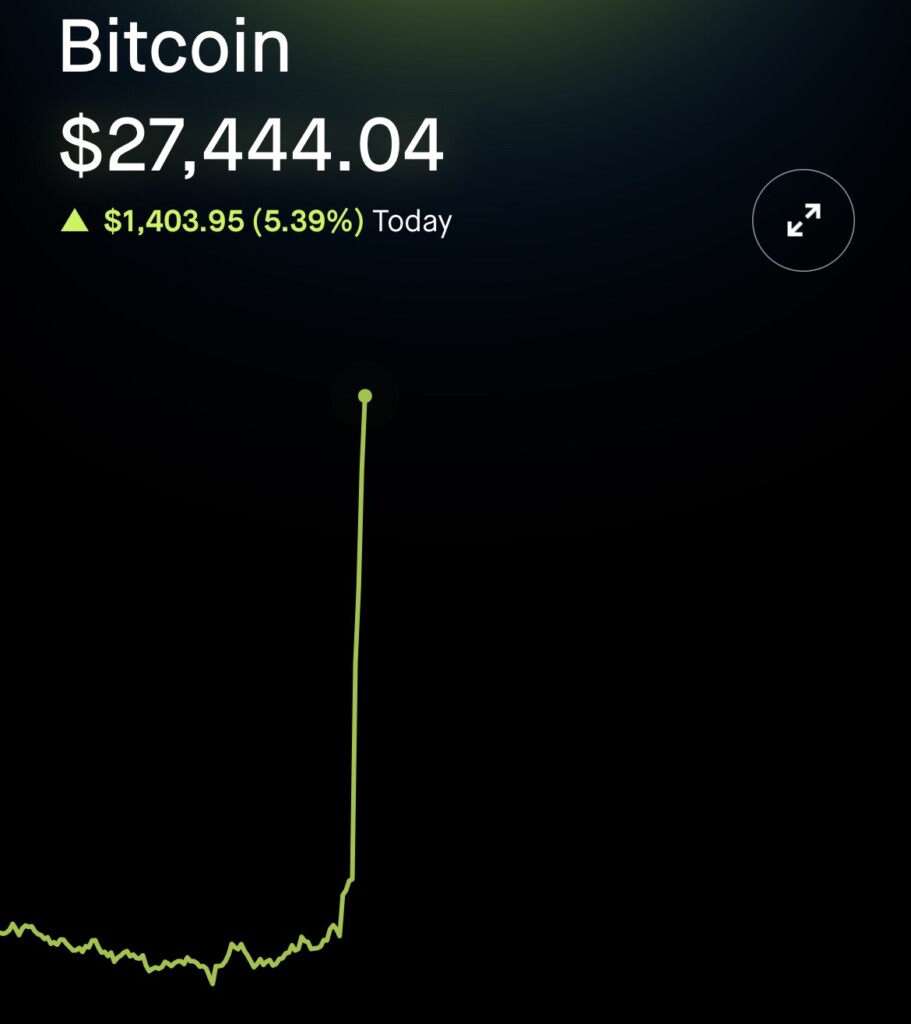

3. Potential for High Returns: While Bitcoin is known for its price volatility, it has also delivered substantial returns for early investors. Those who recognized its potential in the early days and held onto their investments have seen exponential growth in their portfolios.

4. Diversification: Financial advisors often preach the importance of diversifying one’s investment portfolio. Adding Bitcoin, a non-correlated asset, can provide diversification benefits, potentially reducing risk and enhancing long-term returns.

5. Growing Acceptance: More businesses, both online and offline, are accepting Bitcoin as a form of payment. This growing acceptance and utility enhance its intrinsic value. Major financial institutions are also beginning to offer Bitcoin-related services, further legitimizing its presence in the financial landscape.

6. Future Potential: The technology behind Bitcoin, blockchain, has the potential to revolutionize various industries by providing transparency, security, and decentralization. As the pioneer of this technology, Bitcoin stands to benefit as more use-cases for blockchain are discovered.

7. Financial Sovereignty: Bitcoin provides individuals with control over their money, without the need for intermediaries like banks. This financial sovereignty, especially in countries with unstable currencies or restrictive financial policies, can be invaluable.

While the potential benefits of investing in Bitcoin are numerous, it’s essential to approach it with caution. Like any investment, there are risks involved. It’s crucial to do your research, understand the market, and, if possible, consult with financial professionals. However, with its unique properties and the transformative potential of blockchain technology, Bitcoin is undoubtedly worth considering as part of a diversified investment strategy.